This article provides information about how to setup and create new local taxes values. While CheckMark Inc attempts to maintain up-to-date and accurate tax information, we cannot be responsible for changes or discrepancies in tax values. There may also be additional taxes for your locality that will need to be setup and maintained by you. Please check your locality’s current tax publication if you are in doubt as to the accuracy of any tax value.

If necessary, local taxes can be configured for your company. The local tax tables, along with the employee’s earnings, and the number of withholding allowances (if necessary), determine how much local tax is withheld from an employee’s check. CheckMark Online Payroll accommodates up to 10 local tax tables, but each employee can be assigned only one. After a local tax has been added to your company, you can assign it to an employee on the Employees window. See “Setting up Employees Taxes“.

NOTE: If you have more than one local tax per employee, you can also set up a local tax as a deduction. For instructions on setting up deductions. See “Setting up Deductions“.

Creating a New Local Tax Category

You can add a new Local tax category if the local tax is a Fixed % or Fixed Amount.

Note: You cannot create a new Local Tax that uses a tax table for calculation

- Click Company, click Payroll Setting, and then select Local Taxes.

- Click New, enter name and click OK, then new local tax should be added to the list.

- Select new local tax form categories list, enter values and click Save.

Note: You can create a new Local Tax that uses a tax table available.

Adding Pre-Defined Local Taxes to Your Company

- Click Company, select Payroll Settings and then select Local Taxes.

- Click Load Latest Values to initiate the display of Local Tax Categories screen.

- Select categories from the list and then click OK to add in Local Tax Categories list.

Note: To select more than one Local Tax categories, drag through the list. To select non consecutive categories, hold down the CTRL key for Windows or Command key for Macintosh and click the desired names.

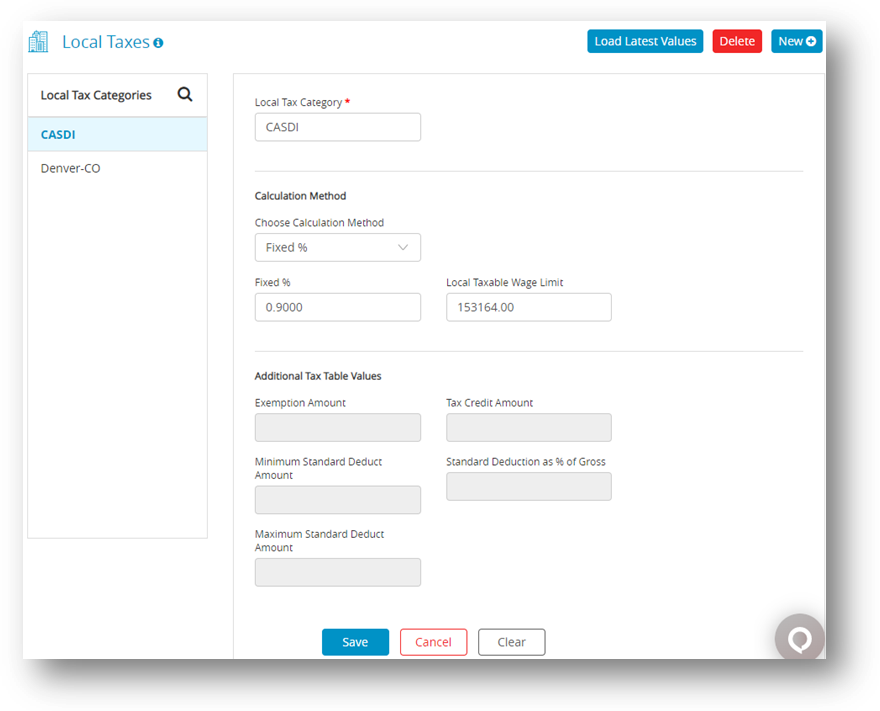

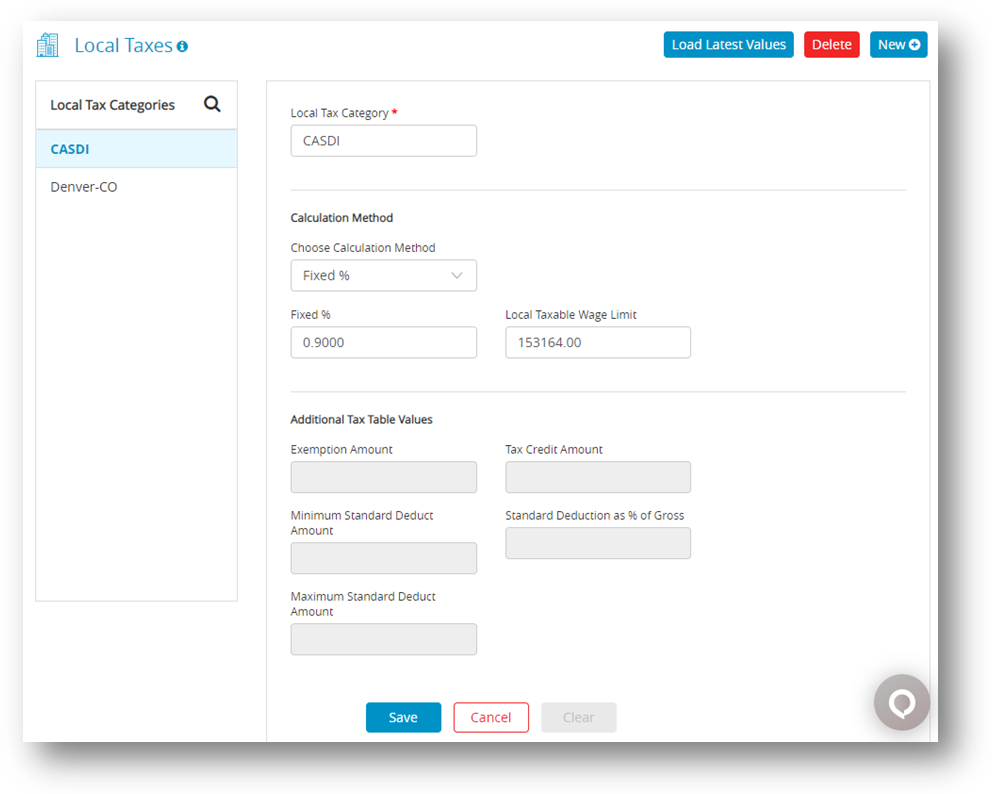

- Select Local Tax Categories form categories window and enter values accordingly.

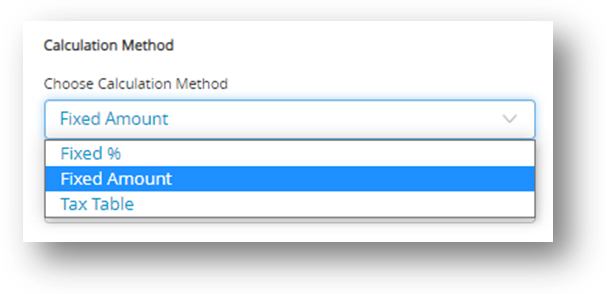

Note: Click Choose Calculation Method drop down for appropriate calculation.

- Click Save.

You can also perform the following actions in the Local Taxes window.

Options in Local Taxes Window

| Options | Procedure |

|

New

|

New option is for adding a new local category if the local tax is a Fixed % or Fixed Amount.

|

| Delete |

|

Setting Up CASDI for California Employees

California’s State Disability Insurance (CASDI) should be set up as a fixed %. Please verify the current rates with EDD or visit the website at https://edd.ca.gov/en/claims/

Note: You can also set up CASDI as a Deduction Category