This article is about how to calculate the pay for employee paychecks and special checks, such as bonuses and after-the-fact paychecks.

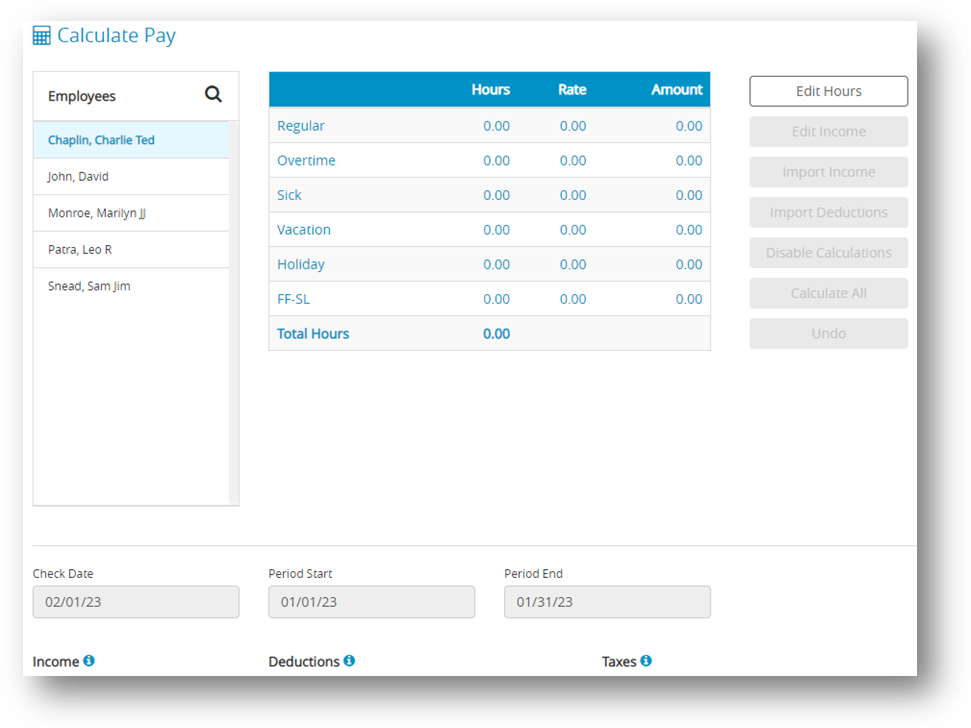

CheckMark Online Payroll can calculate the pay for one employee at a time or all employees for any combination of pay frequencies at one time. After you’ve entered employee hours with the Enter Hours or Distribute Hours window (you can also enter hours on the Calculate Pay window), the next step is to have CheckMark Online Payroll calculate employee wages, additional income and deduction amounts, taxes, and net pay for the current pay period.

Calculate Pay window options

| Options | Description |

| Check Date | When you first open the Calculate Pay screen, you will see the Calculate Pay Dates window. You need to enter the Check Date, Period Start and Period End dates. Click on the date of the calendar window for the date to fill in the appropriate field. When the dates are filled in, Click OK to continue to the Calculate Pay window. Dates entered in the Check Dates window are displayed on the Calculate Pay window while you are calculating your employee paychecks. |

| Next Period | This button will calculate Check Date, Period Start and Period End based on the pay frequency set on the first employee in the employee list and dates currently being displayed. |

| Change Frequency | If you have multiple pay frequencies, you can click the Change Frequency. |

Calculate Pay

When you access the Calculate Pay window, you will be presented with a list of all employees in your employee database, which is displayed on the left side of the screen. The employee names that appear in black indicate that there is currently no calculation saved for that particular employee. On the other hand, if an employee’s name is displayed in green with a dollar sign ($) icon on the left side, it means that a calculation has already been saved for that employee.

Options on Calculate Pay Window

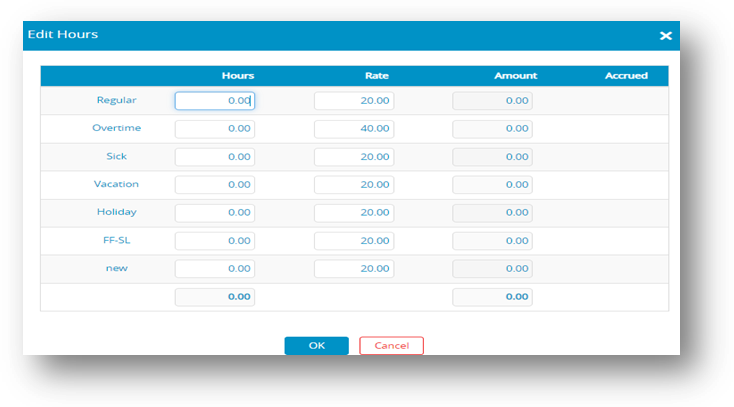

✔ Edit Hours

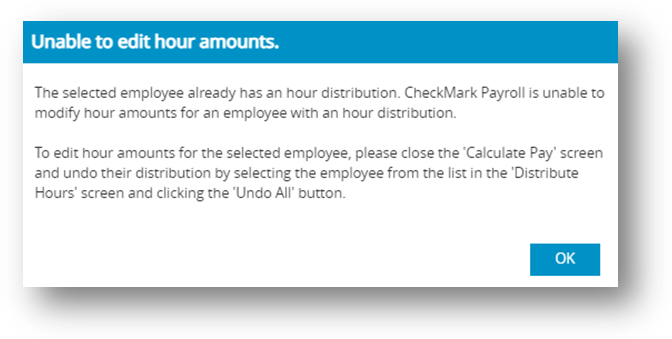

Select Edit Hours if you need to adjust the number of hours or wage per hour for the pay period. Hours entered on the Enter Hours window can be edited directly in Calculate Pay, but if hours were entered in Distribute Hours, you will need to edit hours on the Distribute Hours window. An employee name must be selected before this option is available. Changing the hourly rate on the Edit Hours window affects only the current calculation and does not change the employee’s hourly rate for future pay calculations.

The following is an alert message for Checkmark Online Payroll indicating that the hour distribution has been completed for an employee:

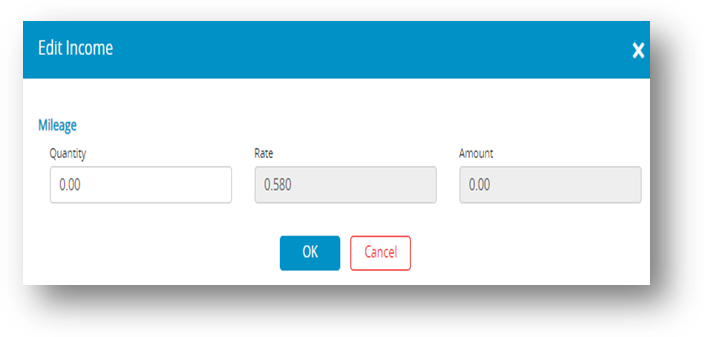

✔ Edit Income

Select Edit Income if you need to enter information for an additional income that is setup to calculate based on further information, such as mileage, commission, piecework or tips. An employee name must be selected before this option is available.

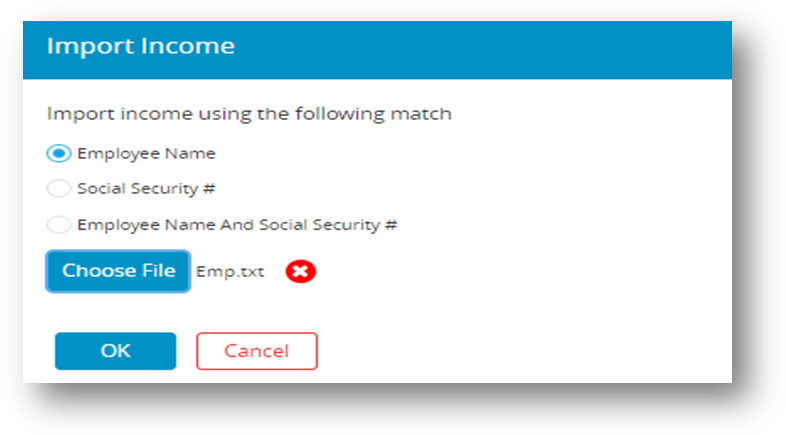

✔ Import Income

Select Import Income if you wish to import the additional incomes for your employees using a tab-delimited text file. An example is listed below for two employees. One employee, Jennifer Brown, has additional Commission and the other, James Wilcox, has additional Piecework and Mileage.

Brown[TAB]Jennifer[TAB]Commission[TAB]2500.00[ENTER]

Wilcox[TAB]James[TAB]Piecework[TAB]127.5[TAB]Mileage[TAB]105.9[ENTER]

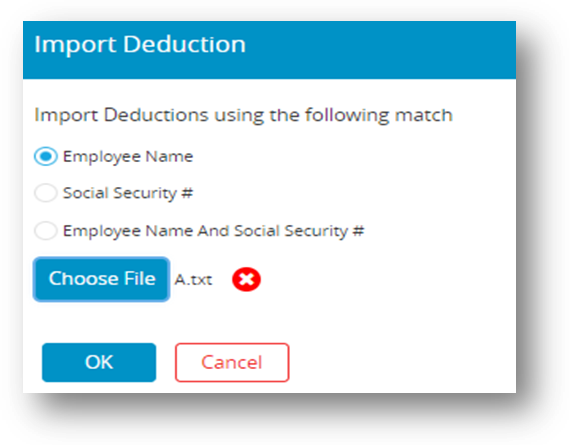

✔ Import Deduction

Select Import Deductions if you wish to import the variable deductions for your employees using a tab-delimited text file. An example is listed below for two employees. One employee, Jennifer Brown, has a reimburse deduction and the other, James Wilcox, has Office supplies.

Brown[TAB]Jennifer[TAB]reimburse[TAB]2500.00[ENTER]

Wilcox[TAB]James[TAB]Office[TAB]127.5[ENTER]

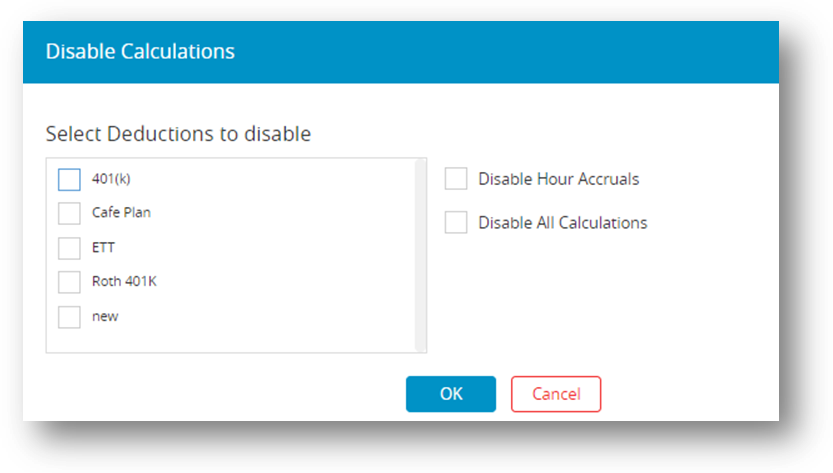

✔ Disable Calculations

Select this option if you wish a deduction to be turned off for this payroll, for hour accrual to not accrue on this check or to disable all the calculations when entering checks such as after the-fact payroll checks. Items selected in this window will affect all calculations made while you are in the Calculate Pay window. To deselect any or all of the options in this window, close Calculate Pay and re-enter the window. If this option is unavailable, you probably have an employee selected in the list. Deselect the employee and try again.

Select any or all deductions that you do NOT wish to calculate on this paycheck. For example, when calculating special checks such as bonus checks, you may not wish for items such as health insurance or 401(k) to be deducted. Select those items from the list then click OK.

✔ Disable Hour Accrual

Select this option if you are doing a special check and do not wish employee accruals to calculate on this check. An example is an employee that has accrual based on a per pay period basis and you are calculating a bonus check in addition to a regular paycheck on the same check date.

✔ Disable All Calculations

Select this option if you wish to manually enter all of the employee income, tax and deduction fields such is the case when entering after-the-fact checks.

Note: An employee’s Social Security and Medicare withholding are exact computations based on values shown for Federal Tax Parameters on the Federal Taxes Setup window and should NOT be manually changed for an individual check. There are, however, times when this is necessary specifically when entering after-the-fact checks since items already distributed MUST be matched exactly. Even if you select the “Disable Calculations” option, CheckMark Online Payroll will still alert you if there are any discrepancies between the inputted values and the calculated values. However, the system will still permit you to save the changes you have made.

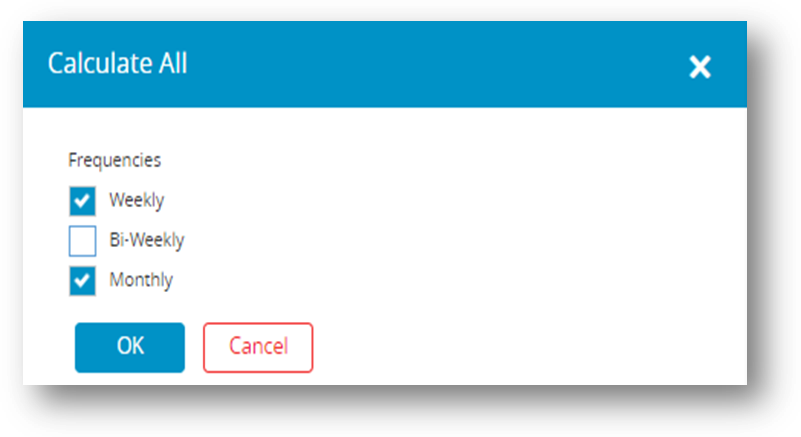

✔ Calculate All

If you want CheckMark Online Payroll to calculate the pay for all employees in a given pay period using your company and employee settings, then choose this option. When you select this option, a list of possible pay frequencies appears. Select any or all pay frequencies that you wish to calculate pay. All frequencies enabled are those that appear and have been assigned to employees on the Wages tab of the Employees window.

✔ Undo

Select this option if you wish to undo an employee’s saved calculation. CheckMark Online Payroll deletes the saved calculation and removes the “$” from the employee’s name turning from “green” to “black” again. If you select Undo with no employee name selected from the employee list, ALL calculations that have been saved will be deleted.

| Option | Description |

| Save | Select this option after you have finished editing the employee’s pay calculation. |

| Create Check | Select this option if you wish to create the employee’s paycheck directly in this window and not on the Review/Create Paychecks window.

CheckMark Online Payroll will not affect employee YTD balances or create reports without creating an employee paycheck. Once the check or direct deposit number is entered, click Create. |