Setting Up Employee Accruals

CheckMark Payroll accommodates up to three accrued hours per employee. Accrued Hours are hour categories where you track hours earned and used for each employee such as vacation or sick.

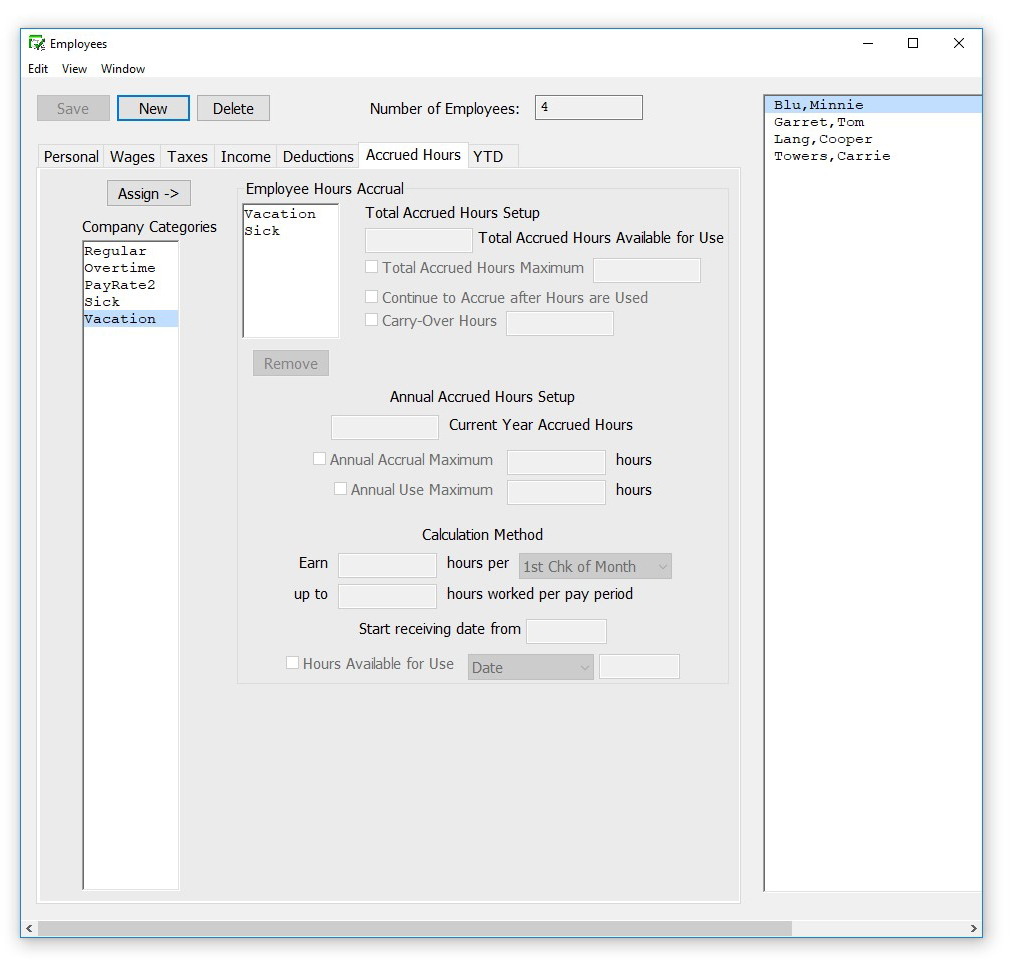

Assigning Accruals to an Employee

- Select the Accrued Hours view tab on the Employees window.

- Select an employee from the employee list if one is not already selected.

- Select the hour category for the employee from the Company Categories list.

The categories that appear in the Company Categories list are those that were set up with the Hour Categories window.

- Click Assign.

Tip: You can also double-click an hour category to assign it to an employee.

- Define the accrued hour category.

- Repeat steps 3–5 for each accrued hour category for the employee.

- Click another view tab after you’ve finished setting up the accrued hours for this employee to continue setting up the employee or click Save.

Modifying an Accrual

You can modify an existing accrual assigned to an employee.

- Select the employee from the list.

- Highlight the accrual you want to modify.

- Change the status of the accrual information.

- Click Save.

Remove an Accrual from an Employee

- Highlight the employee from the list.

- Select the hour category from the Employee Hours Accrual list.

- Select Remove.

Items in the Accrued Hours View Tab

| Current Accrued Hours | Enter the number of accrued hours that the employee has already accumulated. |

| Earn a Maximum of Hours | Check this option and enter the limit for the number of accrued hours that an employee can accumulate. |

| Start Receiving | Enter a date the employee should start accruing hours. If not date is entered, the employee will start accruing hours on the next paycheck. |

| Earn Hours Per | Enter the number of hours the employee should had added onto their Current Accrued Hours based on the frequency selected in the Per drop down list. Choose from Month, Year, Hour Worked, or Pay Period. |

| Month | If you choose Month, the employee will receive the number of accrued hours entered in the edit box on the first paycheck of each month. The employee will start receiving the accrued hours on the first paycheck after the date entered in the Start Receiving box. If no date is entered, the employee will start receiving the accrued hours on the next paycheck. |

| Year | If you choose Year, the employee will receive the number of accrued hours entered in the edit box at one time. The employee will start receiving the accrued hours on the first paycheck after the date entered in the Start Receiving box. A Start Receiving date in the current payroll year is required. |