Types of Employee Earnings Reports in CheckMark Payroll

Earnings Register: For the range of check dates selected, the Earnings Register report shows the employee’s selected check period along with YTD income, deductions, taxes, and net pay, as well as any employer matching amounts. Totals for the company are listed at the end of the report. You can see this report arranged by department by selecting the By Department checkbox.

Hours Register: For the range of check dates selected, the Hours Register report shows the employee’s selected check period and year-to-date hours for hour categories as well as accrued hours available.

You can also get an Hours Register report that contains only Hours Worked. Simply check the Hours Worked Only box. This report is helpful in filling out worker’s compensation reports or SUTA reports in states where this information is required.

Check Summary The Check Summary report shows an employee’s income, taxes, deductions, and net, vacation and sick pay for each check in the selected check dates. Totals for all categories are also shown by employee.

Check Details: The Check Details report shows income, tax amounts, deductions, total tax amounts, total deductions, and net pay by check for each selected employee for the selected check dates. Totals for selected employees are listed at the end of the report.

Creating Employee Earnings Reports

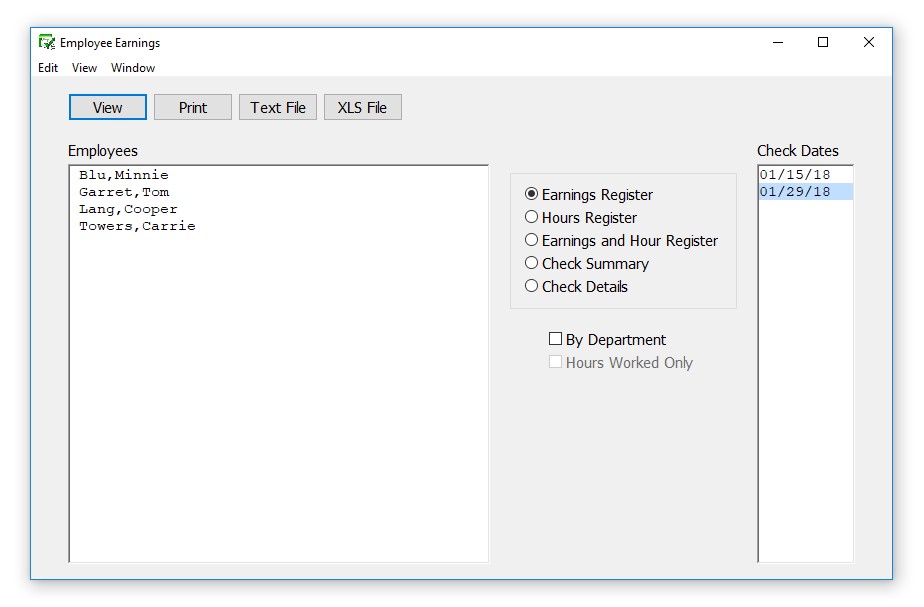

- Click Employee Earnings in the Command Center.

- Select the employee or employees for the report.

You can select a consecutive or non-consecutive series of employees from the list by dragging through the list or by using the CTRL key (Windows) or COMMAND (�) key (Mac).

If no employee names are highlighted, all employees will be reported.

- Select the type of report.

- Choose one or more check dates.

You can select a consecutive series of check dates from the list by dragging through the list. For details, see “Making Selections in a List Box.”

- Click View, Print, Text File or XLS File.