State Taxes

You can easily create SUTA taxes reports in CheckMark Payroll, a simple and efficient solution for managing your payroll taxes. The State Taxes window allows you to produce a SUTA report, wage summary, California DE-6 Form and the MMREF file for NY and CA DE-6.

Creating SUTA Taxes Reports

The SUTA report shows wages exempt from SUTA (state unemployment), wages subject to SUTA, wages in excess of the SUTA maximum, and SUTA taxable wages. It also shows your SUTA rate, SUTA tax amount, number of employees per month and number of employees in the pay period including the 12th of the month for each month of the quarter.

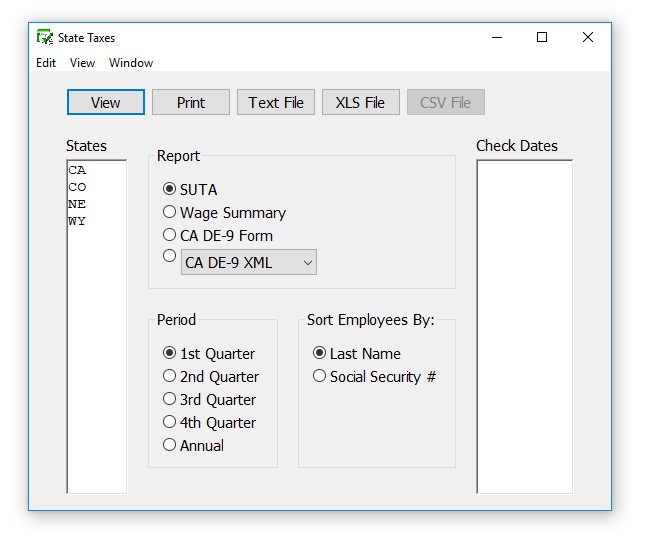

- Click State Taxes in the Command Center.

- Select one or more states for the SUTA report.

You can select a consecutive or non-consecutive series of states from the list.

If no states are highlighted, all states will be reported.

- Make sure that the SUTA radio button is selected.

- Select the quarter for which you are reporting, or select Annual.

- Select the Sort Employees by option.

If Last Name is selected, the report will be organized by employees’ last name.

If Social Security # is selected, the report will be organized by employees’ Social Security Number.

- Click View, Print, or Text File.

Note: You can omit social security number for employees on all reports by selecting Omit SS# on Reports in the Preferences option located under the File menu. For information on setting preferences see Setting Preferences.