Posting Employee Checks to MultiLedger

Employee check payroll information from CheckMark Payroll can be posted to MultiLedger by following these instructions. Paychecks post to MultiLedger as two general journal entries.

Set up Ledger Accounts in CheckMark Payroll

Before posting to MultiLedger, you should assign account numbers to payroll categories in CheckMark Payroll.

- In CheckMark Payroll, click Setup in the Command Center, then select Ledger Accounts.

- Assign MultiLedger account numbers to all applicable Payroll Categories.

Review Posting Summary

After you have calculated payroll and created checks in CheckMark Payroll, you should review the Posting Summary to make sure the information is correct before you post to MultiLedger.

- In CheckMark Payroll, click Reports in the Command Center, then select Employee Paychecks, then select Posting Summary.

- Select the appropriate Check Date(s).

- Highlight the checks that you want to review from the list on the left.

If no checks are highlighted, information for all checks will be reported.

- Click View or Print.

The Posting Summary report shows check information in a summarized format. The net for each check is shown, along with totals for wages, income, taxes, and deductions. Employer payroll taxes are shown as an entry at the bottom of the report. These are accrued tax liabilities and total expense for Social Security, Medicare, FUTA, and SUTA.

- Verify that all ledger accounts are assigned correctly.

Posting to MultiLedger

- Make sure you have your MultiLedger company files open.

- In CheckMark Payroll, click Reports in the Command Center, then select Employee Paychecks if you haven’t already.

- Select the appropriate Check Date(s).

- Select CheckMark from the Format drop-down list.

- Highlight the checks that you want to post to MultiLedger from the list on the left.

If no checks are highlighted, all checks will be posted/sent to MultiLedger to be posted.

- If you distribute wages or hours to jobs, you should check the Include Jobs in Post Summary option.

- Check the Mark Posted Checks option.

That way, checks that have been posted to MultiLedger will be marked with an “x”. Using this feature does not prevent posting again if you delete the general journal entries in MultiLedger.

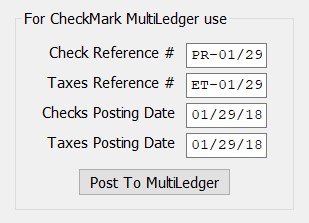

- Verify that the Checks Reference #, Taxes Reference #, Checks Posting Date, and Taxes Posting Date are correct.

You can use these edit boxes to enter reference numbers and posting dates for checks posted to MultiLedger. The default name for the Checks Reference # is “PR” followed by the date of the first unmarked check in the list. The default name for the Taxes Reference # is “ET” followed by the date of the first unmarked check in the list. For information on marking checks that have been posted to MultiLedger, see step 13 above.

The default date for the Checks Posting Date and Taxes Posting Date is the date of the first unmarked check in the list. If necessary, you can change the information in these edit boxes.

Note: If you need to post payroll checks that have the same date as checks you’ve already posted, you should change the Checks Reference # and Taxes Reference #. Otherwise, you will receive an error message and the posting will fail, as MultiLedger cannot accept entries with both the same reference number and same date.

- Click Post to MultiLedger. When the posting is complete, a message appears, “Post command sent to MultiLedger”. The checks will be posted to the general journal in MultiLedger.

Voided checks will also post over to MultiLedger as 0.00 in the general journal entry and appear as 0.00 in the bank reconciliation window.

- Click OK.

Note: When you receive the message that the posting has been sent, it does not necessarily mean that the posting was successful. The posting process sends information from CheckMark Payroll to MultiLedger, but does not send information from MultiLedger back to CheckMark Payroll. You should check the General Journal in MultiLedger to make sure the PR and ET entries were sent correctly. You should see two entries in the General Journal in MultiLedger. A PR-[date] entry for employee paychecks and an ET-[date] entry for employer taxes.

Posting Employer Checks to MultiLedger

Employer payment checks from CheckMark Payroll can be posted to MultiLedger by following these instructions. Employer Payments post to MultiLedger’s Disbursements journal.

Set up Ledger Accounts in CheckMark Payroll

Before posting to MultiLedger, you should assign account numbers to payroll categories in CheckMark Payroll.

- In CheckMark Payroll, click Setup in the Command Center, then select Ledger Accounts.

- Assign MultiLedger account numbers to all applicable Payroll Categories.

Review Posting Summary

After you have created employer payment checks in CheckMark Payroll, you should review the Posting Summary to make sure the information is correct before you post to MultiLedger.

- In CheckMark Payroll, click Reports in the Command Center, then select Employer Payments, then select Posting Summary.

- Select the month.

- Highlight the checks that you want to review from the list on the left.

If no checks are highlighted, information for all checks will be reported.

- Click View or Print.

- Verify that all ledger accounts are assigned correctly.

Posting to MultiLedger

- Make sure you have your MultiLedger company files open.

- In CheckMark Payroll, click Reports in the Command Center, then select Employer Payments if you haven’t already.

- Select the month or series of months.

- Highlight the checks that you want to post to MultiLedger from the list on the left.

If no checks are highlighted, all checks will be posted/sent to be posted to MultiLedger.

- Select CheckMark from the Format pull-down menu.

- Click Post to MultiLedger.

If a vendor does not exist in MultiLedger, you will be asked to add the vendor. When the posting is complete, a message appears, “Post command sent to MultiLedger”. The checks will be posted to the Disbursements Journal in MultiLedger.

- Click OK.

Note: When you receive the message that posting has been sent, it does not necessarily mean that the posting was successful. The posting process sends information from CheckMark Payroll to MultiLedger, but does not send information from MultiLedger back to CheckMark Payroll. You should check the Disbursements Journal in MultiLedger to make sure the checks were sent correctly.