Setting Up Ledger Accounts

This article shows you how to set up ledger accounts in CheckMark Payroll that allow you to post your payroll to an accounting program.

If you won’t be posting your payroll to an accounting program, or your accounting program doesn’t use account numbers, you don’t need to set up ledger accounts. However, you might find ledger accounts useful on Posting Summary reports to manually transfer your payroll data to an accounting system.

You can assign accounts to the following payroll categories:

- General, such as the cash account for employee paychecks

- Additional Income, such as tips or mileage

- Employee Taxes, such as federal, state, and local withholding and Social Security and Medicare

- Deductions, such as 401(k) plans or health insurance

- Employer Taxes, such as employer portions of Social Security and Medicare, FUTA, and SUTA

- Department wages and tax expense

- Job wages and tax expense (can be used only with CheckMark MultiLedger)

Assigning the Posting Accounts

Items displayed under the Payroll Categories radio buttons are directly affected by the setup on other windows on the Command Center.

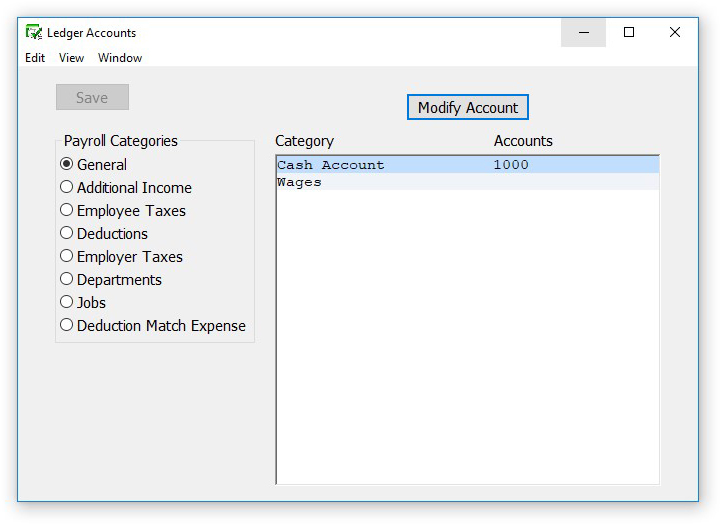

- Click Setup in the Command Center, then select Ledger Accounts.

- Select an option under Payroll Categories.

After selecting the payroll category, items associated with the category appear in the Items list:

- Select an item from the Items list box.

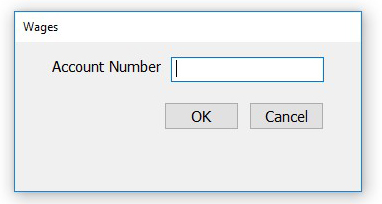

- Click Modify Account…

Tip: You can also double-click an item to open the Modify Account Number dialog.

- Enter an account for the selected item and click OK.

Accounts can be up to 16 alpha-numeric characters.

- Repeat steps 3–5 for each item in the payroll category.

- Click Save after you have finished entering the accounts in a payroll category.

Repeat steps for 2–7 for each payroll category.

Modifying a Posting Account

- Select an option under Payroll Categories.

- Select an item from the Items list.

- Click Modify Account.

- Modify the account number in the edit box and click OK.

- Repeat steps 2–4 for each account in the payroll category.

- Click Save after you’ve finished modifying accounts in the payroll category.

- Repeat steps 1– 6 for each payroll category.

Deleting a Posting Account

- Select an option under Payroll Categories.

- Select an item from the Items list.

- Click Modify Account.

- Press the DELETE key on your keyboard.

- Click OK.

- Repeat steps 3–5 for each account in the payroll category.

- Click Save after you’ve finished deleting accounts in the payroll category.

- Repeat steps 1–7 for each payroll category.

Posting Account Descriptions

General

Cash Account: The cash account from which payroll checks are paid.

Wages: An expense account for gross wages.

EIC: An expense account for Earned Income Credit.

Additional Income

The Additional Income items that appear in the list are those that were set up on the Additional Income window. You can assign an account to each item, typically an expense account.

Employee Taxes

Federal: A liability account for employee federal taxes withheld.

Social Security: A liability account for the Social Security tax withheld.

Medicare: A liability account for the Medicare tax withheld.

Liability accounts for employee state and local taxes withheld also appear in the list.

Deductions

The Deduction items that appear in the list are those that were set up on the Deductions window. You can assign an account to each item, typically a liability account.

Employer Taxes

| Cash Account | The cash account from which employer expenses and liabilities are paid. |

| Social Security Liability | A liability account for the employer portion of Social Security. |

| Social Security Expense | An expense account for the employer portion of Social Security. |

| Medicare Liability | A liability account for the employer portion of Medicare. |

| Medicare Expense | An expense account for the employer portion of Medicare. |

| FUTA Liability | A liability account for employer federal unemployment tax. |

| FUTA Expense | An expense account employer federal unemployment tax. |

| SUTA Liability | A liability account for State Unemployment appears for each state. |

| SUTA Expense | An expense account for State Unemployment appears for each state |

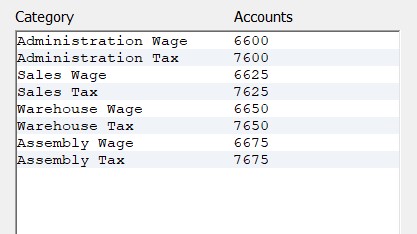

Departments

Wages: An expense account for department wages.

Tax Expense: An expense account for department taxes for employer portions of

Social Security and Medicare, FUTA, and SUTA.

Note: Department or job wage and tax expense accounts override general wage expense and employer tax expense accounts.

Note: If department or jobs are setup, the employer taxes will not be posted by tax expense, but by department/job liability and will be broken out by tax for the entire payroll.

Jobs

Note: Use this option if you distribute employee wages to jobs in MultiLedger.

Wages: An expense account for job(s) wages.

Tax Expense: An expense account for job(s) taxes for employer portions of Social

Security and Medicare, FUTA, and SUTA.

Note: Department or job wage and tax expense accounts override general wage expense & employer tax expense accounts.

Deduction Match Expense

Expense: An expense account for the employer deduction expense, that is not broken out by department/job expense, for deductions set up with an employer matching amount or percentage.