CheckMark Online Payroll can produce form 940 as well as a wage summary and quarterly liability report.

Types of 940 FUTA Tax Reports

| Types | Description |

| Wages Summary | This report shows the total annual wages, wages exempt from FUTA, wages over the annual limit, and total taxable wages by employee. |

| Quarterly Liability | This report shows total taxable wages per quarter by employee. In addition, this report shows total FUTA liability per quarter. |

| Form 940 | Choose this option to print the Form 940 on plain paper. |

Creating 940 Reports

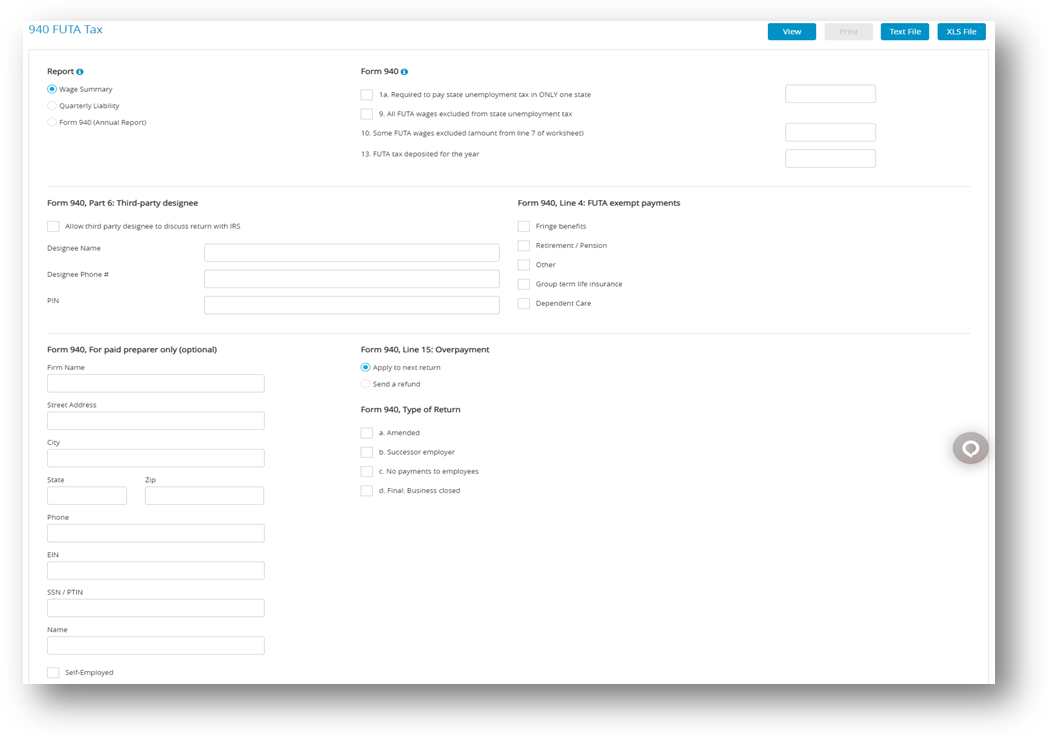

The 940 FUTA Taxes window prints the Form 940, Employers Annual Federal Unemployment (FUTA) Tax Return and gives you information that is useful for filling out the return manually.

- Click Reports drop-down option from the menu and then click Payroll.

- Click 940 FUTA Tax.

- Fill in necessary information in the 940 FUTA Tax Window as appropriate for your report.

- Click View and select print icon on top right corner of the view tab to download file.

Step result: The details filled in form will open in Acrobat Reader. If necessary, modify/edit any field in Acrobat Reader, save the file if you wish, and/or print out pages from Acrobat Reader. Changes made in Adobe Reader are not reflected in Payroll.

Fields on the 940

| Fields | Description |

| 1a | Mark this box if you pay unemployment tax (SUTA) in only 1 state. Also, fill in the two (2) letter postal abbreviation in the box to indicate which state you pay the unemployment taxes in.

If box 1a is not selected, CheckMark Online Payroll will automatically mark box 1b on Form 940 indicating that you pay unemployment taxes to more than one (1) state. You are then required to fill in Part 1 Schedule A (940) and submit with your Form 940. Schedule A (940) is not printable from CheckMark Online Payroll directly so you will need to download from irs.gov, or fill in this form that was sent to you by the IRS in the mail. |

| 9 | Check this box if all FUTA wages were exempt from state unemployment (SUTA). If line 9 is selected, line 10 does NOT apply. |

| 10 | Enter the amount to print on Line 10 if some of the FUTA wages you paid were excluded from state unemployment or if you paid any state unemployment tax (SUTA) late. This amount is from line 7 of the worksheet included in the Form 940 instructions. |

| 13 | Enter an amount to print on Line 13 for your FUTA tax deposited for the year. |

| Part 6: Third-party Designee | Enter information that will print in the appropriate section on the 940 if you use a third-party designee. |

| Part 8: For paid preparers only (Optional) | Enter information here that will print in the appropriate section on the 940 if you are a paid preparer. |

| Overpayment | If there is an overpayment on Line 15, select whether it is to Apply to next return or Send a refund. |