At CheckMark, we take pride in providing our customers with the most accurate and up-to-date tax information possible. However, we understand that tax regulations can change frequently, and it can be challenging to keep up with all the updates. That’s why we always recommend that our customers double-check any tax values they’re unsure about.

It’s crucial to ensure that all tax values in your payroll settings are accurate, as incorrect values can result in costly penalties and legal issues. As such, we advise that you reference official tax publications such as Circular E or the Employer’s Tax Guide for the most reliable tax information. State or local tax publications can also provide valuable information specific to your region.

In the event of any discrepancies or changes in tax regulations, CheckMark will do our best to update our system promptly. However, it’s still essential to double-check any values you’re unsure about to ensure compliance with tax laws.

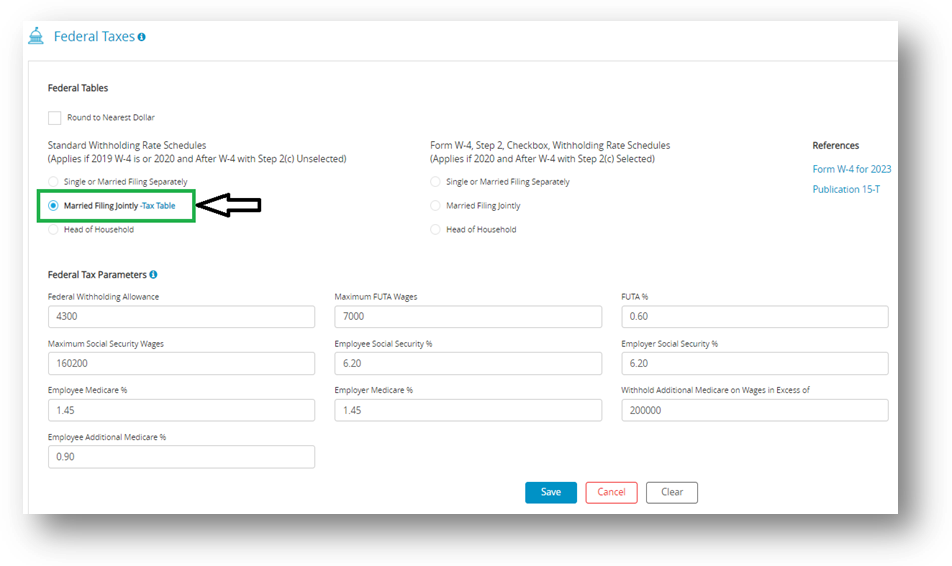

Setting Up Federal Tax Values

- Federal Single

- Federal Married

- Annual W/H Allowance

- FUTA (Federal Unemployment Tax Act)

- Social Security

- Medicare

Note: FUTA rate includes the credit of 5.4% for payment of SUTA taxes to your state. If your state is a credit reduction state, the rate may need to be modified.

Note: You assign the appropriate federal table to each employee on the Employees screen. See “Setting up Employees Taxes“.

CheckMark Online Payroll uses the annual percentage method to calculate Federal withholding. To

verify the tax tables that your company is using for calculation:

- Click Company and then select Payroll Settings.

- Select the radio button next to the desired withholding rate schedules.

- Click the Tax Table link to verify the values.

To reload the Federal withholding tables and tax parameters:

- Click Company and then select Payroll Settings.

- Click the Load “Year” Values button.

- When prompted to replace the existing values, click YES.