This article shows you how to set up ledger accounts in CheckMark Online Payroll that allow you to post your payroll to an accounting program.

If you won’t be posting your payroll to an accounting program, or your accounting program doesn’t use account numbers, you don’t need to set up ledger accounts. However, you might find ledger accounts useful on Posting Summary reports to manually transfer your payroll data to an accounting system.

You can assign accounts to the following payroll categories:

| Categories | Description |

| General | ✔ Cash Account: The cash account from which payroll checks are paid.

✔ Wages: An expense account for gross wages. |

| Additional Income | The Additional Income items that appear in the list are those that were set up on the Additional Income window. You can assign an account to each item, typically an expense account. |

| Employee Taxes | ✔ Federal: A liability account for employee federal taxes withheld.

✔ Social Security: A liability account for the Social Security tax withheld. ✔ Medicare: A liability account for the Medicare tax withheld. Liability accounts for employee state and local taxes withheld also appear in the list. |

| Deductions | The Deduction items that appear in the list are those that were set up on the Deductions window. You can assign an account to each item, typically a liability account. |

| Employer Taxes | ✔ Cash Account: The cash account from which employer expenses and liabilities are paid.

✔ Social Security Liability: A liability account for the employer portion of Social Security. ✔ Social Security Expense: An expense account for the employer portion of Social Security. ✔ Medicare Liability: A liability account for the employer portion of Medicare. ✔ Medicare Expense: An expense account for the employer portion of Medicare. ✔ FUTA Liability: A liability account for employer federal unemployment tax. ✔ FUTA Expense: An expense account employer federal unemployment tax. ✔ SUTA Liability: A liability account for State Unemployment appears for each state. ✔ SUTA Expense: An expense account for State Unemployment appears for each state |

| Departments | ✔ Wages: An expense account for department wages.

✔ Tax Expense: An expense account for department taxes for employer portions of Social Security and Medicare, FUTA, and SUTA. Note: Department or job wage and tax expense accounts override general wage expense and employer tax expense accounts. Note: If department or jobs are setup, the employer taxes will not be posted by tax expense, but by department/job liability and will be broken out by tax for the entire payroll. |

| Jobs | ✔ Wages: An expense account for job(s) wages.

✔ Tax Expense: An expense account for job(s) taxes for employer portions of Social Security and Medicare, FUTA, and SUTA. Note: Use this option if you distribute employee wages to jobs in MultiLedger. Note: Department or job wage and tax expense accounts override general wage expense & employer tax expense accounts. |

| Deduction Match Expense | An expense account for the employer deduction expense, which is not broken out by department/job expense, for deductions set up with an employer matching amount or percentage. |

Assigning the Posting Accounts

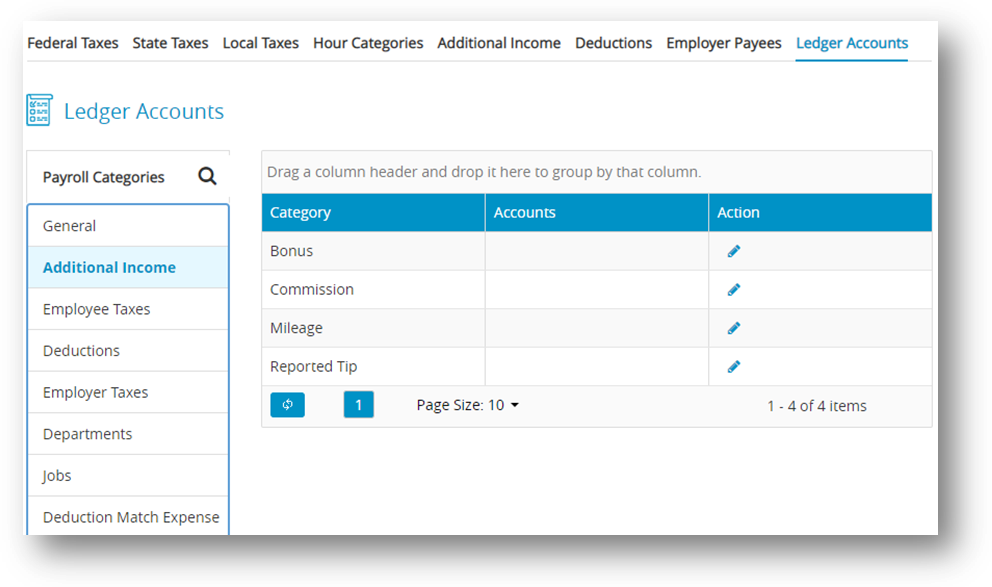

- Click Company, select Payroll Settings and then select Ledger Accounts.

- Select an option under Payroll Categories.

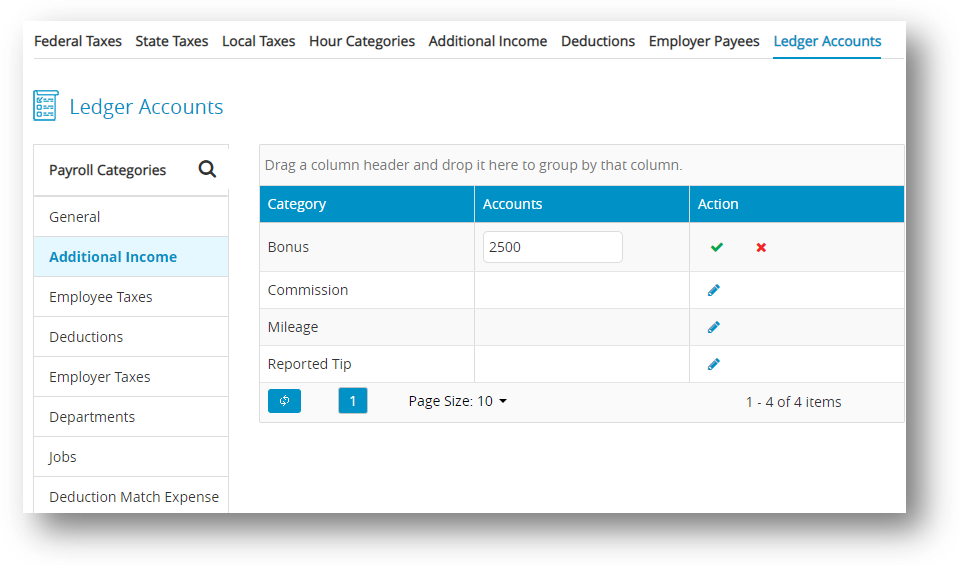

Step result: After selecting the payroll category, items associated with the category appear in the category list. - Select an item from the Category list and then click edit action button.

- Enter an account for the selected item and then click check action button to save.

Note: Accounts can be up to 16 alpha-numeric characters.

Modifying the Posting Accounts

- Click Company, select Payroll Settings and then select Ledger Accounts.

- Select an option under Payroll Categories.

Select an item from the Category list to modify and then click edit action button. - Modify the account number for the selected item and then click check action button to save.

- Repeat steps 2-4 to modify each account in the payroll accounts.