Setting Up Profit Centers

If your company has several departments or divisions, you might want to individually track their income and expenses —that’s where profit centers come in. Each portion of your company (whether it’s a department, store, or division) can be assigned a profit center name and account numbers.

You can create income statements for your profit centers. For details, see “Profit Center Income Statements”

To set up profit centers, you need to complete two steps:

- Enter the general profit center names on the Profit Centers window under the Setup menu. Profit center names must be entered to produce an income statement report for a particular profit center.

- Enter specific profit center account numbers and names in your company’s chart of accounts.

These two steps are discussed in the following sections.

Setting Up Profit Centers on the Profit Centers Window

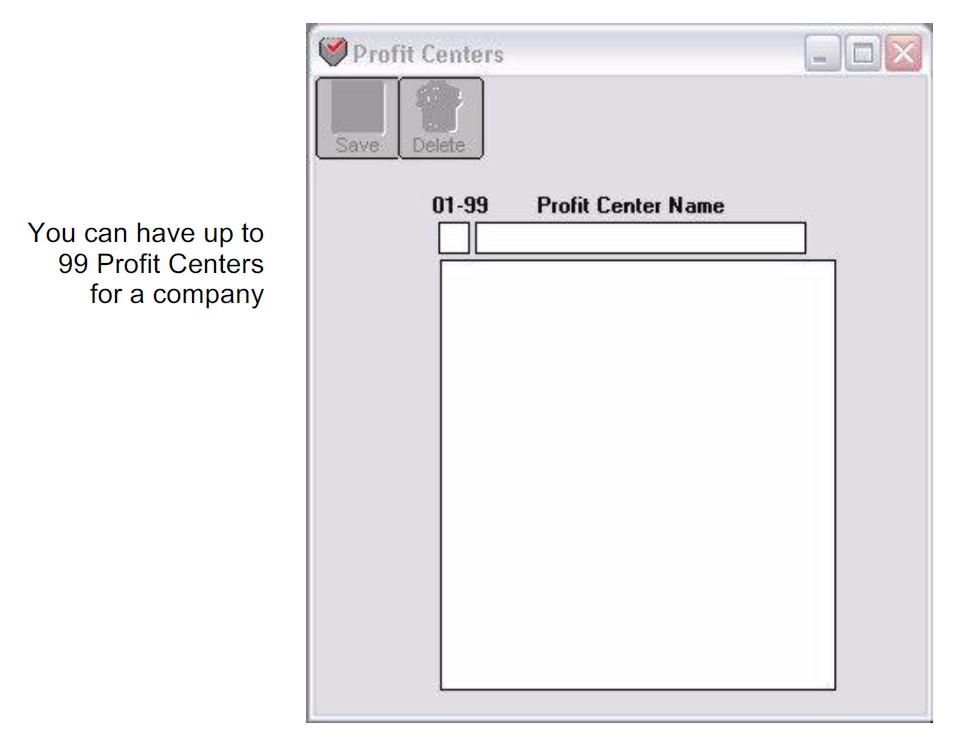

- Choose Profit Centers from the Setup menu.

- Enter a number for the profit center that is between 1 and 99.

Note: Leading zeros for single-digit profit centers are automatically added for you.

- Enter a name for the profit center and press TAB.

- Click Save.

Repeat this step for up to 99 profit centers.

Don’t forget to set up the profit centers in your chart of accounts too.

Setting Up Profit Centers in the Chart of Accounts

You should set up a general account, followed by specific profit center accounts. For example, you could have a general sales account such as the following:

- 4000 Sales

You could then use the following profit centers for two stores:

- 4000.01 Sales – Store 1

- 4000.02 Sales – Store 2

Notice that each profit center account you enter into your chart of accounts has a four-digit number followed by a decimal point and the appropriate profit center number (01-99). These profit center numbers correspond to those set up on the Profit Centers window.

When you create a consolidated income statement, the general account “4000 Sales” will be used for the consolidated description. If no 4000 account has been set up in the chart of accounts, the first profit center account description will be used for the consolidated description.

You should follow the same procedure for entering profit center accounts into your chart of accounts as you do for entering any other account. For details, see “Setting Up the Chart of Accounts.”

What accounts can I set up as profit centers?

You can set up profit centers in your chart of accounts for any type of account from 4000 and greater, including income accounts (such as sales) and operating expense accounts (such as small business advertising).

You cannot set up profit centers for assets (such as inventory, in the 1000-1999 range), liability (in the 2000 range), or equity accounts (in the 3000 range).

Related Articles

How to Set Up Budget Amounts in CheckMark MultiLedger

How to Set Up, Modify & Delete Shipping Methods in CheckMark MultiLedger

How to Set Program Preferences in CheckMark MultiLedger

How to Set User Settings in CheckMark MultiLedger

How to Customize Financial Statements in CheckMark MultiLedger

How to Set Up, Modify & Delete Jobs in CheckMark MultiLedger

How to Set Up, Modify & Delete Sales Tax in CheckMark MultiLedger

How to Set Up, Modify & Delete Salespersons in CheckMark MultiLedger

How to Select Font for Printing in CheckMark MultiLedger

How to Use Print Screen in CheckMark MultiLedger

How to Set Up MICR Encoding Information in CheckMark MultiLedger

How to Format Checks, Invoices, Statements, 1099s & Deposits in CheckMark MultiLedger