Saving Federal and State Electronic Information in the EFW2 Format

Before you save Federal and State electronic information in the EFW2 file , you should verify some information for your company and your employees. Generally, if you’ve already printed W-2s for your employees and all of the information is correct, you can save the information as a file. You should make sure that:

- Your company name, address, and Federal and State ID numbers are correct on the Company Information and State Taxes windows.

- Each employee should have a valid 9-digit Social Security Number.

- Any deferred compensation or pension plans have been set up correctly in CheckMark Payroll and correctly assigned to the employees. For more information, see the setup of State Tax Values, Local Tax Values and Hour Categories.

When you’re ready to save the electronic file information in the EFW2 format, do the following:

- Click W-2 & W-3 Statements in the Command Center.

- Select the EFW2 File radio button.

- Select Federal or your state from the pull-down list.

Note: Some state require <CR><LF> between each record in order to file electronically. If necessary, select check box Add CR/LF to EFW2 before creating your state’s EFW2 file. For more information, check with your state or see your states website.

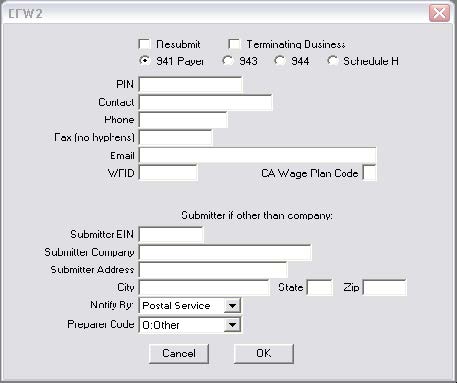

- Click the EFW2/W3 Setup button.

- Enter the correct data for your company, then click OK.

If you are filing the EFW2 file on behalf of another company, you can enter your own Submitter information in the Submitter EIN, Submitter Company, Submitter Address, City, State, and Zip fields. Otherwise, CheckMark Payroll will use the Federal ID, Company, and Address information from the Company Information window.

- Click Text File.

A Save dialog appears. The default name for the file is “W2REPORT.TXT.” Do not change this name unless your state requires a different file name.

- Choose the directory in which you want to save the text file.

- Click Save.

Follow the instructions in the SSA publication about Electronic Filing

(EFW2) or your state publication for complete instructions on filing.

Note: For Federal Filing: After saving the W2REPORT.TXT text file, you should run the Social Security Administration’s software, AccuWage, to make sure that the information is correct before submitting the file. For more information on AccuWage, see http://www.ssa.gov/ employer/accuwage/index.html. Available for Windows computers only.