This article shows you how to set up employer payees in CheckMark Online Payroll for employer payments, such as Federal, State and Local taxes as well as other employee deductions. Utilizing employer payees is not mandatory since its usage in CheckMark Online Payroll does not have any impact on the reports generated by the payroll system.

You can pay multiple items to the same payee, but the payee will need to be setup separately in the list, once for each item. You can combine up to 5 items on an employer payment check with the exceptions of 940 and 941 payments. The CheckMark Online Payroll enables you to perform operations such as adding, modifying, and deleting payees, provided that there is no payment checks linked to the payee within the present year.

Note: Punctuation marks such as a comma (,) or period (.) in a payee’s name and address can cause errors when posting payment information into certain accounting programs.

Setting Up a New Payee

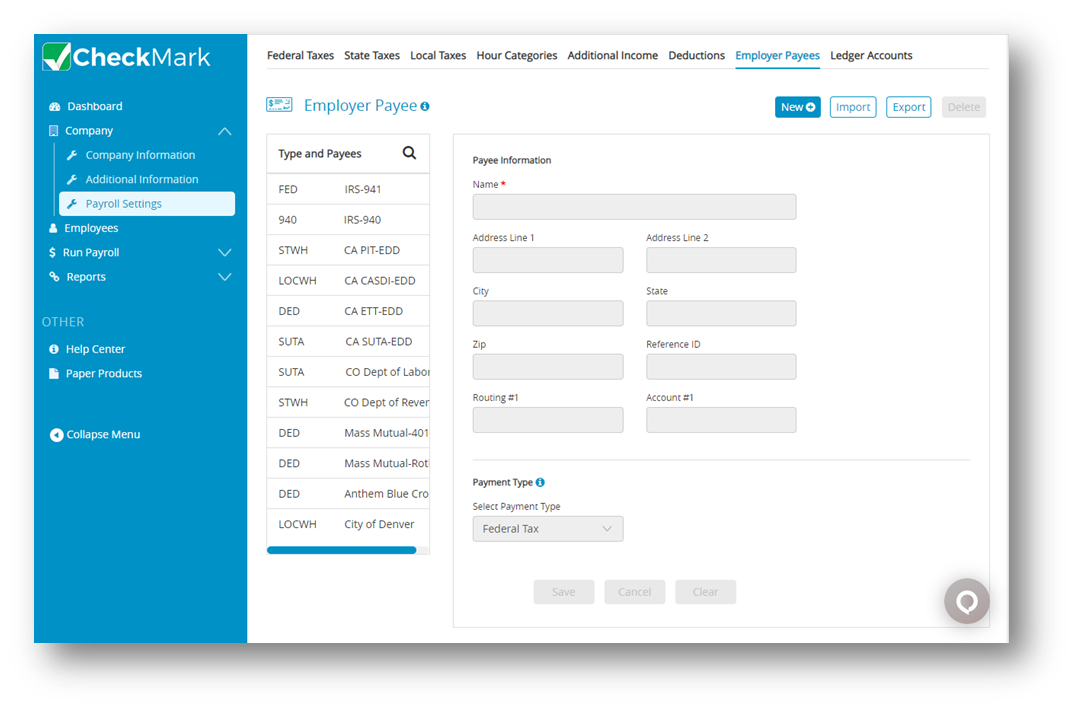

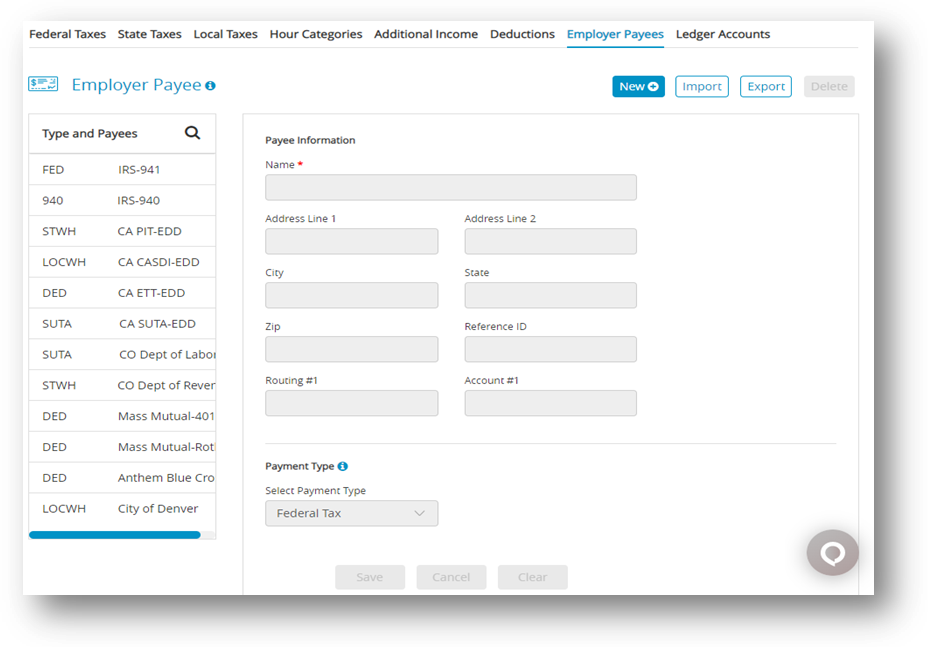

- Click Company, select Payroll Settings and then select Employer Payees.

- Click New.

- Enter the name of the payee that will receive the payment and click OK.

Step result: The new Payee should now be added to the list of Employer Payees. - Select the category from the Employer Payees list.

- Add the payee information and select the payment type.

- Click Save.

Payee Information

| Fields | Description |

| Name | It can accommodate up to 30 characters. |

| Address Line 1 | It can accommodate up to 30 characters. It is recommended that you use postal service guidelines when entering address information. |

| Address line 2 | It can accommodate up to 30 characters. |

| City | Enter the employee’s city. City will accommodate up to 25 characters. |

| State | Enter the 2-letter postal abbreviation for your employee’s state. |

| Zip | Enter the 5-digit ZIP code, plus 4-digit extension. |

| Reference/ID | Enter account #, identification #, federal or state ID number to print on the payment check. Reference/ID will accommodate up to 17 characters. |

| Routing #1 | Enter the Routing # |

| Account #1 | Enter the Account # |

| Type of Payment | ✔ Federal Tax: Federal withholding, Social Security and Medicare taxes.

✔ 940 Tax – FUTA: Federal unemployment tax. ✔ State Withholding: The drop-down displays the states that are available in the State Taxes list. Select the state(s) that you withhold taxes in. A separate payee must be setup for each state in your list. ✔ Local Withholding: The drop-down list displays local taxes that are available on the Local Taxes list. Select the local tax that you withhold taxes for. A separate payee must be setup for each local tax in your list. ✔ SUTA: The drop-down displays the states that are available in the State Taxes list. SUTA refers to the state unemployment tax. A separate payee must be setup for each state in your list. ✔ Employee Deduction: The drop-down list displays deductions that are on the Deduction list. A separate payee must be setup for each deduction in your list. |

Modifying an Employer Payee

- Click Company, select Payroll Settings and then select Employer Payees.

- Select the name from Payee list.

- Modify the information for payee.

- Click Save.

Import Employer Payee Information

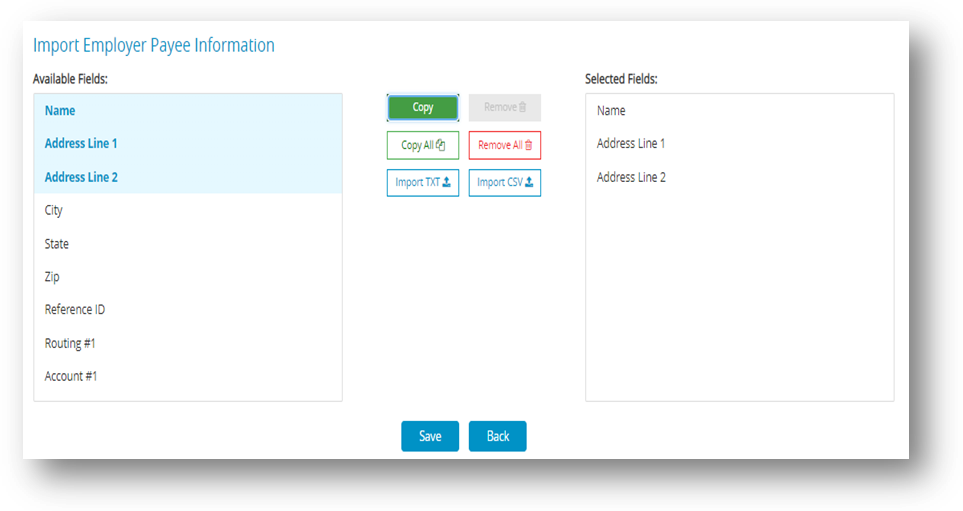

- Click Company, select Payroll Settings and then select Employer Payees.

- Click Import.

- Select fields from Available Fields list and then click Copy.

Important: Name field is mandatory to import a file (TXT or CSV).

Note: Selected fields should be loaded in Selected Field list. To select all fields click Copy All and to remove fields click Remove or Remove All.

- Click Import TXT or Import CSV.

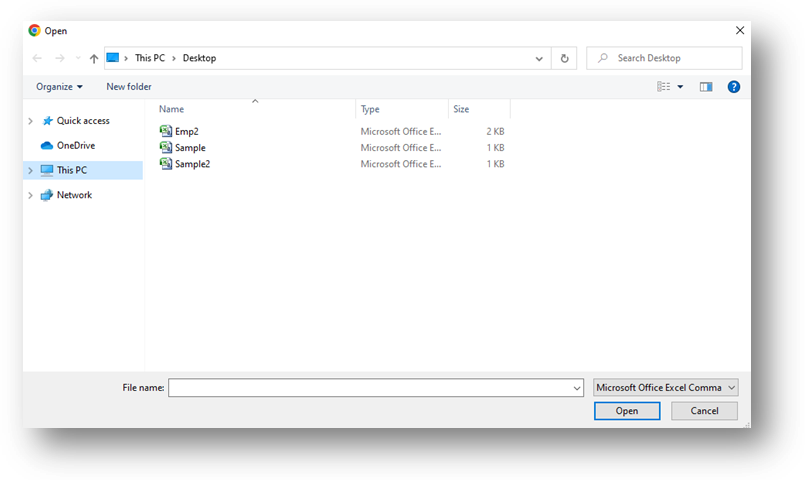

Step result: Displays a new window asking to select file to import. - Select a file to import and then click Open.

Step result: An Open dialog appears.

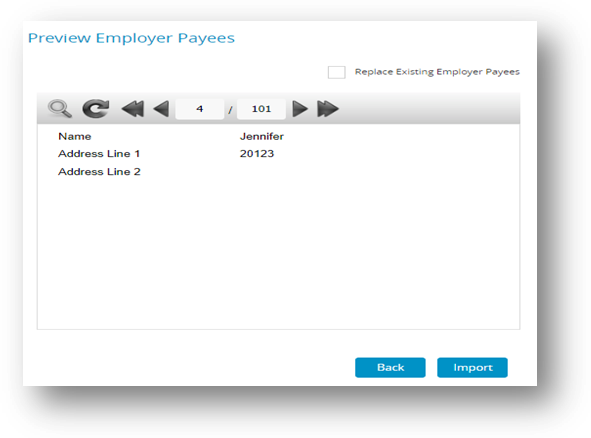

- Click Import.

Note: Click check box to Replace Existing Employer Payees.

- Click Save and then click Back.

Step result: Employer information should be added to the list of Type and Payees.

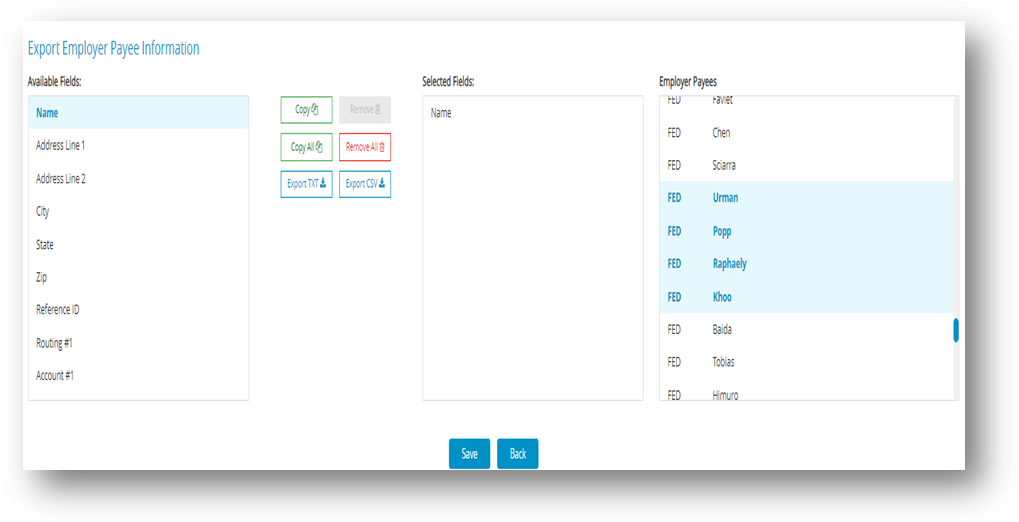

Export Employer Payee Information

- Click Company, select Payroll Settings and then select Employer Payees.

- Click Export.

- Select fields from Available Fields, then click Copy.

Step result: Selected fields should be loaded in Selected Field list. - Select employer from Employer Payees list.

- Click Export TXT or Export CSV.

Step result: The TXT file should be opened, while the CSV file should be downloaded for storage. Click Save if required for further exporting.

Deleting Employer Payee Information

You can delete a payee as long as no checks in the current year are associated with the payee.

- Click Company, select Payroll Settings and then select Employer Payees

- Select the name from the Payee list.

- Click Delete.

Step result: An alert appears asking you to verify that you want to delete the payee. - Click OK.

Types of Employer Payments

Here are the types of employer payments that you can set up.

| Payment Type | Description |

| Federal Tax | This refers to the deposit that you make for federal income tax withheld, Social Security, and Medicare taxes. |

| 940 Tax-FUTA | This refers to the deposit that you make for the Federal unemployment tax (FUTA). |

| State Withholding | The drop-down list shows the states that were added to your company on the State Taxes window. If you don’t see the state you need, you can add the state to your company using the State Taxes window.

For more details, see “Setting up State Taxes“. |

| Local Withholding | The drop-down list shows the local taxes that have been added to your company. If you don’t see the local tax that you need, you can add the local tax to your company using the Local Taxes window.

For more details, see “Setting up Local Taxes“. |

| SUTA | This refers to the deposit that you make for the state unemployment tax. The drop-down list shows the states that were added to your company on the State Taxes window. |

| Employee Deductions | This refers to the deposits that you make for employee deductions, such as United Way or Health Insurance. The dropdown list shows your company’s Deduction categories that were added on the Deductions Setup window. |