Use the Income view tab to set up employee income, other salary or hourly wages for your employees. Before an Additional Income category can be assigned to an employee, it must be set up on the Additional Income window. For more information about income, see Setting up Additional Income. You can assign a maximum of eight Additional Income categories to each employee.

Assigning Additional Income Categories to an Employee

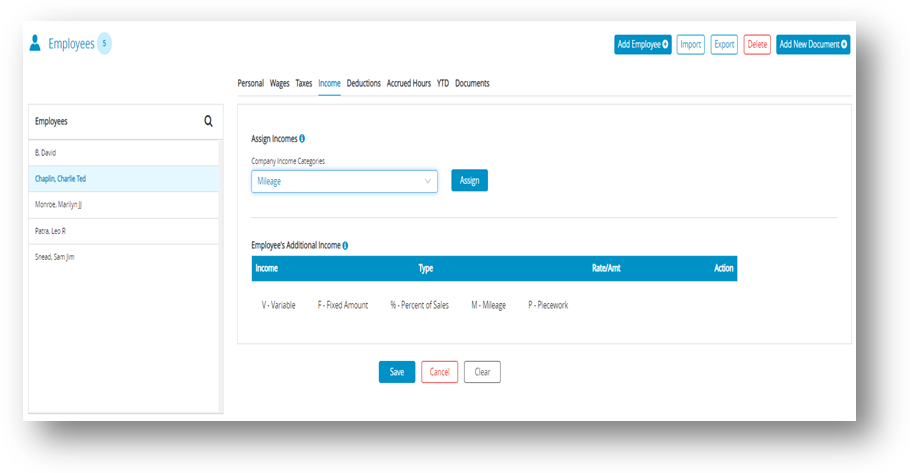

- Select an employee from the Employees list on the Employees window.

- Click Income view tab on the Employees window.

- Select Income category from Company Income Categories drop-down list.

Note: The categories that appear in the Company Income Categories list are those that were set up with the Additional Income window. - Click Assign.

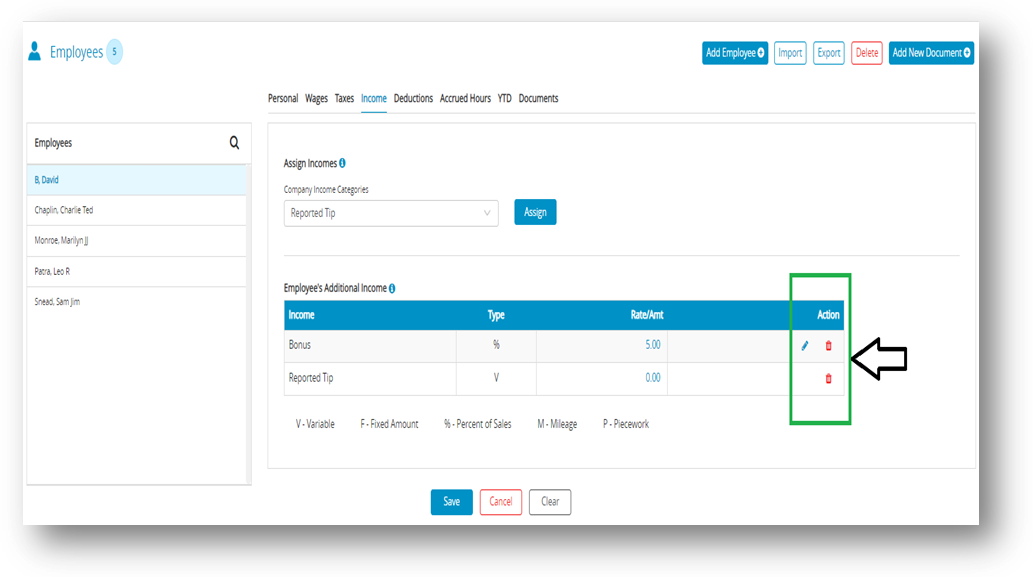

Step result: The Company Income Categories should be added in the Employee’s Additional Income.

Note: You can modify or remove the entries by clicking modify or remove Action Icons for Income. The edit icon will only appear if there is a value in the Rate/Amt field. The value for a Variable Additional Income category is entered when you calculate the employee’s pay on the Calculate Pay window.

- Click Save.

Modifying & Removing an Additional Income Category from an Employee

| Action | Procedure |

| Modify | You can change the amount of an existing Income category if it’s not setup as V-Variable. This amount is entered when you calculate the employee’s pay on the Calculate Pay screen.

|

| Remove | You can remove an Additional Income from an employee as long as the employee does not have any income associated with it. The only time to remove an Income category from an employee is after you have started a new year, but before you have created a payroll in the new year. To stop the category from being applied mid-year, simply modify the amount/rate to zero in the Employee setup.

|