Creating 941 Reports

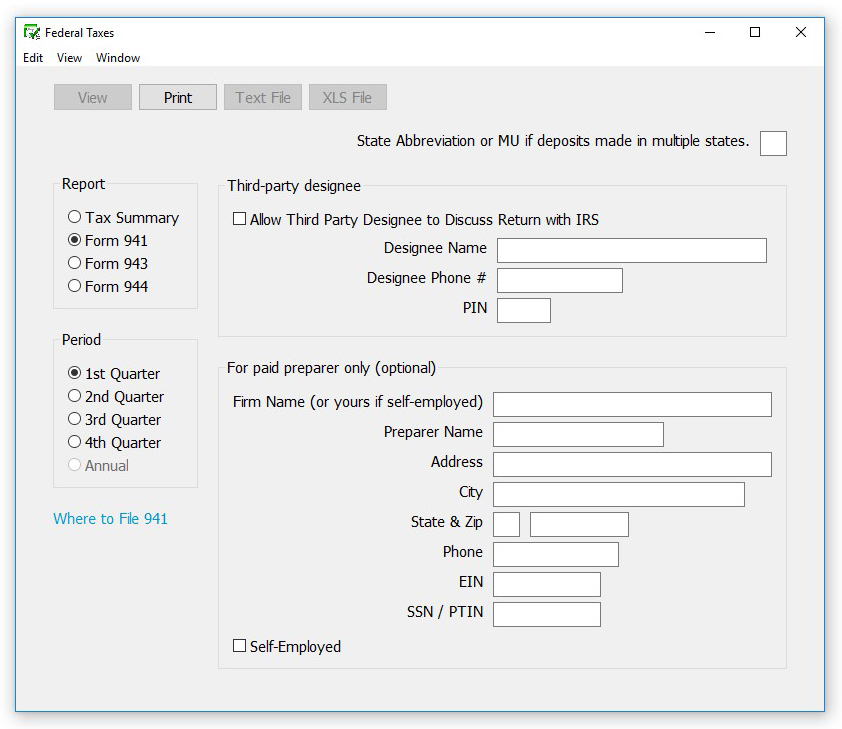

It easy to create 941 reports in CheckMark Payroll to track employee wages and taxes and ensure compliance with IRS regulations. The Federal Taxes window prints the Form 941, Employer’s Quarterly Federal Tax Return form and gives you information that’s useful for filling out the form manually.

- Click Federal Taxes under Reports in the Command Center.

- Enter the 2 letter state postal code where you make your deposits or MU if you make deposits in multiple states.

- If necessary, enter information for Third-party designee and/or For paid preparers only (optional).

- Select the quarter for which you are reporting.

- Select the Form 941 Report Option.

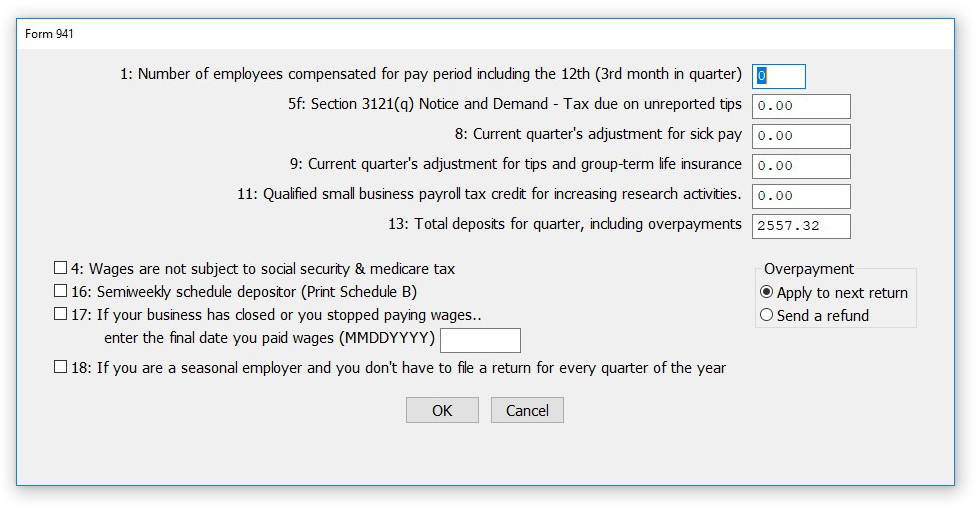

- Click Print. A pop up window appears.

Note: Be sure to change the amount in the Line 11 Total Deposits field, if different than the program calculation.

If you change the Total Deposit to a number $0.40 higher or lower than the program calculation, the difference will show in fractions of cents (line 7a 941, or 6a 944). If the difference is more than $0.40, it will show as either a balance due (line 12) or an overpayment (line 13).

- Fill in all appropriate fields. When finished, click OK. The filled in Form will open in Acrobat Reader. If necessary, modify/edit any field in Acrobat Reader, save the file if you wish, and/or print out pages from Acrobat Reader.

Changes made to Form 941 in the Adobe Reader program are not reflected in Payroll.