This article explains how to setup new Employees for each employer.

Creating New Employee

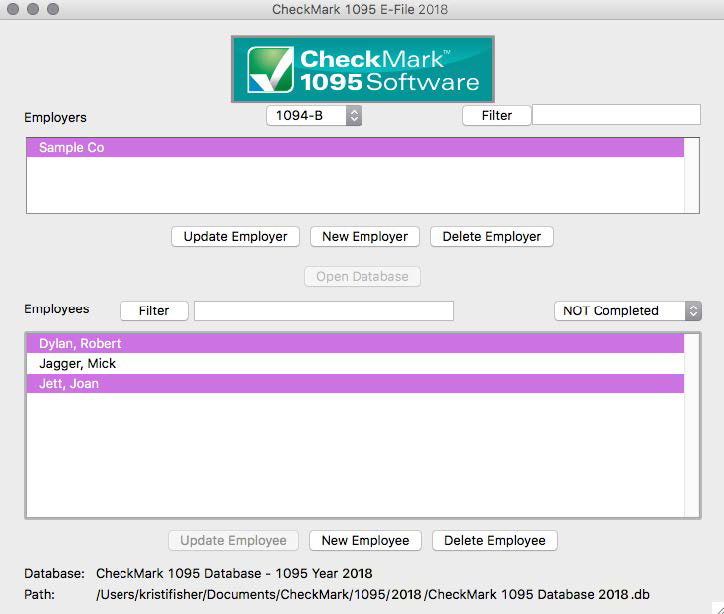

- Open the Database that contains the employer to which you want to add employees. If no Database exists you must first create one. See “Create New Database.”

- Select an Employer from the list. If no Employers are listed, you must first set up an employer before adding employees. For information on setting up a new employer, see “Creating a New Employer.”

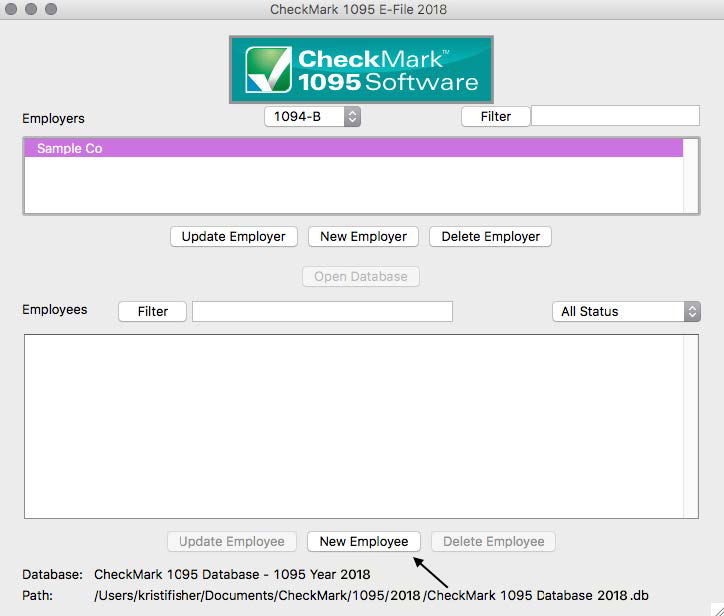

- Click the New Employee button.

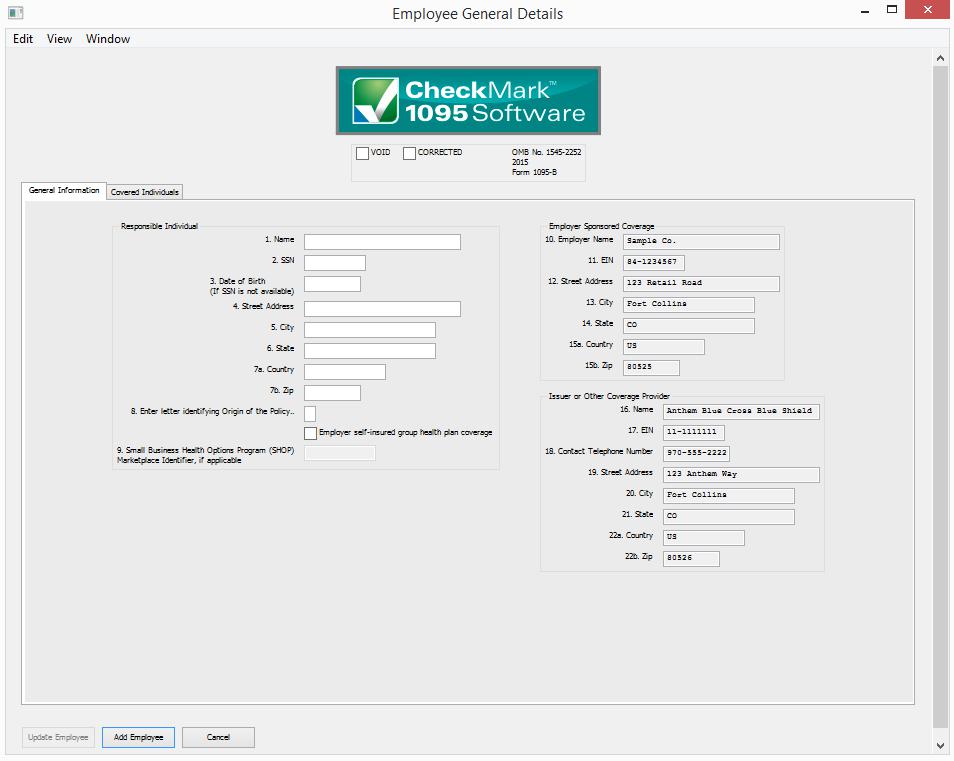

The list of fields for the new employee corresponds to the same fields found on the 1095 forms

- Choose which type of 1095 form this employee should receive and click OK.

- Enter the Employee’s SSN along with the Employee’s Information. Do not enter the Date of Birth unless the SSN is not available.

- Fill in any fields that are applicable for the employee.

- Click the Add Employee button to Save the information.

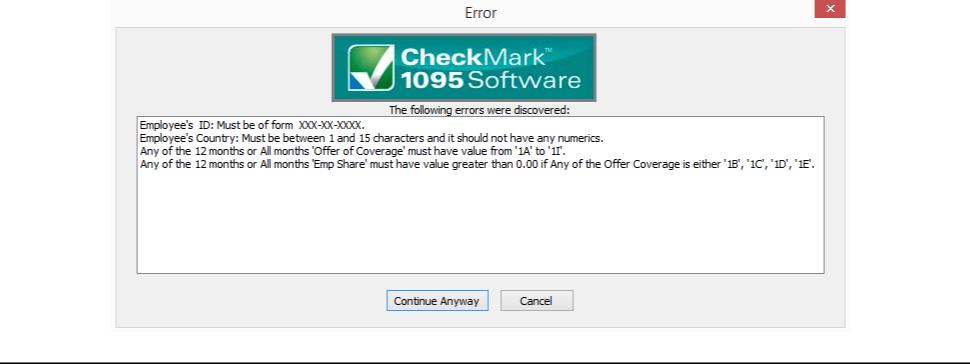

If any information is invalid, a popup window will open explaining which fields have errors.

Press cancel to go back to the set up screen to correct any errors, or Continue Anyway to Save the employee information

NOTE: If any field has an invalid entry, once you return to the Employee set up screen, that field name will show up in “Red”. In addition, some fields will not save the invalid information and remain empty. For more information on validated information, see “Validated Status.”

Updating an Existing Employee

- Select the employer that contains the employee(s) you wish to update.

- Highlight the employee in the list you wish to update and click Update Employee button.

- After all changes have been made to the Employee Information, click Update Employee button to save changes.

Voided Employee

If a 1095 is incorrectly filed, or included in a filing, that was incorrectly filed, you can resubmit the 1095 as a Voided copy to void the original 1095 to the IRS. Please read the IRS Instructions on how to file this.

- Select the employee from the list and click Update Employee button

- Click the Void check box at the top of the screen.

If the employee’s Status is already considered Printed and/or Completed, you’ll receive a pop up window asking if you would like to change the status back to Not Printed and/or Not Completed. For information on what the different Statuses mean, see “Status”

- Mark the corresponding checkbox next to “NOT Printed’ and/or “NOT Complete” if you want to change the status and click the Save and Continue button. If you do not want to change the status, click the Cancel button. If you do not select either checkbox, you can still click the Save and Continue button to save any updated employee information without changing their status.

If you initially printed the form, reprint another 1095 with the updated Void status and submit that form to the IRS with a new 1094 form. for instructions on printing 1095 forms, see “Printing 1095s for Employees.”

If you initially e-filed, create a new .txt file with that employee and updated Void information and submit it to the IRS. For information on e-Filing, see “Creating a file to eFile.”

Corrected Employee

If a 1095 is filed, or included in a filing, with incorrect information, a Corrected 1095 must be filed with the IRS.

- Select the employee from the list and click the Update Employee button.

- Click the Corrected check box at the top of the screen, update any information and click the Update Employee button to Save.

If the employee’s Status is already considered Printed and/or Completed, you’ll receive a pop up window asking if you would like to change the status back to Not Printed and/or Not Completed. For information on what the different Statuses mean, see “Status.”

- Mark the corresponding checkbox next to “NOT Printed’ and/or “NOT Complete” if you want to change the status and click the Save and Continue button. If you do not want to change the status, click the Cancel button. If you do not select either checkbox, you can still click the Save and Continue button to save any updated employee information without changing their status.

If you initially printed the form, reprint another 1095 with the updated Corrected status and submit that form to the IRS with a new 1094. for instructions on printing 1095 forms, see “Printing 1095s for Employees”

If you initially e-Filed, create a new .txt file with that employee and updated Corrected information and submit it to the IRS. For information on eFiling, see “Creating a file to eFile”

Deleting an Employee

- Select the employer that contains the employee(s) you wish to delete

- Highlight the employee in the list you wish to Delete.

If you want to delete more than one employee, you can highlight multiple employees at once. See “Selecting Multiple Employees”

- Click Delete Employee button.

- A pop-up window appears to confirm that these are the employees you want to delete.

- Click Confirm Delete to complete the process.

Filtering Employees

You can use the Filter button to search for certain employees in the list. To find a particular employee, enter all or part of the name into the Filter box area above the employees section and click the Filter button. The Filter will search for any employees that contain those variables.

You can also use an asterisk(*) to help sort groups. For instance, if you enter the first letter and then an asterisk, ex: N*, you will receive all employees that start with the letter “N”.

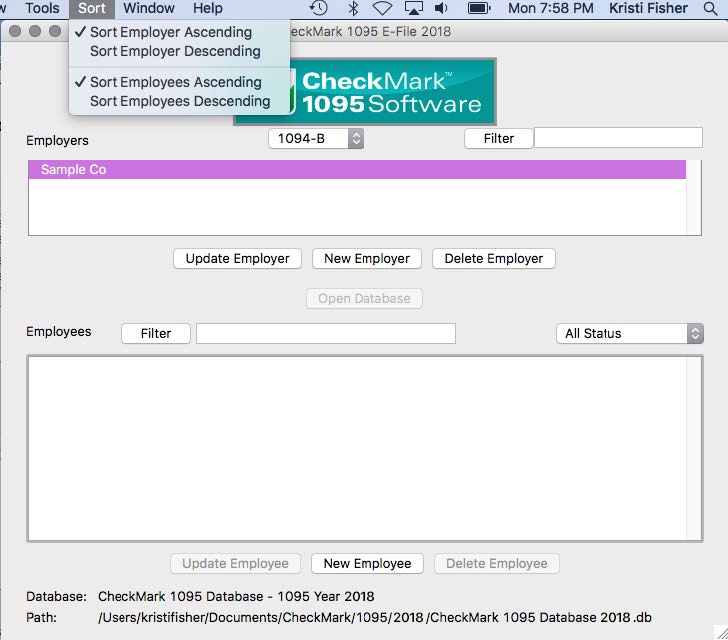

Sort Employees

You can sort employees by Ascending or Descending order. To select which type of sort to use, go under the Sort menu at the top of the screen and choose either Sort Employees Ascending or Sort Employees Descending.

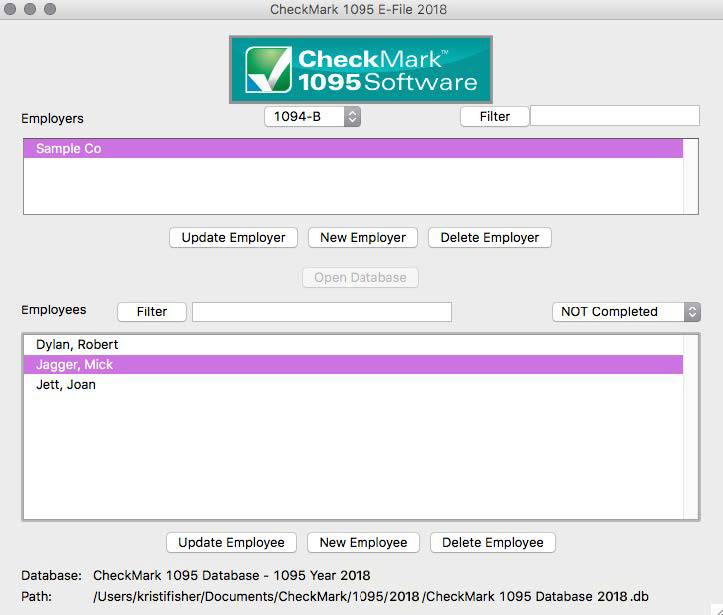

Status

The Status drop down menu has certain statuses that are categorized based upon their setup and completion of being printed. You can sort using the different options to see which employees or vendors have been Printed, Completed, Validated, Voided, or Corrected.

Employees can be in multiple statuses at the same time, however you can only sort by one status at a time.

NOTE: Before choosing a Status, you should first select one in the list.

Printed Status

You can easily sort using this status to see which employees still need the form 1095 printed.

You can select either Printed or Not Printed status to sort for employees by whether or not you have printed a 1095 for them. Once you select the Print Forms for Employee command from the File menu, that employee will automatically be moved to the Printed status from the NOT Printed status.

Completed Status

You can use the Completed status to indicate which employees have or have not been printed or e-Filed this form 1095 for employer related copies.

Once you select the Print forms for Filing option under the File menu, employees listed under NOT Completed will be moved to the Completed status.

Validated Status

Sorting by Validated or NOT Validated helps you easily determine if there is any employee that is not set up correctly. In the employee screen, certain fields require specific characters, numbers, etc. to be accepted upon filing.

Select Validated to see which employees are ready to be filed. Select NOT Validated to see any employees that have set up criteria which is incorrect for filing purposes. Once you have sorted by NOT Validated, select an employee and click on the Update Employee button to view the set up and make necessary changes. Fields marked in “RED” do not meet the requirements for filing and corrections should be made.

Voided Status

In the Employee set up screen, there is a checkbox at the top of the screen for Void. If you filed a 1095 for an employee that was unintended, you can mark Void to resent the 1095 for that employee as a void status.

Choosing a Voided status will list all employees marked Void in the Employee set up screen. All other employees that are not marked Void in the employee set up screen are listed as NOT Voided for a status.

Corrected Status

In the Employee set up screen, there is a checkbox at the top of the screen for Corrected. If you filed an incorrect 1095 and need to resubmit a new 1095 with updated information, select the Corrected checkbox in the employees set up screen before submitting the new 1095 information.

The Corrected status indicates all employees who are marked as Corrected in the employee set up screen. All other employees will be listed as Not Corrected.

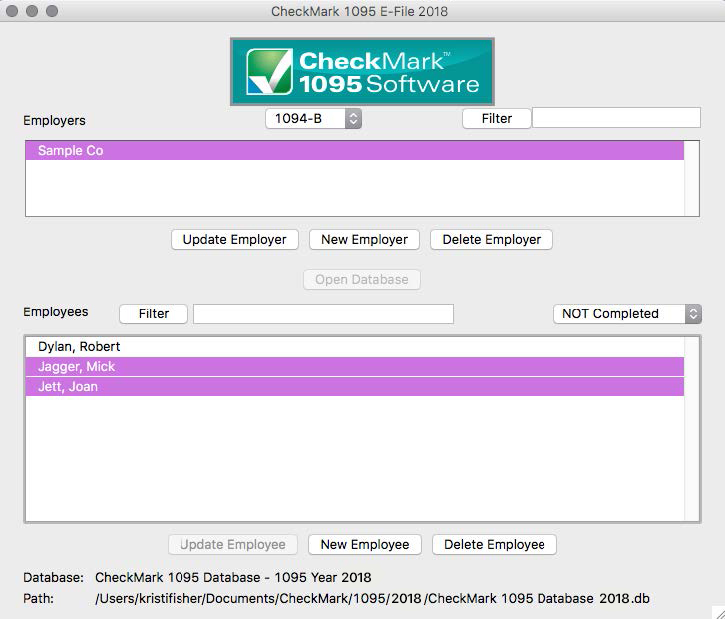

Selecting Multiple Employees

Consecutive Selection

Windows: You can select multiple employees by clicking the first employee while holding down the mouse and moving the mouse down through the list

You can also click the first employee, hold down the ‘SHIFT’ key on the keyboard and then click on the last employee you want in the list.

Macintosh: Click on the first employee you want in the list, hold down the ‘SHIFT’ key on the keyboard and then click on the last employee you want in the list

Non-Consecutive Selection

Windows: To select specific employees as a group, click on the first employee you want, hold down the ‘CTRL’ key on the keyboard and click on any other employees you want to include.

Macintosh: To select specific employees as a group, click on the first employee you want, hold down the ‘COMMAND’ key on the keyboard (also known as the Apple key) and click any other employees you want to include.