Transaction Dates

You can use the +/- keys on your keyboard to increment/decrement the date in any transaction window. You can also type over the date to modify it.

Date Formats

Enter dates in the MM/DD/YY format. For example, to enter February 15, 2017, you would enter the date like this: 2/15/17. Notice that you do not have to enter any leading zeros.

If you want to enter dates in the DD/MM/YY format, check the “International Date Format [dd/mm/yy]” option on Preferences under the File menu.

Valid Transaction Dates

The following table shows the dates that are allowed for each transaction window:

| Transaction Window | Valid Dates |

| Item Purchases

Customer Invoices Vendor Payments Customer Payments Disbursements Journal Receipts Journal General Journal Finance Charges Adjust Inventory |

Any date from 30 open months, provided the month isn’t locked. No date prior to the current fiscal year is allowed. |

|

Payables Journal Sales Journal |

Any date from the 30 open months, provided the month isn’t locked. For setting up a company’s outstanding receivables and payables, you can enter a date prior to your current fiscal year.

|

Note: To see what the current fiscal year is, click Company Information in the Command Center.

Date Alert Messages

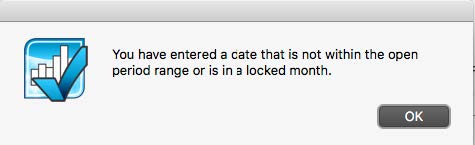

If you enter an invalid date and try to move the cursor out of the Date field on a transaction window, the following message appears:

Click OK and change the highlighted date to a valid one.

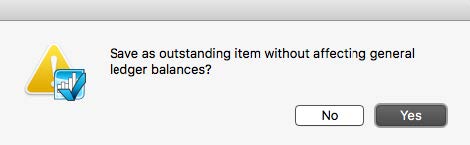

If you enter an invoice in the Sales Journal or Payables Journal with a date prior to your current fiscal year, the following alert appears:

Click Yes to save the transaction. Saving the transaction adds the detail to your Accounts Receivable or Accounts Payable report, but does not affect any ledger balances. Invoices entered in the Sales Journal or Payables Journal with a date prior to your current fiscal year should be invoices that your company has not yet received payment for or that your company has not yet paid as of the first day of your current fiscal year.

Click No to not save the transaction.

Related Articles

How to Move Between the Fields in MultiLedger

How to Use Pop-Up Lists in MultiLedger

How to Use Document Numbers in MultiLedger

Working with 30 Open Months in MultiLedger

Locking and Unlocking Months in MultiLedger

How to Add Comment Lines in MultiLedger