Importing using a tab-delimited text file

- Open up the CheckMark 1099 application.

- Open the Database which contains the company you want to import into.

Note: If the company you want to import recipients to does not exist, you will need to create a new company or import a company before importing recipients. For information on creating a new company or importing a company, see “Creating a New Company.” or “Importing a Company.”

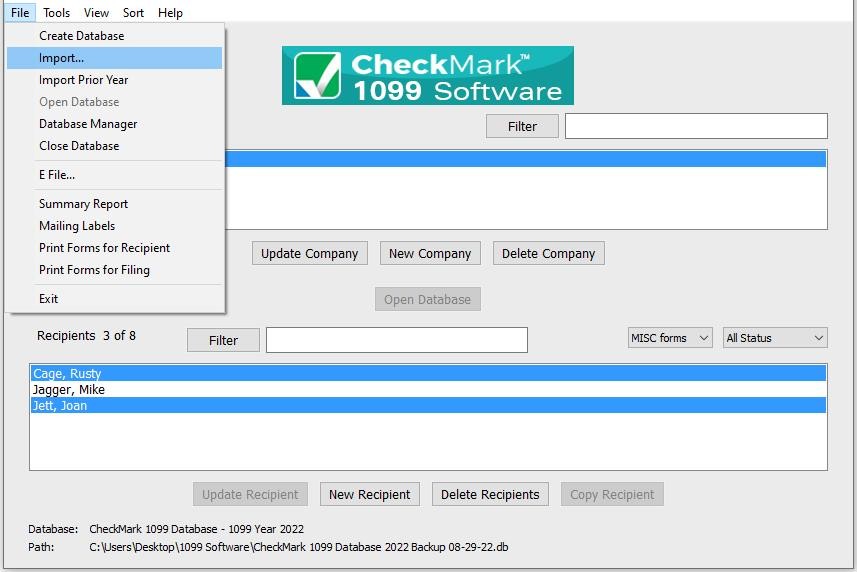

- Go under the File menu and select Import…

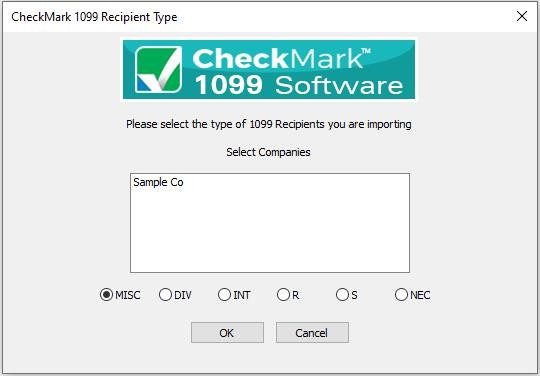

- Select Recipient or Company in the popup window.

- In the popup window select which type of 1099 recipient(s) you are importing: MISC, DIV, INT, R, S or NEC and which company you want to import the recipients to.

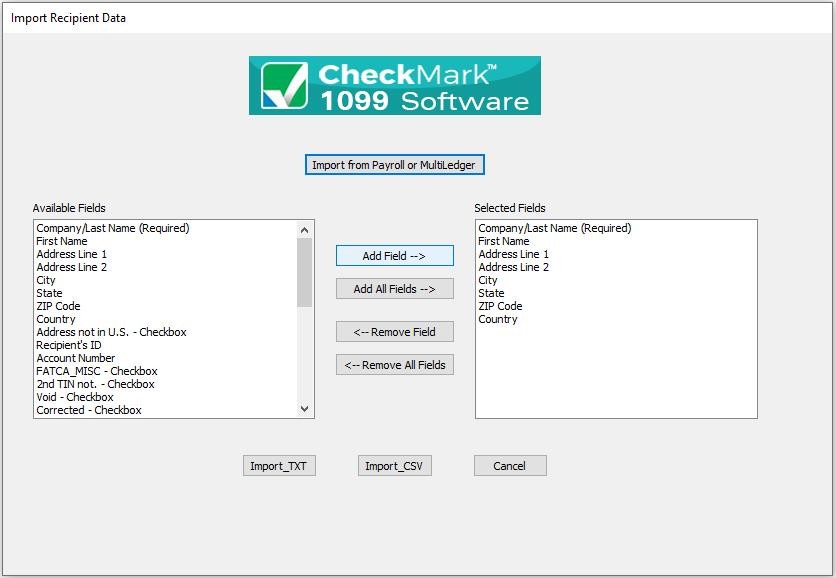

- The import screen allows you to select which fields are being imported. Select the fields in the same order as the text file you’re importing. Click the Import button after you have added all fields to the Selected Field list.

- A Look in screen for Windows or choose the file to Import screen for Macintosh screen appears allowing you to browse to the location where you saved your text file.

- Select the text file and click Open. All recipients will be imported into the selected company.

Text File Format for Importing

CheckMark 1099 program uses a tab-delimited .txt file for importing Companies and the Recipients.

Each field is separated by a Tab with Return at the end of the record before starting the next recipient. An example of a text file to be imported is shown below and contains the Selected Fields: Company Name/Last Name (required), First Name, Address 1, Address 2, City, State, Zip, Recipients ID.

Power[tab]Max[tab]44 Main St[tab]Ste 101[tab]Fort Collins[tab]CO[tab]80525[tab]123-45-6789[return]

- If any fields are not applicable, for instance the address 2 field, a space can be used as a place holder. For example:

Power[tab]Max[tab]44MainST[tab]”space”[tab]FortCollins[tab]CO[tab]80525[tab]123-45-6789[return]

- If no space is included, two consecutive [tabs] will also work. For example:

Power[tab]Max[tab]44 Main St[tab][tab]FortCollins[tab]CO[tab]80525[tab]123-45-6789[return]

IMPORTANT: Make sure the items in the Selected Fields list are in the same order as the items in the text file being imported to ensure that all values are imported into the correct fields.

Related Articles

How to Export Recipients from CheckMark Payroll

How to Export Companies from CheckMark Payroll

How to Export Recipients from CheckMark MultiLedger

How to Import Recipients from CheckMark Payroll and MultiLedger