Creating 944 Reports

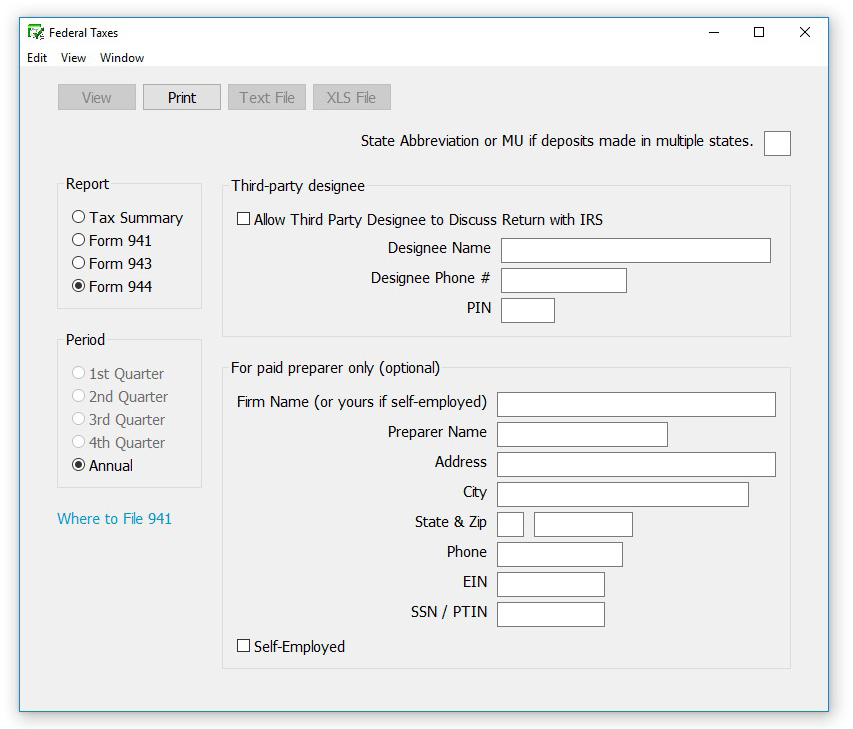

Easily create 944 reports in CheckMark Payroll in just a few simple steps. The Federal Taxes window prints the Form 944, Employer’s Annual Federal Tax Return and gives you information that’s useful for filling out the form manually.

- Click Federal Taxes under Reports in the Command Center.

- Enter the two letter state postal code where you make your deposits or MU

if you make deposits in multiple states.

- If necessary, enter information for Third-party designee and/or For paid preparers only (optional).

- Select the Form 944 Report Option.

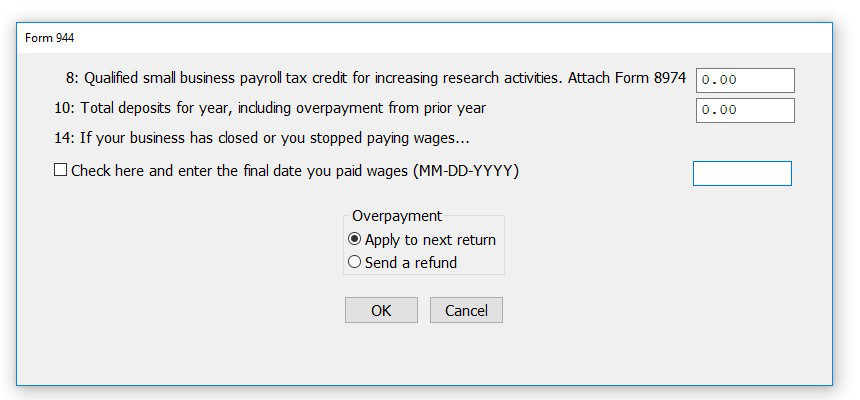

- Click Print. A popup window appears.

If applicable, enter amounts into the fields corresponding to:

- Total deposits for the year, including overpayment from prior year

- COBRA Premium Assistance Payments

- Number of Individuals

- Click Ok.

The filled in Form will open in Acrobat Reader. If necessary, modify/ edit any field in Acrobat Reader, save the file if you wish, and/or print out pages from Acrobat Reader.

Changes made in Adobe Reader are not reflected in Payroll.

What can cause an amount to appear on the “Adjustment for Fractions” line?

Any amount on the Adjustment for Fractions line on the Tax Summary report will be printed on Line 7a of the 941 on the Fractions of Cents field or 6a, Current Year’s Adjustments, of the 944. If the amount is under one dollar, the difference is probably due to rounding and is nothing to be concerned about. If the amount is large, however, you should research the discrepancy. Amounts of more than one dollar can be caused by the following:

- After checks have been created, a deduction or income category defined as exempt has been re-defined as non-exempt. Or a deduction or income item defined as non-exempt has been re-defined as exempt.

- Social Security or Medicare amounts have been manually adjusted on the Calculate Pay window to override the calculated amounts. These amounts are exact calculations and should not be manually adjusted.

- An employee who was marked as Exempt from Social Security and/or Medicare was changed to Non-exempt. Or an employee who was set up as Non-exempt from Social Security and/or Medicare was changed to Exempt.

If you change the Total Deposit to a number $0.40 higher or lower than the program calculation, the difference will show in fractions of cents (line 7a 941). If the difference is more than $0.40, it will show as either a balance due (line 12) or an overpayment (line 13).