This article provides information about how to add Additional Information for Payroll and Payroll Direct Deposit in CheckMark Online Payroll.

1. Payroll

This describes about how to select Payroll Year. Ensure that always the current year is selected.

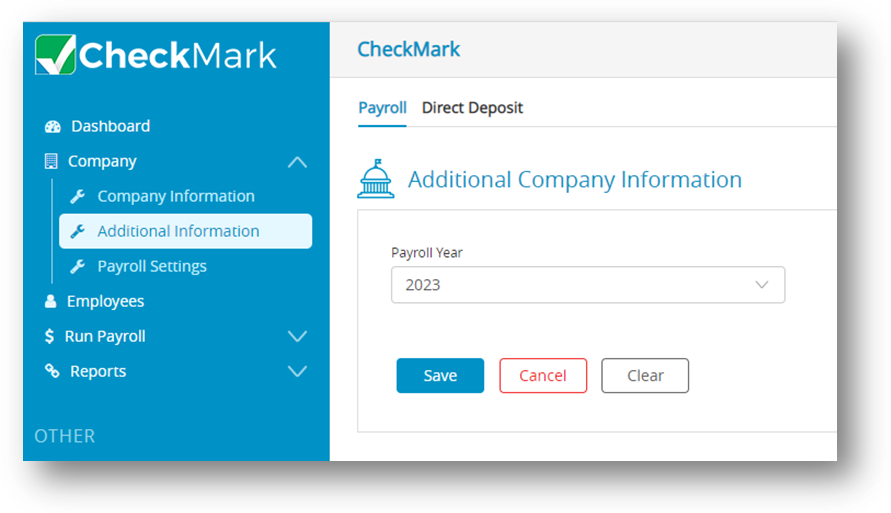

- Click Company and select Additional Information.

- Click Payroll and select the current years in the Payroll Year dropdown.

- Click Save.

Note: By default, when you click on the payroll option, the dropdown will display the current year.

2. Setting up Direct Deposit

CheckMark Online Payroll offers the convenience of paying your employees through direct deposit into their checking or savings accounts. However, before you can use this feature as an employer, you need to provide your bank account details and obtain approval for Automated Clearing House (ACH) direct deposit.

To set up and add your bank account details for ACH direct deposit, follow these steps:

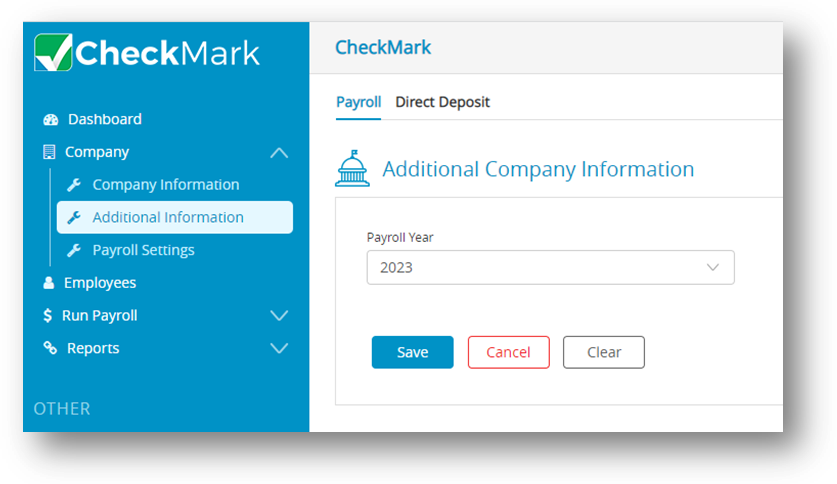

- Click Company and select Additional Information.

- Click Direct Deposit.

- Enter the required information, including your bank name, routing number, and account number.

- Review and confirm the details you entered, then click “Save“.

- Once your bank account is approved, you can start using ACH direct deposit to pay your employees.

It’s important to note that your bank account must be located in the United States and capable of accepting ACH transactions to use this feature.

Fields in Direct Deposit Window:

| Fields | Description |

| Originator Name | This is usually your company name, but you should contact your bank to make sure of the exact name to enter. This field is limited to 23 characters. |

| Originator Routing# | This is the 9-digit routing number of your bank, and is printed at the bottom of your checks. You can be able to enter up to 10 characters. |

| Destination Name | This is the name of the institution receiving the ACH file. You can be able to enter up to 23 characters. Your bank should provide you with this information. |

| Destination Routing# | This is the 9-digit routing number of the institution that will receive the ACH file. Your bank should provide you with this information. |

| Company ID | Check with your bank to obtain the correct ID number for your company that will be used during the transaction. You can enter this ID number in a field that can hold up to 10 characters. |

| Entry Description | This entry will appear on employee’s bank statement when his pay is posted to his account. This field is limited to 10 characters. Examples for this include PAYROLL, DIRECT PAY, or DIRDEPOSIT. |

| Discretionary Data | This is for information your bank may have asked you to insert in your ACH file. Limited to 20 characters or 16 if all letters are capitalized. |

| Account Number | This is the offsetting account number used in a balanced file. If your bank requires a balanced file, enter the necessary account number in this field. This field allows 17 numbers. |

| Effective Date | This is the date you would like the transaction to take place. Typically, it is one to two banking days after you have posted your ACH file. Your bank should let you know what the lead time is for the deposit. |

| File ID Modifier | The default value is an “A.” Increment to “B”, “C”, and so on for additional files sent on the same day, if you are instructed to do so by your bank. |

| Balanced File | If your bank requires a balanced file, place a checkmark in this box. |

| Omit SS# | This option omits the social security number on the ACH direct deposit file. |