After an employer payee is setup on the Employer Payees window and at least one paycheck has been created, you can calculate the amount of liability based on a single check date or range of check dates and create payment checks on the Create Payments window. CheckMark Payroll allows you to override the amount of liability by selecting the amount box and changing the amount you wish to submit on the payment check. Calculations are based on the paychecks created for the check date(s) selected.

You can select up to five payee categories at one time, but types Fed and 940 payments have to be made as individual checks and cannot be combined with each other or any other liability payment.

Important: Creating payment check in the CheckMark Payroll program in no way affects your employer reports.

Creating Employer Payments

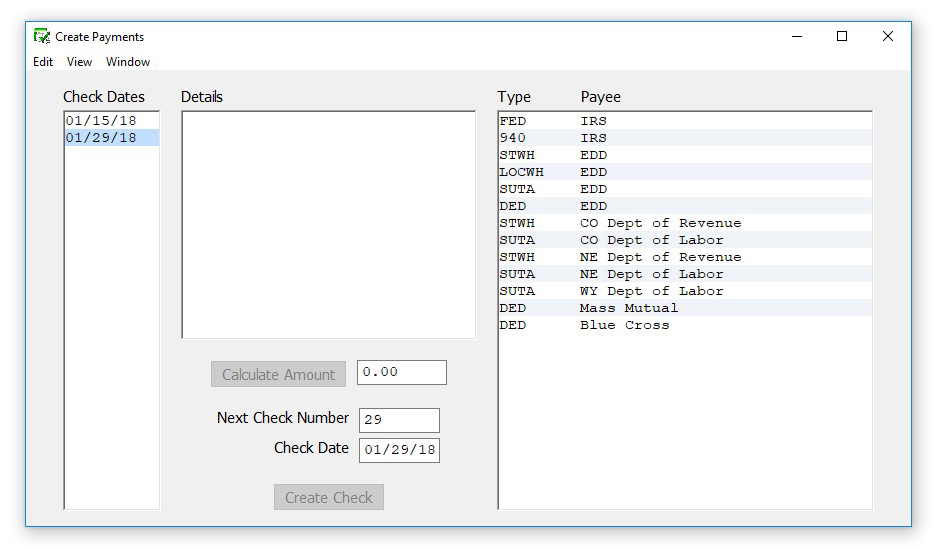

- Click Payroll in the Command Center, then select Create Payments.

- Select the date or range of dates for the employer payment calculation from the Check Dates list.

- Select the Payee(s) for the payment from the Payees list.

You can select up to five different payees per check by dragging through the list for consecutive selections, or using the CTRL key (Windows) or Command (�) key (Mac) for a non-consecutive selection. If you don’t see the payees you want in the list, they haven’t been set up on the Employer Payees window. For details, see Setting Up Employer Payees.

Note: You cannot combine 941 and 940 payments.

- Click Calc Amount.

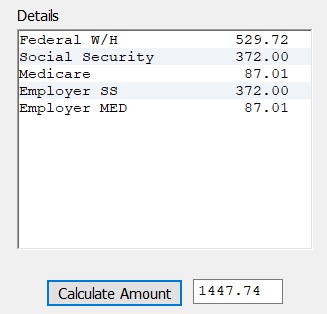

The calculated amount appears in the edit box.

Note: You can override the calculated amount shown for the payment by editing the value in the Amount edit box. However, if you override the calculated amount on this window, it will not change any reports, as they are based solely on paychecks created.

Once calculated, an employer payment’s calculations appear in the middle box. You cannot edit the calculation details. The calculation details for State W/H do not appear, only the amount due.

- Verify the check number and date and change if necessary.

Check numbers can be up to 8 numbers in length. Letters and other characters entered will be truncated.

- Click Create Check.

Important: Employer Payments in CheckMark Payroll can only be created with a check date in the current payroll year.