Creating New York MMREF File

You can easily create the New York MMREF File in CheckMark Payroll Software to file your taxes quickly and accurately. New York requires submission of the test file with notification that the test was certified and successfully processed. Contact the New York State Department of Tax and Finance for complete filing instruction. Additional information is included in NY Publication 911 available www.tax.state.ny.us.

- Click State Taxes in the Command Center.

- Select the NY MMREF option in the drop down menu under the Report section.

- Select NY in the States list and choose what Quarter you want to save from the Period section (annual option not available).

- Click the Text File button and choose the location where you want to save the file. The file is named MMREF by default.

Note: Even if the Preference to Omit SS# on Reports is selected under the File menu, the Social Security number for each employee will still appear when printing this report.

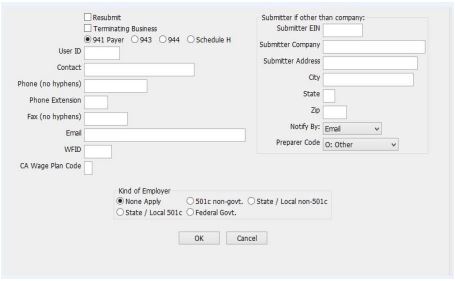

- Enter the appropriate information for your company in the edit boxes, then click OK.

If you are filing the MMREF file on behalf of another company, you can enter your own information in Submitter fields. Otherwise, CheckMark Payroll program will use the Federal ID, Company, and Address information from the Company Information window.

A Save dialog appears. The file is named MMREF by default.

- Choose where you want to save it.

- Contact the EDD for complete instructions on filing.

Note Even if the Preference to Omit SS# on Reports is selected under the File menu, the Social Security number will still be included in the MMREF file.