Types Employer Payments Reports

| Types | Description |

| Check Register | The Check Register report shows check data for the selected month, including check number, check date, payee, payment description, and the check amount. |

| Posting Summary | The Posting Summary report shows check information in a summarized format and can be used to create manual journal entries in your accounting system. (You can also save the posting summary information as a text file that can be imported into an accounting program). |

Posting File Formats

| Posting File Formats | Description |

| Quicken (QIF) | You can export posting information to Intuit’s Quicken. Select the Quicken (QIF) option and click View and then select print option to edit. |

| QuickBooks (IIF) | You can export posting information to Intuit’s QuickBooks. Select the QuickBooks (IIF) Format option and click View and then select print option to edit.

CheckMark Online Payroll creates an Informational Interchange Format (IIF) file for importing checks into QuickBooks. The posting file format includes account names and account types to post all payroll information into the general ledger. The accounts named in the file are based on the set up of your payroll company in CheckMark Online Payroll. If these accounts DO NOT exist in your QuickBooks chart of accounts list, QuickBooks by default, will create the accounts upon import. Inserting ledger accounts into the Payroll program will not override the accounts created in the IIF file. We suggest that before importing payroll the first time you make a backup of your QuickBooks data. After successfully importing payroll into QuickBooks, carefully look through the transaction(s) imported and also evaluate the changes, if any, to your chart of accounts. If you do not wish these changes to occur, restore your QuickBooks backup and manually post your payroll data to QuickBooks. |

| Peachtree 3.0 | You can export posting information to Peachtree Accounting, version 3.0. Select the Peachtree 3.0 Format option and click View and then select print option to download. |

| Peachtree 3.5, 5.0 | You can export posting information to Peachtree Accounting, version 3.5 and 5.0. Select the Peachtree 3.5, 5.0 Format option and click View. A dialog appears then select print option to download. |

| M.Y.O.B | You can export posting information to Best ware’s M.Y.O.B.™ Select the M.Y.O.B. Format option and click View. A dialog appears then select print option to download. |

| Big Business | You can export posting information to Big Business. Select the Big Business Format option and click View. A dialog appears then select print option to download. |

| CheckMark | You can export posting information to CheckMark. Select the CheckMark Format option and click View or Text File. A dialog appears then select print option to download. |

| RAKEFET | You can export posting information to RAKEFET. Select the RAKEFET Format option and click View. A dialog appears then select print option to download. |

| DBA Software | You can export posting information to DBA Software. Select the DBA SOFTWARE Format option and click View. A dialog appears then select print option to download. |

| POS/OE 4 | You can export posting information to POS/OE 4. Select the POS/OE 4 Format option and click View. A dialog appears then select print option to download. |

| CONNECTED | You can export posting information to Connected accounting. Select the Connected Format option and click View. A dialog appears then select print option to download. |

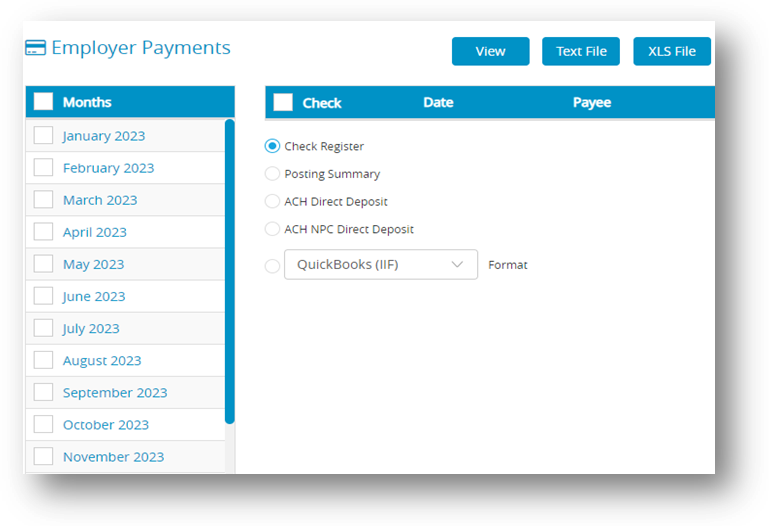

Creating Employer Payments Reports

- Click Reports drop-down option from the menu and then click Payroll.

- Click Employer Payments.

- Select the month(s) for the report.

- Select the checks for the report.

Note: You can select a consecutive or non-consecutive series of checks from the list. If no checks are highlighted, all employer checks will be reported. - Select the type of report.

- Click View, Text File or XLS File.