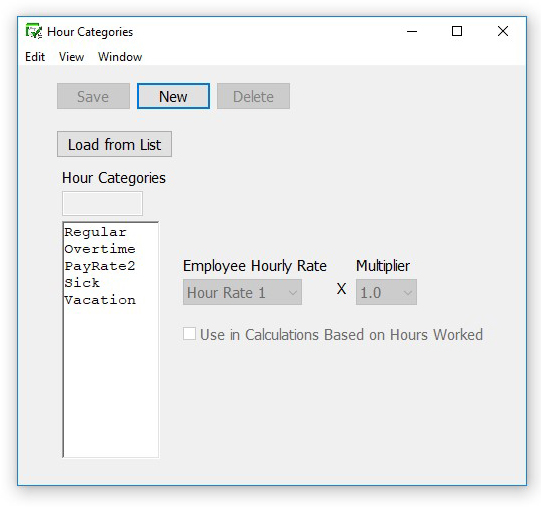

Use the Hour Categories window to set up hour categories in CheckMark Payroll. Hour categories is the types of hours that your company uses to calculate pay for hourly employees. You can also set up accrued hour categories, such as sick and vacation.

You can define up to eight hour categories for your company; all of which can be used for any employee.

Important You should carefully choose the order of the hour categories in the Hour Categories list because it determines the order of their appearance on the Distribute Hours and Enter Hours windows. Setting up hour categories according to their frequency of use with the most used hour category first is recommended.

Once you’ve created at least one set of payroll checks or set up beginning year-to-date balances with the YTD view mode on the Employees window, you should not change the order, delete or modify the names since this could adversely affect these balances.

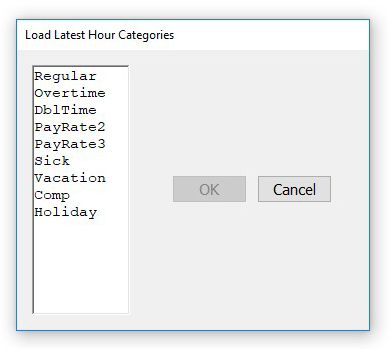

CheckMark Payroll comes with several pre-defined hour categories. Click the Add from List button in the Hour Categories window for a complete list. You can add a pre-defined hour category to your company, and then use it as is or change its definition.

Adding a Pre-Defined Hour Category to Your Company

- Click Setup in the Command Center, then select Hour Categories.

- Click Load from List.

- Select one or more hour categories from the list

- Click OK.

Creating a New Hour Category

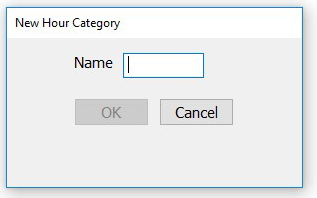

If you need an hour category that isn’t pre-defined in CheckMark Payroll, use the New button to create a new one.

- Click New.

- Enter a name, up to eight characters, for the hour category and click OK.

- Define the new hour category.

Employee Hourly Rate: Use this drop-down list to select whether Hour Rate 1, 2, 3, or 4 should be used for the hour category. The hourly rate is assigned to each employee on the Employees window.

Multiplier: Use this drop-down list to select the multiplier (1, 1.5, 2,0.5) by which an employee’s hourly rate should be multiplied.

For example: Regular would be defined as Hour Rate 1 x 1. Overtime would be defined as Hour Rate 1 x 1.5. Employee Brian makes $8/ hour. Regular hours would be paid at $8/hour (1 x $8) and overtime at $12/hour (1.5 x $8).

Use in Calculations Based on Hours Worked: Check this option if the hours in this category should be included for income and deduction calculations based on Fixed Amount/Hour Worked. An example would be Labor & Industry taxes in the state of Washington.

You should also check this option if you plan on accruing hours such as vacation or sick based on hours worked. For example, you wish to accrue vacation on regular hours worked. Check this option on Regular so that each hour worked by those employees would accrue vacation on them at the rate set on the Employee window.

- Click Save.

Modifying an Hour Category

Once you have created at least one check or setup YTD balances on the Employee window, modifying an hour category is NOT recommended since it could adversely affect balances.

- Click Setup in the Command Center, then select Hour Categories.

- Select the hour category from the Hour Categories list.

- Use the Employee Hourly Rate and Multiplier drop-down lists to change the hour category’s definition.

- Click Save.

Deleting an Hour Category

You can delete an hour category as long as there are no employee checks or employee year-to-date balances associated with it.

Important: Once you’ve created at least one set of payroll checks or set up beginning year-to-date balances with the YTD view mode on the Employees window, you should not change the order, delete or modify the names since this could adversely affect these balances.

- Select the hour category from the Hour Categories list.

- Click Delete.

CheckMark Payroll asks you to verify that you want to delete the hour category.

- Click Yes.