Types of Employee Information Reports

Personal Information: The Personal Information report shows the employee personal data, including name, address, phone number, Social Security number, birth date, employee number, employment status, email address and default department.

Wage Information: The Wage Information report shows the employee’s salary or hourly rates, pay frequency, hire date, last raise date, termination date, accrued hours available, and department/job distribution percentages, and direct deposit if marked.

Tax Information: The Tax Information report shows the tax set up for the employee including, W-2 options, selected federal, state, SUTA state, local tables, and more.

Income/Deduction: The Income/Deduction Information report shows the Additional Information Income and Deduction categories and their associated definitions that have been set up for the elected employees.

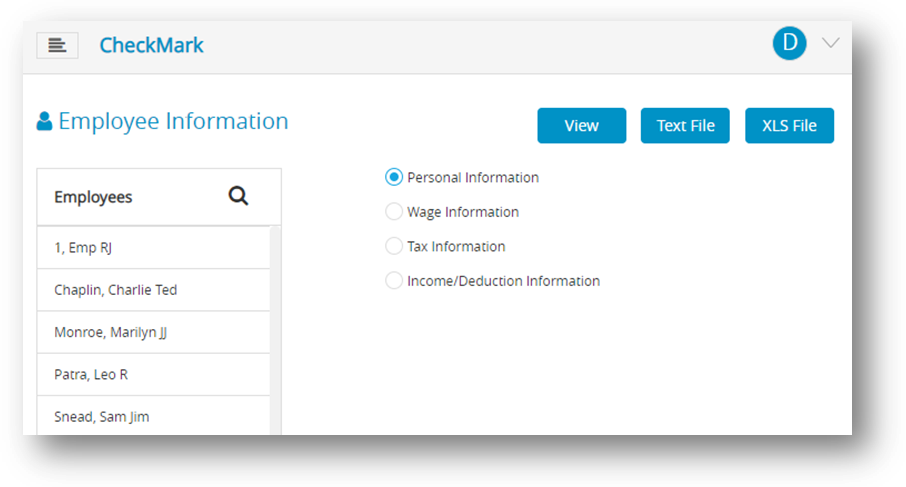

Creating Employee Information Reports

- Click Reports drop-down option from the menu and then click Payroll.

- Click Employee Information.

- Select the employee or employees for the report.

Note: You can select a consecutive or non-consecutive series of employees from the list by dragging through the list or using the CTRL key (Windows) or Command key (Mac). If no employee names are highlighted, all employees will be reported. - Select the type (personal, wage, tax and income) of report.

- Click View, Text File or XLS File based upon your requirement.

Note: To print a file, you first need to download it. To do this, click on the print icon on the View window. It should be download the file that you wanted to print and then give it for print. Make sure you have a printer connected to your device before attempting to print the downloaded file.