You can print forms 941, 943 and 944 from the Federal Taxes window along with a Tax Summary report.

Types of Federal Tax Reports

| Types | Description |

| Tax Summary | The Tax Summary report shows tax information, including employee names, total wages and tips, federal withholding, Advance EIC, Social Security wages, Social Security tips, and Medicare wages and tips for the selected quarter or current payroll year. You can use this tax data for filling out the Federal 941 form or use the annual report for filing form 943 or944.

Each type of withholding is summarized and the total taxes due are shown after the employee list. An amount shown for Adjustment for Fractions will print on line 7a of the 941 report (6a on Form 944) in the Fractions of Cents field. An amount on the Adjustment for Fractions line is usually due to Social Security and Medicare rounding and is typically less than one dollar. If the amount is larger, a warning will come up and you should research the cause. The second half of the report is the Employer’s Record of Federal Tax Liability. This section shows tax liability information based on actual payroll checks that have been created for the quarter only. If you view the annual Tax Summary report, this part of the report gives monthly liabilities. State Withholding amounts, as well as the number of employees for each month of the quarter are shown at the bottom of each quarterly tax summary report. |

| Form 941 | Choose this option to print the 941 (Employer’s Quarter Federal Tax Return form) on plain paper. |

| Form 943 | Choose this option to print the 943 (Employer’s Annual Federal Tax Return for Agricultural Employees) on plain paper. |

| Form 944 | Choose this option to print the 943 (Employer’s Annual Federal Tax Return) on plain paper. |

Creating 941 Reports

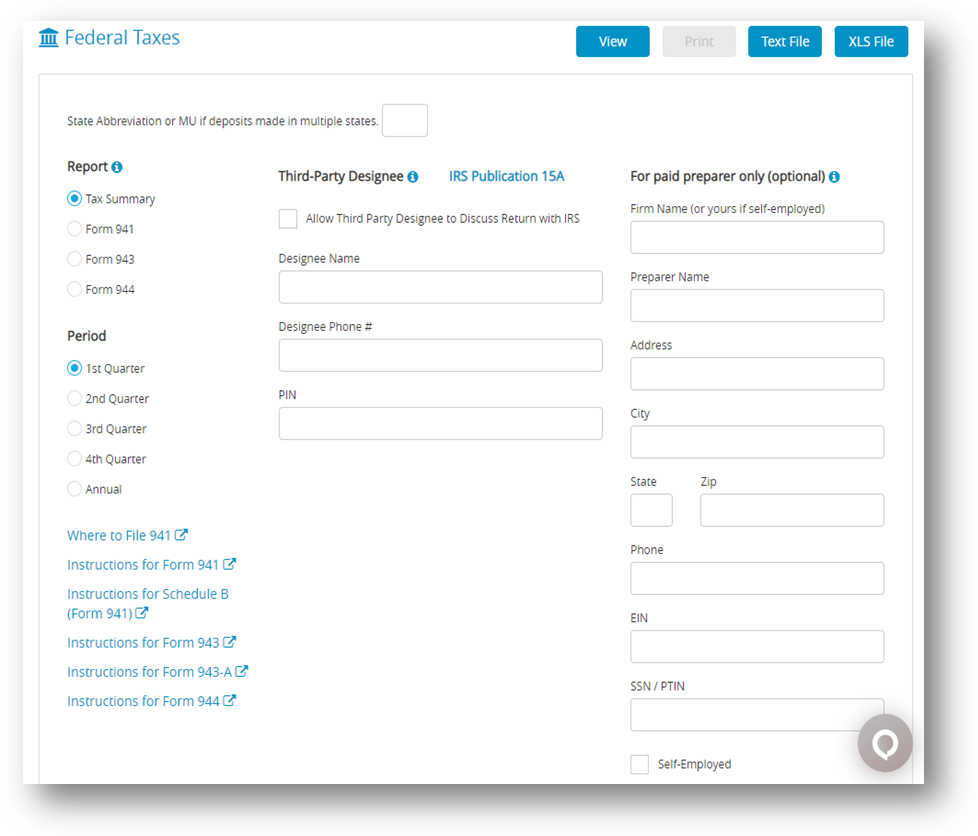

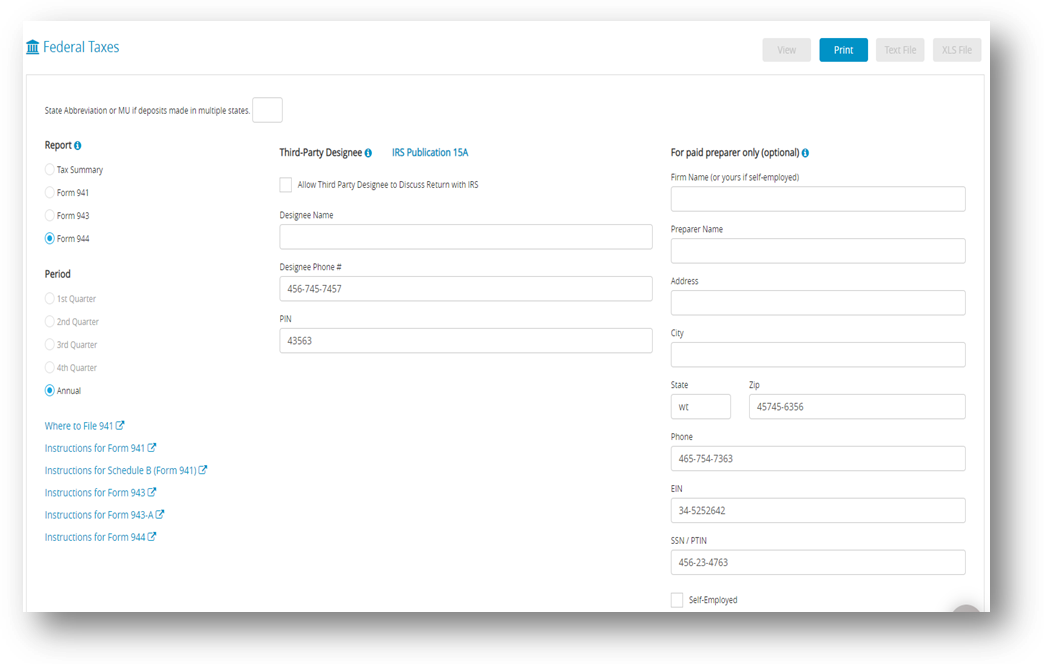

The Federal Taxes window prints the Form 941, Employer’s Quarterly Federal Tax Return form and gives you information that’s useful for filling out the form manually.

- Click Reports drop-down option from the menu and then click Payroll.

- Click Federal Taxes.

- Enter the 2 letter state postal code where you make your deposits or MU if you make deposits in multiple states.

- If necessary, enter information for Third-party designee and/or For paid preparers only (optional).

- Select the quarter for which you are reporting.

- Select the Form 941 Report Option.

- Click Print.

Step result: A pop up window appears. - Select employee name, check dates and then click OK.

Note: Be sure to change the amount in the Line 11 Total Deposits field, if different than the program calculation.

If you make changes to the Total Deposit amount on lines 7a (941) or 6a (944) of your tax form, any difference of $0.40 or less will be shown in fractions of cents. But if the change is more than $0.40, the form will either show that you owe more money (line 12) or that you have overpaid (line 13). It’s important to be accurate when making changes to the Total Deposit to avoid mistakes.

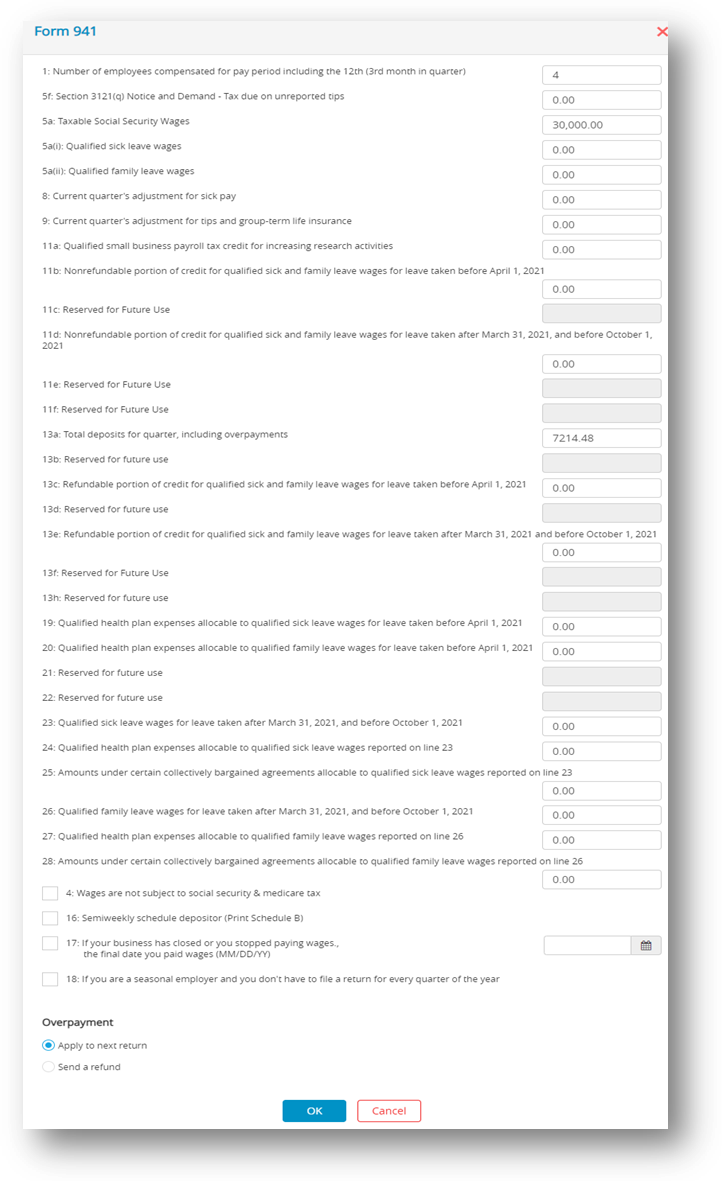

A Form 941 should be displayed as given below.

- Fill in all appropriate fields. When finished, click OK.

Note: The filled in Form will open in Acrobat Reader. If necessary, modify/edit any field in Acrobat Reader, save the file if you wish, and/or print out pages from Acrobat Reader. Changes made to Form 941 in the Adobe Reader program are not reflected in Payroll.

Creating 943 Reports

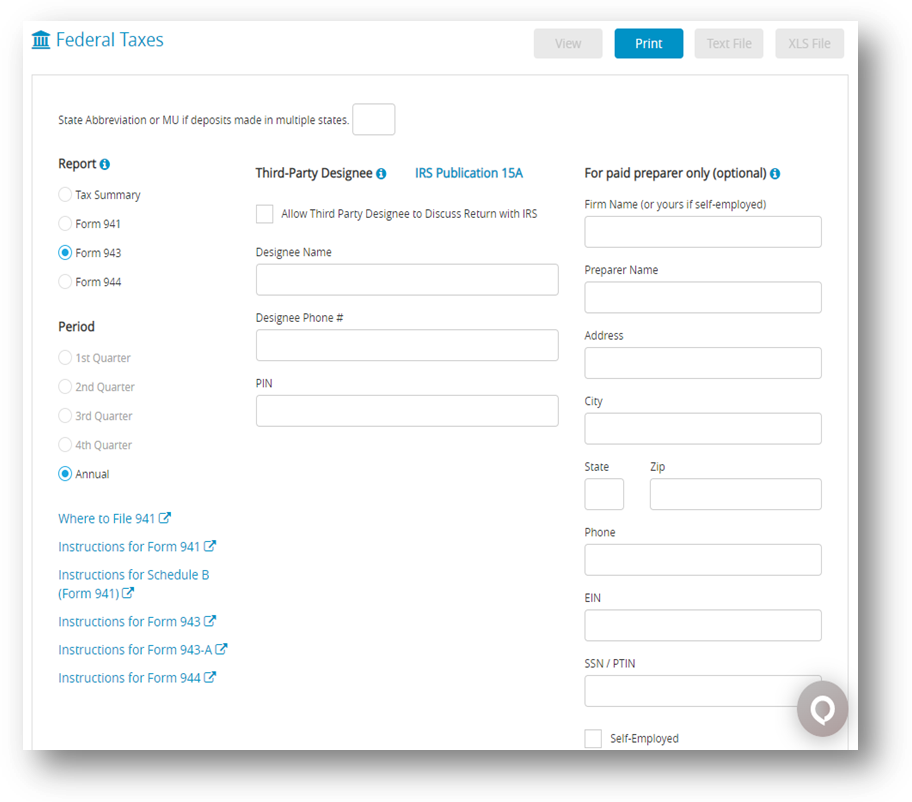

The Federal Taxes window prints the Form 943, Employer’s Annual Federal Tax Return for Agricultural Employees and gives you information that’s useful for filling out the form manually.

- Click Reports drop-down option from the menu and then click Payroll.

- Click Federal Taxes.

- If necessary, enter information for Third-party designee and/or for paid preparers only (optional).

- Select the Form 943 Report Option.

- Click Print.

Step result: A pop up window appears. - Select employee name, check dates and then click OK.

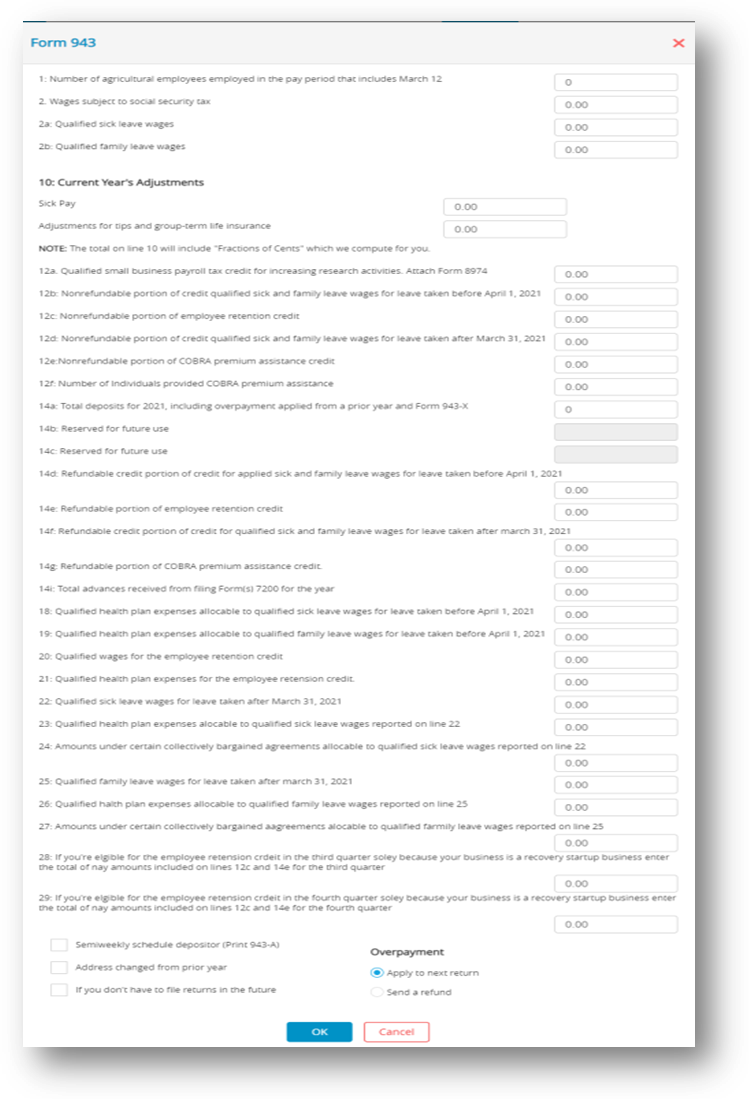

- Fill in or change all appropriate fields if needed. Click Ok.

Note: File should be downloaded. Now open Form in Acrobat Reader. If necessary, modify/ edit any field in Acrobat Reader, save the file if you wish, and/or print out pages from Acrobat Reader. Changes made in Adobe Reader are not reflected in Payroll.

Creating 944 Reports

The Federal Taxes window prints the Form 944, Employer’s Annual Federal Tax Return and gives you information that’s useful for filling out the form manually.

- Click Reports drop-down option from the menu and then click Payroll.

- Click Federal Taxes.

- Select the Form 944 Report Option.

- Enter the two letter state postal code where you make your deposits or MU if you make deposits in multiple states.

- If necessary, enter information for Third-party designee and/or for paid preparers only.

- Click Print.

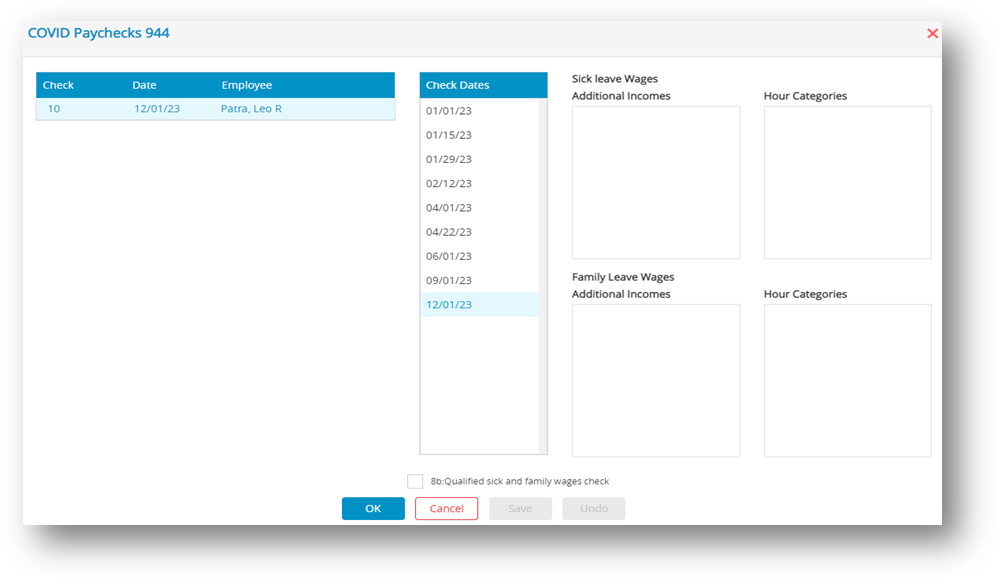

Step result: A popup window appears.

- Select employee name, check dates and then click OK.

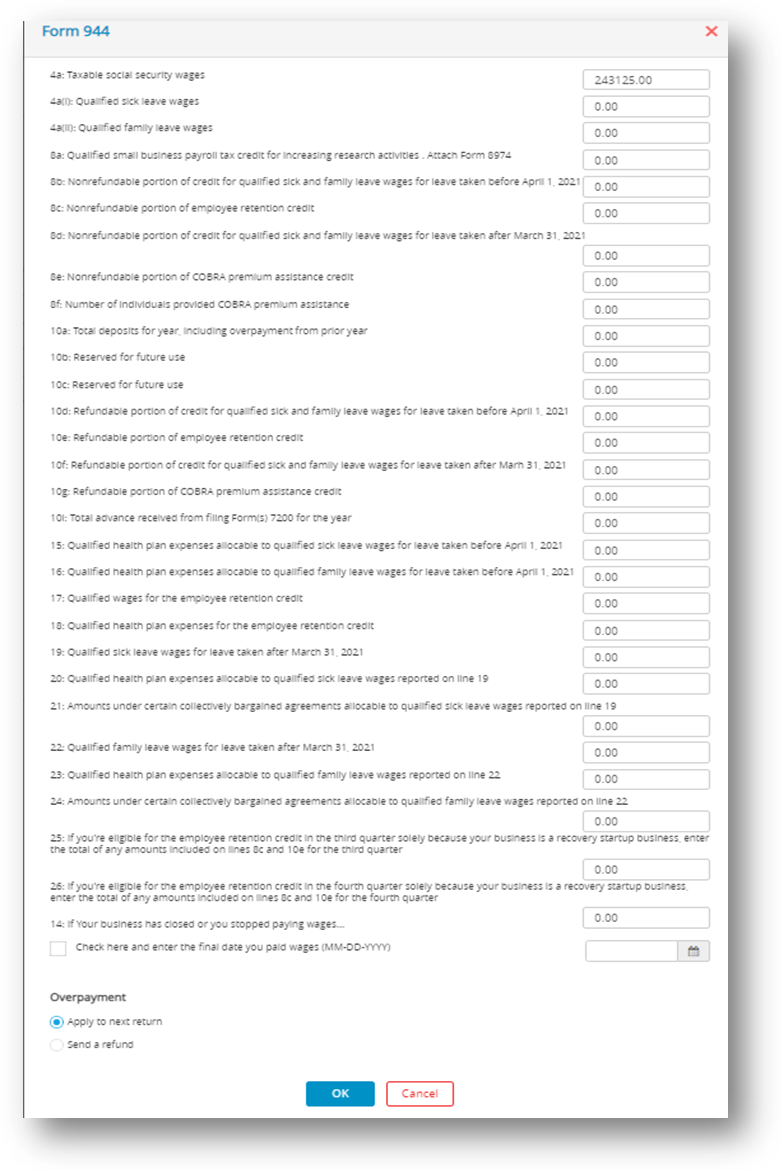

Step result: A popup window appears. Enter amounts into the fields corresponding if applicable.

✔ 10a. Total deposits for the year, including overpayment from prior year.

✔ 14. If your business has closed or you stopped paying wages you need to check this box and fill in the final date you paid wages.

- Click OK.

Note: File should be downloaded. Now open Form in Acrobat Reader. If necessary, modify/ edit any field in Acrobat Reader, save the file if you wish, and/or print out pages from Acrobat Reader. Changes made in Adobe Reader are not reflected in Payroll.

Causes of “Adjustment for Fractions” Amount

Possible Causes of “Adjustment for Fractions” Amount on Tax Summary Report and its Impact on Line 7a of 941 or 6a of 944:

If an amount appears on the Adjustment for Fractions line in the Tax Summary report, it will be reflected on Line 7a of the 941 form’s Fractions of Cents field or Line 6a, Current Year’s Adjustments, of the 944 form. In case the amount is less than one dollar, it might be due to rounding, and there is no need for concern. However, if the amount is significant, further investigation is recommended. Amounts exceeding one dollar could be caused by the following factors:

✔ After checks have been created, a deduction or income category defined as exempt has been re-defined as nonexempt. Or a deduction or income item defined as nonexempt has been re-defined as exempt.

✔ Social Security or Medicare amounts have been manually adjusted on the Calculate Pay window to override the calculated amounts. These amounts are exact calculations and should not be manually adjusted.

✔ An employee who was marked as exempt from Social Security and/or Medicare was changed to Non-exempt. Or an employee who was set up as Non-exempt from Social Security and/or Medicare was changed to exempt.

✔ If you change the Total Deposit to a number $0.40 higher or lower than the program calculation, the difference will show in fractions of cents (line 7a 941). If the difference is more than $0.40, it will show as either a balance due (line12) or an overpayment (line 13).

Reporting of Third-Party Sick Pay

Since no checks have been calculated and created in the CheckMark Payroll program for employees receiving third-party sick pay, their wages are not included in reports such as the Form 941, Form 944 and W-2/W-3 statements. Information regarding sick pay and federal reporting also applies to state reports.

The information included here is for employers where the liability has been transferred to the employer and no optional rules for W-2 have been implemented. For more details about reporting sick pay with special rules, see IRS Publication 15A.

Form 940 Annual Report

Include all wages paid to each employee, including third-party sick pay paid to any employee during the year on your annual Form 940 up to the maximum wages. Wages entered in the Employee window YTD tab are included when calculating Form 940 annual report. These wages will not show on the quarterly breakdown report unless you modify YTD totals for each employee prior to printing the report for 940 deposits.

Form 941 Quarterly report OR Form 944 Annual report

Third-party sick pay must be reported on the Form 941 quarterly report (Form 944 annual report) of wages. You will need to report both the employer and the employee parts for both Social Security tax (up to the maximum wages) and Medicare tax for sick pay on lines 5a and 5c of the Form 941 (lines 4a and 4c of Form 944). On line 7b of the Form 941 (line 6a of Form 944) you will need to show a negative adjustment for the employee portion of the Social Security and Medicare taxes withheld from sick pay by the third-party payer. You will also need to report federal withholding wages on line 2. There is more information in Publication 15, Publication 15A or 941 instructions at www.irs.gov.

Steps for Form 941 (Form 943 or 944) reporting in Payroll

- Click Reports drop-down option from the menu and then click Payroll.

- Click Federal Taxes.

- Select Form 941, 943 or 944 and applicable quarter or annual.

- If necessary, fill in Third-Party Designee information and/or Paid Preparer information and state abbreviation.

- Select Print, a setup screen opens. Enter Social Security and Medicare amount withheld by third-party as a negative number in edit box 7b. Adjust amount of deposits on line 11 for the quarter if you have already deposited the employer amount of the Social Security and Medicare taxes.

- Click OK.

Step result: To properly access the form, please download it first and then open the downloaded file using the latest version of Adobe Reader. - Modify line 2, federal withholding wages to include sick pay.

- DO NOT modify line 3 to include federal withholding withheld by third-party on sick pay wages. This will be reconciled later on the W-3statement.

- Modify lines 5a and 5c (on Form 944, lines 4a and 4c) to include sick pay wages paid by third-party payer. Include sick pay wages on line 5a (4a on Form 944) up to the Social Security maximum taxable wages for the year.

Note: Modifications made in the Adobe Reader fill-in form will not automatically carry through the form. Adjust calculations through the end of all pages of the form. If necessary, you will also need to adjust deposits recorded on page 2 of Form 941 (also Form 944) if you are a monthly depositor for employer portions of Social Security and Medicare taxes that were reported to you by the third-party payer. - If you are a semi-weekly depositor, you will need to make adjustments for any deposits made on the Schedule B.

Note: Calculations made in the Adobe Reader program do not automatically calculate through the form. Be sure to make any necessary adjustments to calculations throughout all pages.