Federal Taxes

You can print forms 941, 943 and 944 from the Federal Taxes window along with a Tax Summary report.

Note The latest version of Adobe Acrobat Reader must be installed and set as the default .pdf application on your system to print forms 941, 943 and 944 from CheckMark Payroll.

Setting an Application as the Default Program

Mac OS X Users: You set the default in the Get Info screen on any .pdf file you have on your computer. Select any .pdf file and then go under the File menu to Get Info. Under the Open With section, select the Adobe Reader program and then select the box that will have wording similar to ‘use the application to open all documents like this’. The wording may vary depending on which version of OS X you are using.

You may also have to set the actual files to open with Adobe Reader. CheckMark Payroll program creates .pdf and .fdf files when printing forms such as 940, 941, 943 and 944. These files are generated in the folder where you save your data files. Select these files and assign Adobe Reader as the default program to open correctly. Refer to your operating system’s owner’s manual for more detail about setting defaults.

Windows XP: CheckMark Payroll creates .pdf and .fdf files when printing forms such as 940, 941, 943 and 944. These files are generated in the folder where you save your data files. Browse to the folder where you save your data files. Right-click on f941.pdf (or the .fdf file) and select the Open With option. If necessary, Browse and select the Adobe Reader program on your computers hard drive. Select the check box to ‘always use selected program to open this kind of file’ (exact wording may vary depending on your Windows version) then click OK. Refer to your operating system’s owner’s manual for more information.

Windows Vista or Windows 7: Open the Control Panel and/or select Default Programs. Choose Associate file type or protocol with a program. Scroll down to .fdf in the list. If necessary, select, choose program and browse for Adobe Reader. Repeat steps for .pdf file extension. Close. Refer to your operating system’s owner’s manual for more information.

Types of Federal Tax Reports

Tax Summary: The Tax Summary report shows tax information, including employee names, total wages and tips, federal withholding, Advance EIC, Social Security wages, Social Security tips, and Medicare wages and tips for the selected quarter or current payroll year. You can use this tax data for filling out the Federal 941 form or use the annual report for filing form 943 or 944.

Each type of withholding is summarized and the total taxes due are shown after the employee list. An amount shown for Adjustment for Fractions will print on line 7a of the 941 (6a on Form 944) report in the Fractions of Cents field. An amount on the Adjustment for Fractions line is usually due to Social Security and Medicare rounding and is typically less than one dollar. If the amount is larger, a warning will come up and you should research the cause. For more information, see “What can cause an amount to appear on the “Adjustment for Fractions” line?.”

The second half of the report is the Employer’s Record of Federal Tax Liability. This section shows tax liability information based on actual payroll checks that have been created for the quarter only. If you view the annual Tax Summary report, this part of the report gives monthly liabilities.

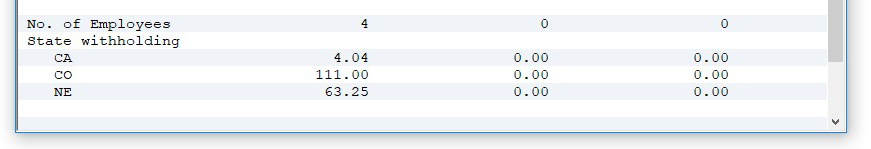

State Withholding amounts, as well as the number of employees for each month of the quarter are shown at the bottom of each quarterly tax summary report.

Form 941 Choose this option to print the 941 on plain paper.

Form 944 Choose this option to print the 944 on plain paper.