Setting Up State Tax Values and SUTA Values

Important: While CheckMark Inc attempts to maintain up-to-date and accurate tax information, we cannot be responsible for changes or discrepancies in tax values. There may also be additional taxes for your specific state that will need to be setup and maintained by you. Please check your state’s current tax publication if you are in doubt as to the accuracy of any tax value.

State taxes, along with the employee’s earnings and withholding allowances, determine how much state tax is withheld from an employee’s check. Even if your state doesn’t have a tax table, you still need to add your state to the State Taxes list, so you can enter your state ID and State Unemployment Tax Authority (SUTA%). After a state tax has been added to your company, you can assign it to an employee on the Employees window.

Adding Pre-defined State Taxes to Your Company

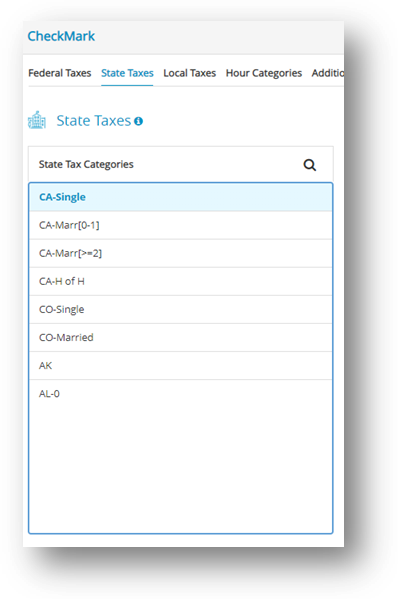

Note: CheckMark Online Payroll accommodates up to 30 or more state tax tables in its State Taxes list. Each employee can be assigned one SUTA and one withholding state at a time.

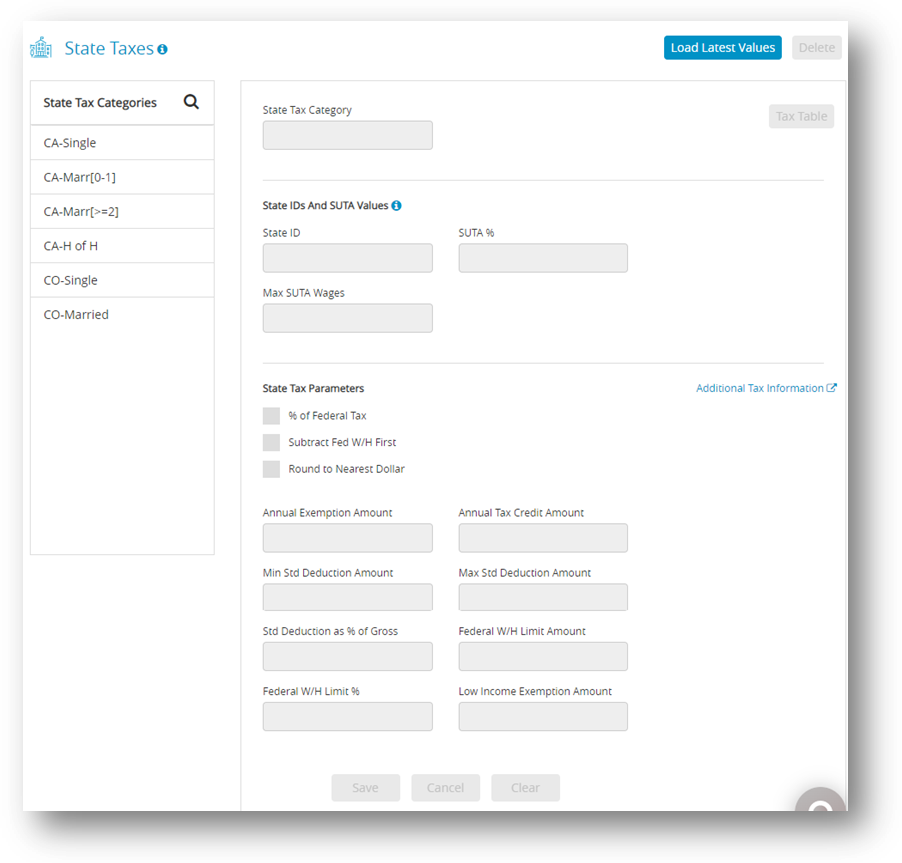

- Click Company, select Payroll Settings and then select State Taxes.

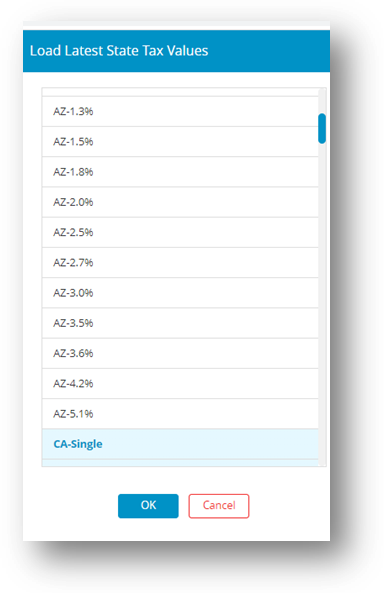

- Click Load Latest Values to initiate the display of State Tax Categories window.

- Select a state from the list and then click OK to add in State Tax Categories list.

Note: To select more than one state, drag through the list to highlight the desired names. To select non consecutive categories, hold down the CTRL key for Windows or CMD key for Macintosh and click the desired names.

- Select the State and enter values accordingly.

Note: To check calculated values click Tax Table. - Click Save.

Important: For Additional Tax Information, refer State Tax Info.

NOTE: When possible, the Exemption Total or Tax Credit total, if applicable for the selected state(s), is calculated for you. If the parameters for this calculation cannot be calculated within the program, you will receive an alert advising you to see the information available by clicking the Additional Web Information button. This button is a link that will launch a page on Checkmark’s website that contains details on manual calculators, as well as other information about your state taxes. An internet connection is required. If you do not have an internet connection, information is available in your state tax guide.

Once the categories are added to the list, you can perform the following actions.

Options for State Taxes

| Option | Procedure |

| Delete |

|

| Clear |

|

Setting Up State ID and SUTA Values

After adding the required states to the company, the following actions should be performed.

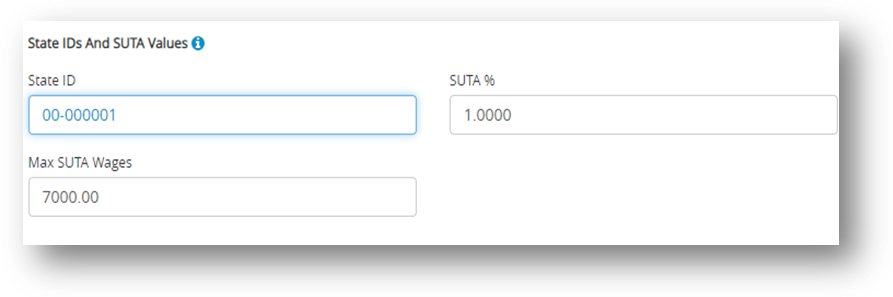

- Select a state from the State Tax Categories list.

Note: If you don’t see the state you need, click the Load Latest Values button to add new state. - Click in the State ID edit box, and enter your state employer identification number.

Note: This is the State ID that prints on W-2s.

- Enter your SUTA %.

Note: This is the rate you pay as an employer that has been given by your state and is based on an experience rating. If the state has presented this number as a rate rather than a percentage, convert it to a percentage by moving the decimal point two places to the right. For example, the rate of .004 should be entered as .4 in the SUTA % edit box. - Check if the displayed Max SUTA Wages value is accurate and then click Save.

Note: The Max SUTA Wages amount for your chosen state is entered automatically. However, it’s important to double-check its accuracy using your state tax guide or your company’s state unemployment report.

Important: Assigning the State ID, SUTA %, and Max SUTA Wages for a state tax table automatically assigns those values to all tables for that state.