Types of Employee Paycheck Reports

| Types | Description |

| Check Register | The Employee Check Register report gives details about checks issued to employees. It includes the number of hours worked, pay rate, income, deductions, net pay, and where the money went within the company. At the end, it also shows how much the company owes for taxes and the number of checks issued. This report helps companies keep track of their payroll and finances better. |

| Posting Summary | The Posting Summary report shows check information in a summarized format and can be used to create manual journal entries in your accounting system. The net for each check is shown, along with totals for wages, income, taxes, and deductions. Ledger accounts are also shown with their associated amounts. If you have ledger accounts set up for department or job wages and taxes, then the ledger accounts and amounts for each department or job are shown. The total debits and credits are shown on the last two lines. |

| ACH Direct Deposit | CheckMark Online Payroll allows you to utilize direct deposit for your employees through your financial institution. Payroll creates an ACH file that you can submit directly to your bank. |

| Web Direct Deposit | You can export a file for use with National Payment Corporation’s Web Direct Deposit. The Web Direct Deposit text file contains only checks for employees who are set up as Direct Deposit employees on the Personal tab of the Employees window. |

| ACH NPC Direct | You can export a file for use with National Payment Deposit Corporation’s Direct Deposit. The ACH NPC Direct Deposit text file contains only checks for employees who are set up as Direct Deposit employees on the Personal tab of the Employees window. |

Employee Checks Report Options

| Options | Description |

| Include Jobs in Post Summary | If you distribute wages or hours to Multi-Ledger Jobs, you should check this box before posting to Multi-Ledger. |

| Mark Posted Checks | If you post paychecks to one of the accounting packages listed in the Format menu, you can check this box so that each time you post paychecks, they will be marked with an “x.” |

| Use Employee # | If using Web Direct Deposit and you would rather use an employee ID number instead of the Social Security number, you can mark this checkbox. You must also set up to use Employee ID # on National Payment Corporation’s Web Direct Deposit set up page. |

Posting File Formats

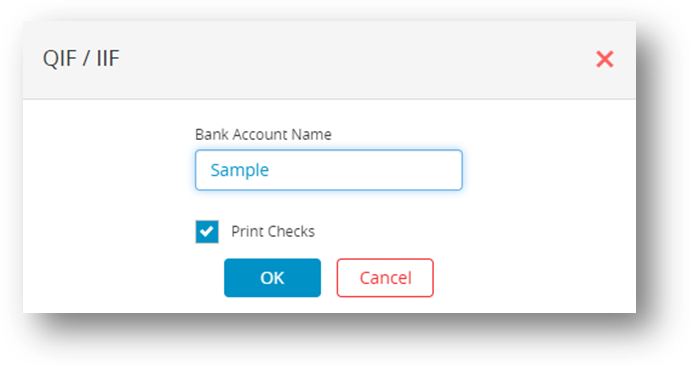

✔ Quicken (QIF)

You can export posting information to Intuit’s Quicken.

- Select Quicken (QIF) option and click Text File or View.

- Enter Bank Account Name.

- Click OK.

Step result: A pop-up screen opens with a list of Expense and Liability accounts.

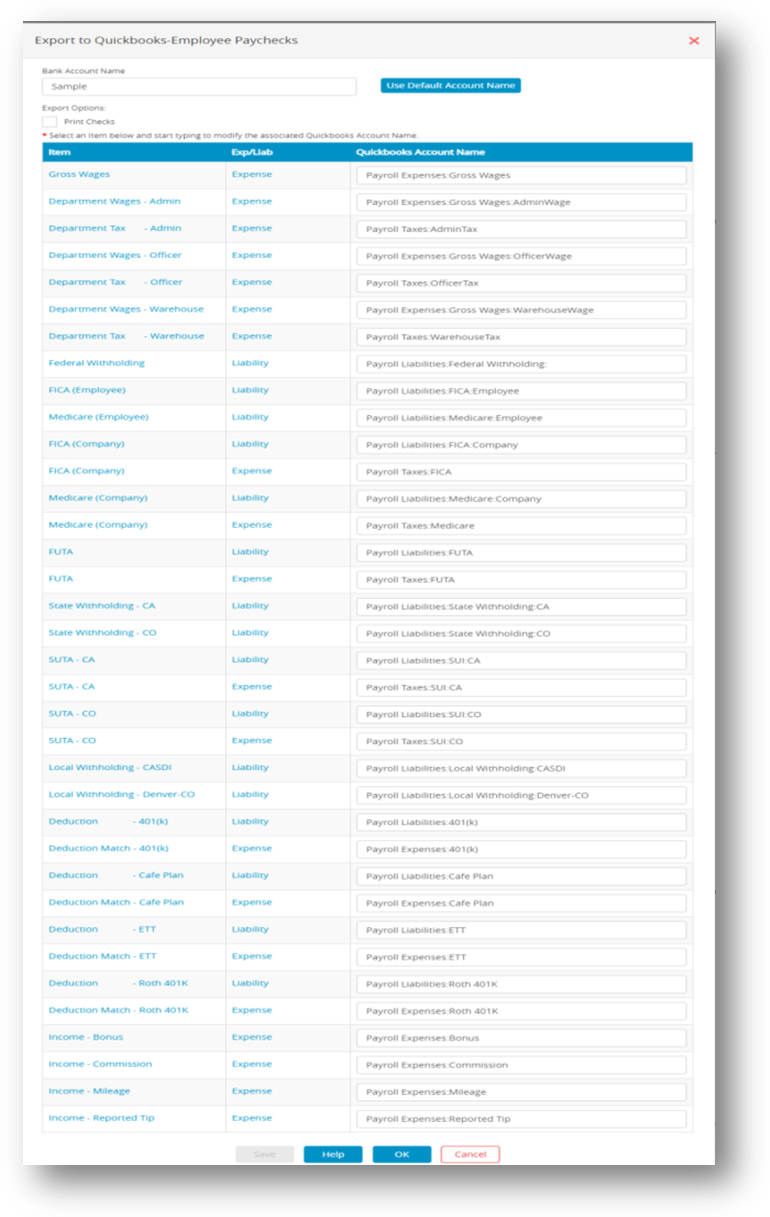

✔ QuickBooks(IIF)

You can export posting information to Intuit’s QuickBooks program.

- Select QuickBooks Format option from the dropdown menu and click Text File or View.

Note: A pop-up screen opens with a list of Expense and Liability accounts. You can use the Default Account Names or if you want to post to your current QuickBooks accounts, you can change the QuickBooks Account Name. To change the name, click the account you want to change under the QuickBooks Account Name column and type in a new name.

- Enter Bank Account Name and check the box if you want to print checks from QuickBooks.

- Click Save once you have finished entering your data.

- Click OK.

✔ MoneyWorks

You can export posting information to Money works.

- Select the Money works format option.

- Click Text File or View.

✔ Peachtree 3.0, 3.5, 5.0

You can export posting information to Peachtree.

- Select the Peachtree3.0, 3.5, 5.0 Format options.

- Click View or XLS File.

Step result: A dialog appears. Use print icon to print.

✔ Sage 50/ Peachtree

You can export posting information to Sage 50.

- Select the Sage 50 format option.

- Click View or XLS File.

Step result: A dialog appears. Use print icon to print if needed.

To select options for other posting file formats on the Employee Paychecks Window, follow these steps:

✔ Y.O.D

✔ Big Business

✔ CheckMark

✔ DBA SOFTWARE

✔ POS/OE 4

✔ CONNECTED

✔ TENTANT PRO

- Click Reports drop-down option from the menu and then click Payroll.

- Click Employee Paychecks.

- Select one or more consecutive check dates for the report.

Note: You can select a consecutive or non-consecutive series of checks from the list. - Select the checks and employee accordingly.

- Click format drop box and select the format.

- Click View, Text File or XLS File based upon your requirements.

By following above steps, you can customize the options for different posting file formats on the Employee Paychecks Window according to your requirements.

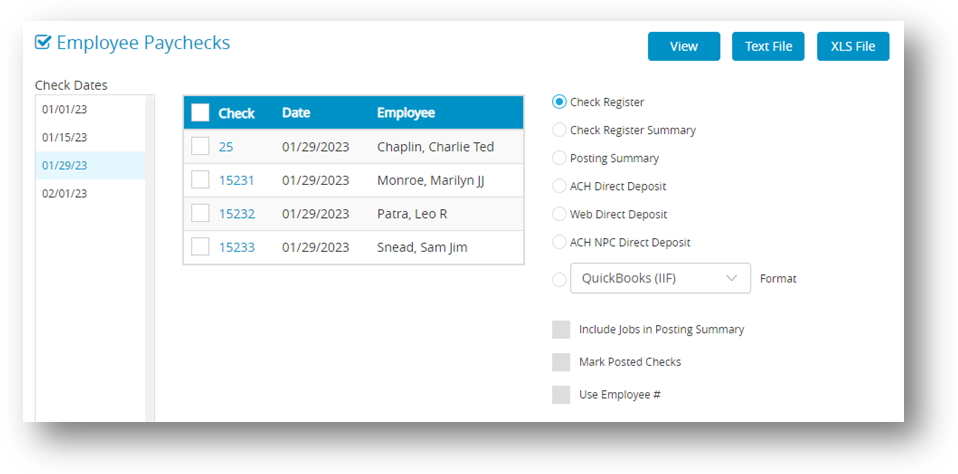

Creating Employee Paycheck Reports

- Click Reports drop-down option from the menu and then click Payroll.

- Click Employee Paychecks.

- Select one or more consecutive check dates for the report.

Note: You can select a consecutive or non-consecutive series of checks from the list. - Select the type of report.

- Click View, Text File or XLS File based upon your requirements.