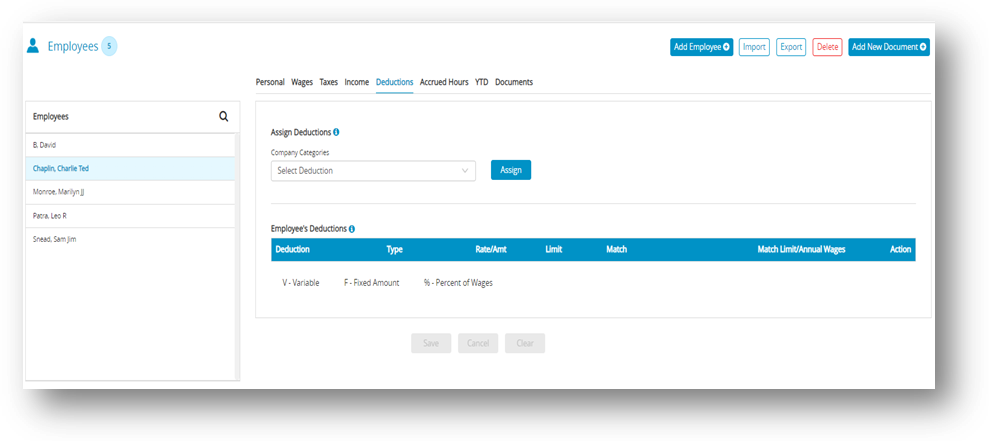

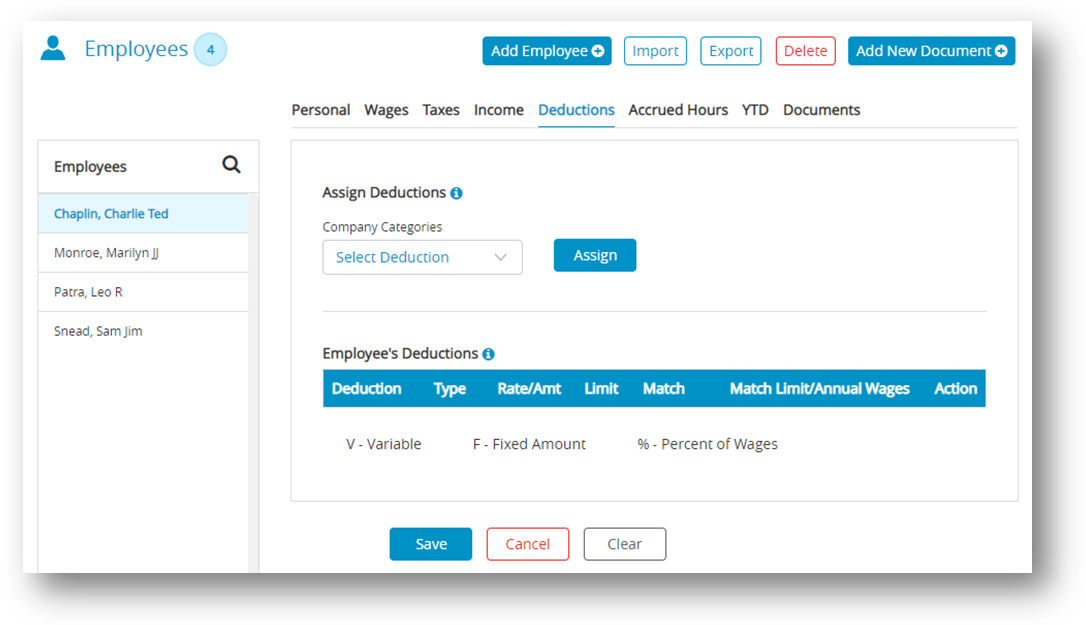

You can assign a maximum of 16 Deduction categories to each employee. Before a Deduction category can be assigned to an Employee, it must be set up on the Deductions window. For more information about employee deductions, see “Setting up Deductions“.

Assigning a Deduction to an Employee

- Select an employee from the Employees list on the Employees window.

- Click Deductions view tab on the Employees window.

- Select Deduction category from Company Categories drop-down list.

- Click Assign.

Step result: The Company Categories should be added in the Employee’s Deductions list.

Note: You can modify or remove the entries by clicking modify or remove Action Icons for Deductions. The value for a Variable Amount Deduction is entered when you calculate the employee’s pay on the Calculate Pay window. - Click Save.

Modifying & Removing a Deduction Category from an Employee

| Action | Procedure |

| Modify | You can change the amount of an existing Deduction category if it is not setup as V-Variable. This amount is entered when you calculate the employee’s pay on the Calculate Pay screen.

|

| Remove | You can remove a Deduction category from an employee as long as the employee doesn’t have any paychecks associated with it. The only time to remove a Deduction category from an employee is after you have started a new year, but before you have created a payroll in the new year. To stop the category from being applied mid-year, simply modify the amount/rate to zero in the Employee set up.

|