Setting Up the Chart of Accounts

The numbering and sequencing of a company’s accounts provides the foundation for the financial reports generated by MultiLedger. While you can add accounts as needed throughout the year, careful thought and planning should go into the initial design and numbering of your company’s chart of accounts.

Note: Setting up income or expense accounts alphabetically with at least 10 digits between numbers allows accounts to be easily searched and allows for insertion of additional accounts in alphabetic order.

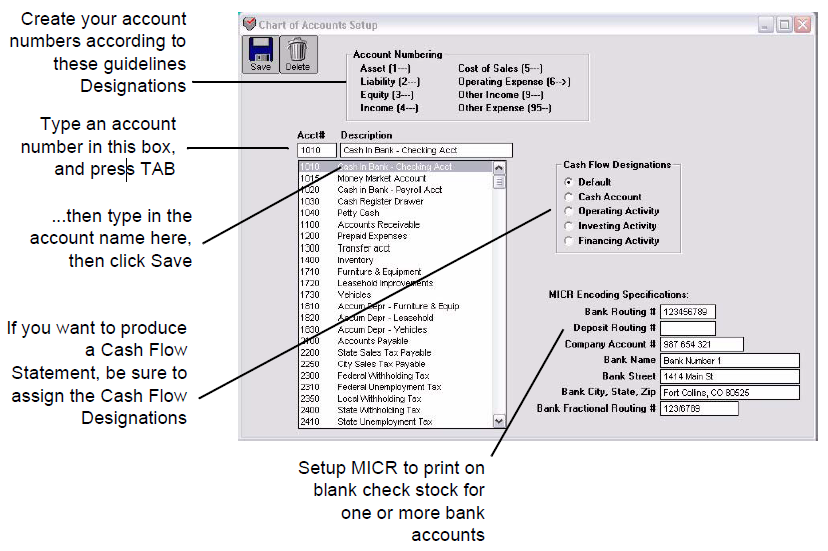

Guidelines for Setting Up Chart of Accounts

Account numbers must meet the following requirements:

- Each account number (except for profit centers) must be four digits long.

- Each account number must adhere to the types of accounts shown below.

For example: all Assets must fall within the 1000–1999 range, all Liabilities must fall within the 2000–2999 range, and so on.

| Assets | 1000-1999 |

| Liabilities | 2000-2999 |

| Owner’s Equity or Capital | 3000-3999 |

| Income | 4000-4999 |

| Cost of Sales | 5000-5999 |

| Operating Expenses | 6000-8999 |

| Other Income | 9000-9499 |

| Other Expenses | 9500-9999 |

Note: Certain headings and ranges can be changed for financial statements. For details, see “Customizing Financial Statements”

Important:

- Do not set up an account to accumulate income (or loss) for the current year. MultiLedger calculates the current year net income, but does not store it in a ledger account.

- Be sure to enter a retained earnings or accumulated owner’s equity account in the 3000–3999 range. Current year income (or loss) is closed into this account at year end.

- Enter only one Accounts Receivable account, one Accounts Payable account, and one Inventory account.

Entering the Accounts

Note: If you are going to use profit centers, see “Setting Up Profit Centers” for guidelines about entering profit centers into your chart of accounts.

- Click Chart of Accounts in the Command Center.

- Enter an account number in the left-hand edit box and press TAB.

Important: Account numbers must meet certain requirements. For more information, to see the previous section “Guidelines for Setting Up Accounts.”

- Enter the account description in the right-hand edit box.

- (Optional) If you will be printing on blank check stock and need to setup MICR for your bank accounts, you can setup this information now. For more information on setting up MICR encoding see “Setting Up the MICR Encoding Information.”

- If needed, click on the appropriate radio button for Cash Flow Designation.

See table below for details.

- Click Save to add the new account to the list.

Repeat steps 2–6 for each account that you want to enter into the Chart of Accounts.

The accounts are saved when you close the Chart of Accounts window.

Setting Up Cash Flow Designations

MultiLedger defaults to the Cash Flow designations in the following chart to produce a Cash Flow Statement. You can change the default and assign the accounts to a different designation by clicking on the account in the list and clicking on the radio button for the Cash Flow designation that you want to assign the account to, then click Save.

| Designation | Default Account Range |

Purpose |

| Cash | 1000 – 1099 |

Cash balance at beginning and end of Period. |

| Operating Activity | 1100 – 1899

2000 – 2599 |

Cash generated from day-to-day business operations. |

| Investing Activity | 1900 – 1999 |

Cash invested in furniture, equipment or other long term assets. |

| Financing Activity | 2600 – 3999 |

Includes loans, investments by the owner, and retained earnings. Also includes reductions in equity due to owners draws on profits. |

Modifying Account Numbers and Names

To modify an account, highlight the appropriate account line, modify the existing account description, and press ENTER. Account numbers cannot be modified—you must delete the entire account and then enter a new account number. If you try to change an account number, a new account will be added to the list but the old one will not be removed or changed. For information on re-numbering accounts see “Renumbering Accounts.”

Deleting Accounts

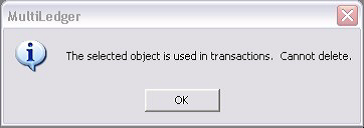

To delete an account, highlight the appropriate account line, and choose the Delete button. (If Delete is dimmed, an account is probably not highlighted. Select an account and try again).

If you try to delete an account that has transactions from the open months, the following warning appears:

Related Articles

How to set up a company with MultiLedger

How to Create a New Company File in MultiLedger

How to Set Up Basic Information in MultiLedger

How to Set Up Posting Categories in MultiLedger

How to Set Up Ledger Account Balances in MultiLedger

How to Set Up Prior Outstanding Receivables in MultiLedger