Creating Local Tax Reports

This report shows the employee social security number, employee name, wages exempt from local taxes, total wages, wages subject to local tax and amount of the local tax withheld. There are totals by local tax at the bottom of the report.

- Click Reports drop-down option from the menu and then click Payroll.

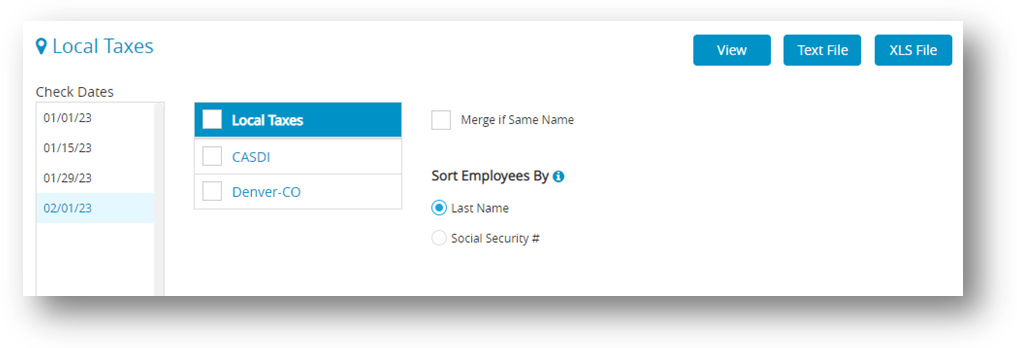

- Click Local Taxes.

- Select one or more check dates for the report.

Note: You can select a consecutive series of check dates from the list. - Select one or more local taxes for the report.

Note: You can select a consecutive or non-consecutive series of local taxes from the list.

If no local taxes are highlighted, all taxes will be reported. - Select the Sort Employees by option.

Note: Choose Last Name to sort the report by employees’ last name or Social Security # to sort by their Social Security Number. - Click View, Text File or XLS File.