Sales Tax Set Up

MultiLedger lets you set up as many as 100 different Sales Tax Categories for tracking purposes. You can also get detailed Sales Tax reports. For information on these reports, see “Sales Tax Report.”

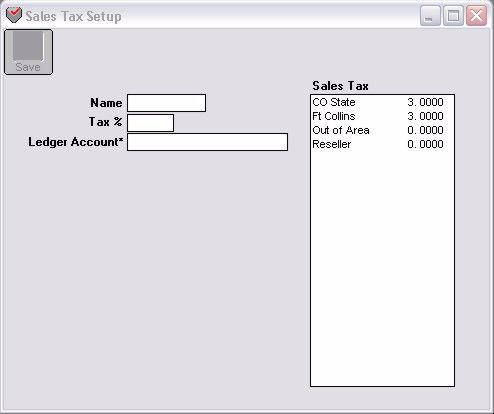

Sales Tax Setup Field Descriptions

The following section describes the fields on Sales Tax Setup.

Tax Name

Enter a name up to 13 characters long, including spaces.

Note: The sales tax categories appear in the pop-up list on Customer Invoices in the order that you enter them. You may want to enter the most common sales tax categories first.

Note: If you type a minus sign (-) in front of the sales tax name, the sales tax name won’t print on invoices.

Tax %

Enter the Tax % as a percentage. For example, a tax rate of 3% should be entered as 3. You can enter a percentage that is up to two places to the left and four places to the right of the decimal point (99.9999).

Note: If you try to enter a percentage that is more than two places to the left or more than four places to the right of the decimal point, MultiLedger will truncate the number, not round it up.

Ledger Account

When you click in this box, a pop-up list of your chart of accounts appears. From the list of your chart of accounts, select a Liability Account (in the 2000 range) to associate with the sales tax category.

When the sales tax category is used on Customer Invoices, the liability account associated with that category is automatically increased.

Setting Up Sales Tax Categories

- Click Sales Tax Setup in the Command Center.

- Type in a name for the sales tax category in the Tax Name edit box.

- Enter the percentage for the sales tax in the Tax % edit box.

- Select a general ledger account (usually a liability account in the 2000 range) from the Ledger Account pop-up list for this sales tax category, then click Save.

Modifying Sales Tax Categories

Important: After modifying a sales tax category, any outstanding invoices using the old sales tax category will not be changed to the modified sales tax category.

To edit or modify a sales tax category, select the category from the list, modify the information, and click Save.

Deleting Sales Tax Categories

You cannot delete sales tax categories.

Related Articles

How to Set Up Budget Amounts in CheckMark MultiLedger

How to Set Up, Modify & Delete Shipping Methods in CheckMark MultiLedger

How to Set Up Profit Centers in CheckMark MultiLedger

How to Set Program Preferences in CheckMark MultiLedger

How to Set User Settings in CheckMark MultiLedger

How to Customize Financial Statements in CheckMark MultiLedger

How to Set Up, Modify & Delete Jobs in CheckMark MultiLedger

How to Set Up, Modify & Delete Salespersons in CheckMark MultiLedger

How to Select Font for Printing in CheckMark MultiLedger

How to Use Print Screen in CheckMark MultiLedger

How to Set Up MICR Encoding Information in CheckMark MultiLedger

How to Format Checks, Invoices, Statements, 1099s & Deposits in CheckMark MultiLedger