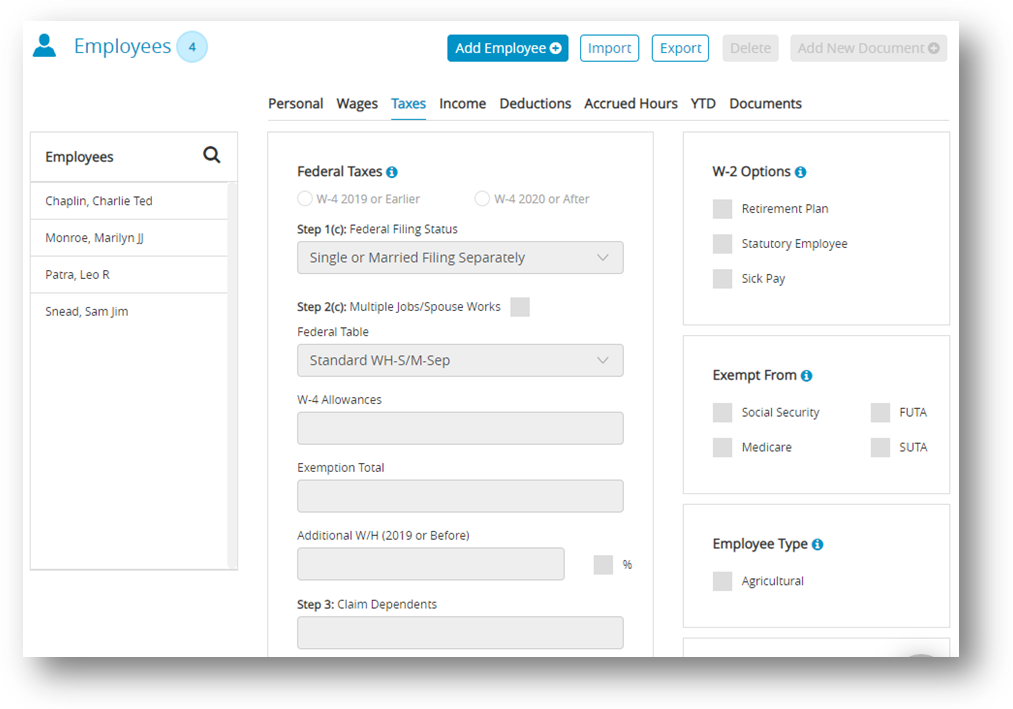

- Select an employee from the Employees list on the Employees window.

- Click Taxes view tab on the Employees window.

- Choose Radio button W-4 2019 or Earlier OR W-4 2020 or After.

- Select the appropriate federal tax table for the employee from the Federal Tax Table drop-down list.

- Enter the number of federal allowances that the employee is claiming based on your W-4 form selection.

Note: You can also withhold additional federal withholding prepay check as a dollar amount or as a percentage of wages. - Select the state for SUTA reporting from the SUTA State drop-down list.

- Select the appropriate state tax table for the employee from the State Tax Table drop-down list.

Important: Even if you do payroll in a state with no state withholding, such as Texas, you still need to assign both the SUTA State and State Table to every employee for correct quarterly wage reports. SUTA State must be selected for each employee before saving employee information or a default SUTA State will be assigned to the employee. If the employee is exempt from taxes, choose the appropriate checkbox ender the Exempt From area. Employee wages marked Exempt From do not need to be reported to SUTA, State or Federal government agencies. However, if the employee is exempt from allowances, you can change the withholding to “99” so no taxes are taken out.

Note: For more information on state taxes, refer additional-tax-information. This will open a page on CheckMark’s website. - Enter the number of state allowances that the employee is claiming.

Note: For most states, after the cursor leaves the State Allowances field, CheckMark Online Payroll automatically calculates the Exemption or Tax Credit Totals. You can also withhold an additional amount per paycheck as a dollar amount or as a percentage of wages. - Check any appropriate W-2 Options for the employee.

- Check any appropriate Exempt From options for the employee.

Note: If the employee qualifies for the HIRE Act, mark the qualified checkbox. - If the employee is an agricultural employee, mark the Agricultural checkbox.

- Select a local tax for the employee from the Local Tax drop-down list if necessary.

- Enter the number of local allowances that the employee is claiming if needed.

Note: For some local taxes, after the cursor leaves the Local Allowances field, CheckMark Online Payroll automatically calculates the Exemption or Tax Credit Totals. - Click Save after entering the employee’s tax information, including the SUTA State.

Items in the Taxes View Tab

| Fields | Description |

| Federal Table | Use the drop-down list to select the appropriate federal tax table for the employee that coincided with the status claimed on the W-4. If Exempt is selected, federal tax will not be withheld when the employee’s pay is calculated. |

| W-4 Allowances | Enter the number of allowances claimed on the employee’s Form W-4. |

| Additional W/H | If you want to withhold additional federal withholding for the employee (beyond the calculated amounts), enter the additional amount that you want to withhold per pay period. You can also enter the amount as a percentage of wages if the % checkbox is checked. |

State Taxes

| Fields | Description |

| SUTA State | Use the drop-down list to select the appropriate state for SUTA reporting. The states that appear are those that have been added to the company with the State Taxes window.

Important: Before saving an employee’s information, it is necessary to select a SUTA State for that employee. If a SUTA State is not selected, a default state will be assigned to the employee. |

| State Table | Use the drop-down list to select the appropriate state tax table for the employee. The tables that appear in the list are those that have been added on the State Taxes window. If “None” is selected, state tax will not be withheld when the employee’s pay is calculated and employee information will not appear on the state wage reports or W-2 reports including the EFW2 State File.

Note: If your employee is exempt from state withholding but you need to report employee’s wages, DO NOT leave the State Table as “None”. |

| Allowances | Enter the number of state allowances that the employee is claiming (usually, this is the number of federal allowances claimed on the employee’s Form W-4, Employee’s Withholding Allowance Certificate). CheckMark Online Payroll uses this number, when possible, to calculate the Exemption Total or Tax Credit Total for a selected state tax table. |

| Exemption Total | When possible, the Exemption Total or Tax Credit Total is calculated Credit Total for you and placed in the correct edit box. The total equals the annual exemption or tax credit amount for the selected table times the number of state allowances entered for State Allowances. This is not applicable for all states and there are some states where this information must be manually calculated and entered. In the State Taxes window when selecting your state, the program will give a message for those states telling you to manually calculate and enter the figure in the Employee Set Up.

Important: Exemption Total does not refer to the number of allowances claimed by an employee. The number of state allowances claimed by an employee should be entered in the State Allowances edit box. |

| Additional W/H | If you want to withhold additional state withholding for the employee (beyond the calculated amounts), enter the additional amount that you want to withhold each pay period. You can also enter the amount as a percentage of wages if the % checkbox is checked. |

W-2 Options

| Fields | Description |

| Retirement Plan | If Retirement Plan is checked, an ‘x’ will be printed in the appropriate box on the employee’s W-2Statement. |

| Statutory Employee | If Statutory Employee is checked, an ‘x’ will be printed in the appropriate box on the employee’s W-2 Statement. |

| Sick Pay | If Sick Pay is checked, an ‘x’ will be printed in the appropriate box on the employee’s W-2Statement. |

| Social Security | You should use a Circular E, Employer’s Tax Guide to verify the requirements for the following federal withholding options. Check the Soc. Sec. Exempt option if an employee is exempt from Social Security. |

| FUTA | Check the FUTA Exempt checkbox if the employee is exempt from Federal unemployment tax. |

| Medicare | Check the Medicare Exempt option if an employee is exempt from Medicare. |

| SUTA | Check the SUTA Exempt checkbox if the employee is exempt from State unemployment tax. |

Local Taxes

| Fields | Description |

| Local | Use the drop-down list to select the appropriate local tax for the employee. The taxes that appear in the list are those that have been set up on the Local Taxes window under Setup. If “None” is selected, local tax will not be withheld when the employee’s pay is calculated and employee earnings will not appear on the local taxes report. |

| Allowances | Enter the number of local allowances that the employee is claiming. |

| Exemption Total and Tax Credit Total | This amount should be calculated and entered into the correct box depending on how the local tax has been setup. Note: Many local taxes are fixed amounts or percentages of wages and not all fields are necessarily applicable to local tax. This is dependent upon how the local tax has been setup on the Local Taxes window under Setup. |