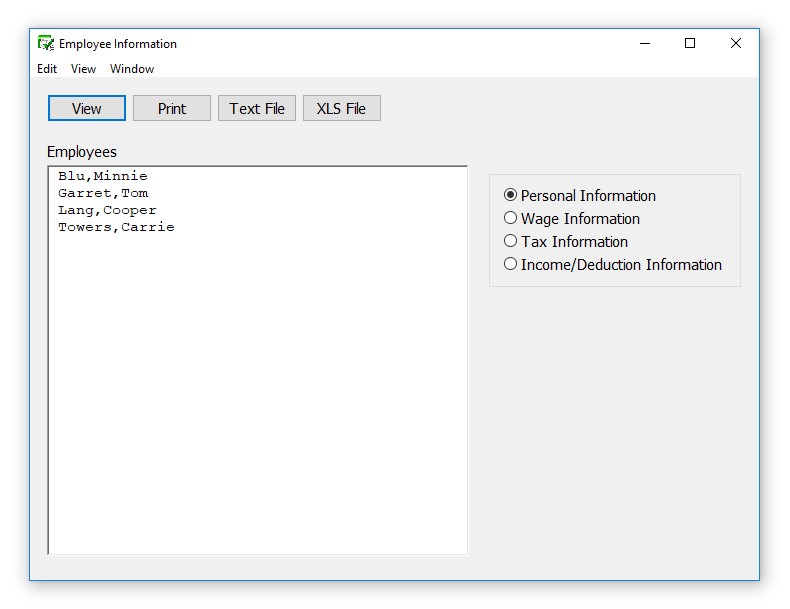

Employee Information

Types of Employee Information Reports in CheckMark Payroll

Personal Information: The Personal Information report shows the employee personal data, including name, address, phone number, Social Security number, birth date, employee number, employment status, email address and default department.

Wage Information: The Wage Information report shows the employee’s salary or hourly rates, pay frequency, hire date, last raise date, termination date, accrued hours available, and department/job distribution percentages, and direct deposit if marked.

Tax Information: The Tax Information report shows the tax set up for the employee including, W-2 options, selected federal, state, SUTA state, local tables, and more.

Income/Deduction Information: The Income/Deduction Information report shows the Additional Income and Deduction categories and their associated definitions that have been set up for the selected employees.

Creating Employee Information Reports

- Click Employee Information in the Command Center.

- Select the employee or employees for the report.

You can select a consecutive or non-consecutive series of employees from the list by dragging through the list or using the CTRL key (Windows) or Command (�) key (Mac).

If no employee names are highlighted, all employees will be reported.

- Select the type of report.

- Click View, Print, Text File or XLS File.