Job Reports

Job summary report shows actual and estimated job income and expense, estimated cost, the difference between these values, and the net income. There is also a Job Detail report that provides more detail.

Click Job Reports in the Command Center.

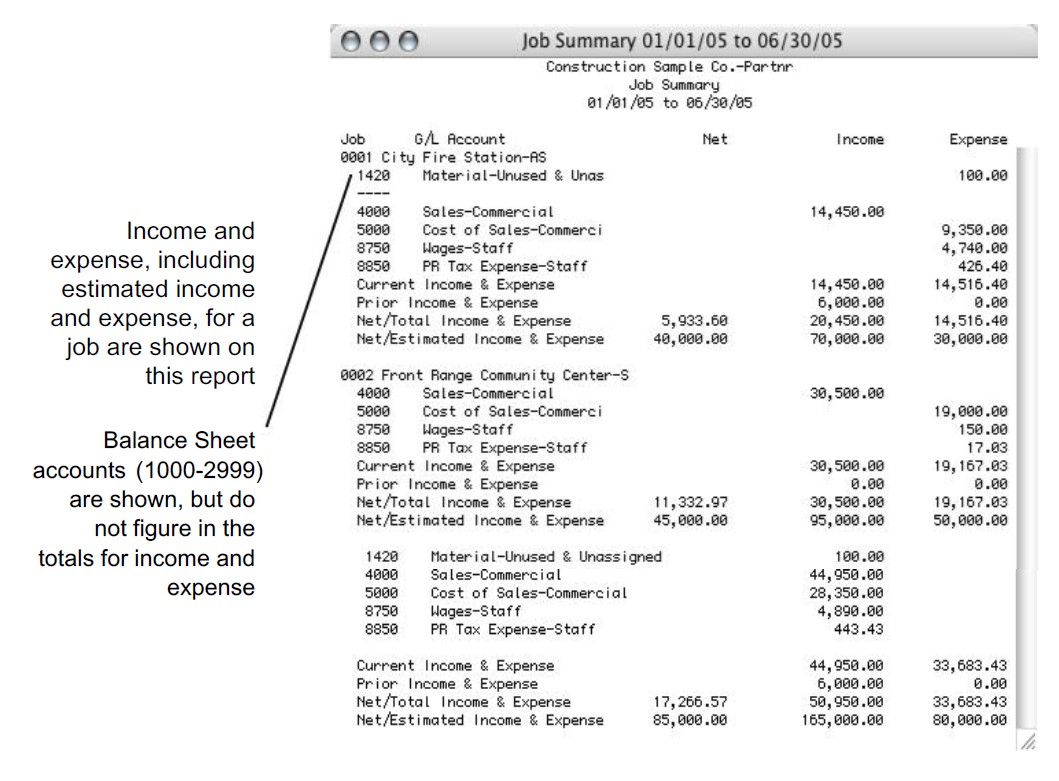

Job Summary

This report shows the following information for each selected job:

- Job number and name

- The general ledger accounts that are affected

- Current and prior income and expense

- Total income & expense, and the net for the job

- Total estimated income & expense, and net for the job

- Totals for all jobs selected

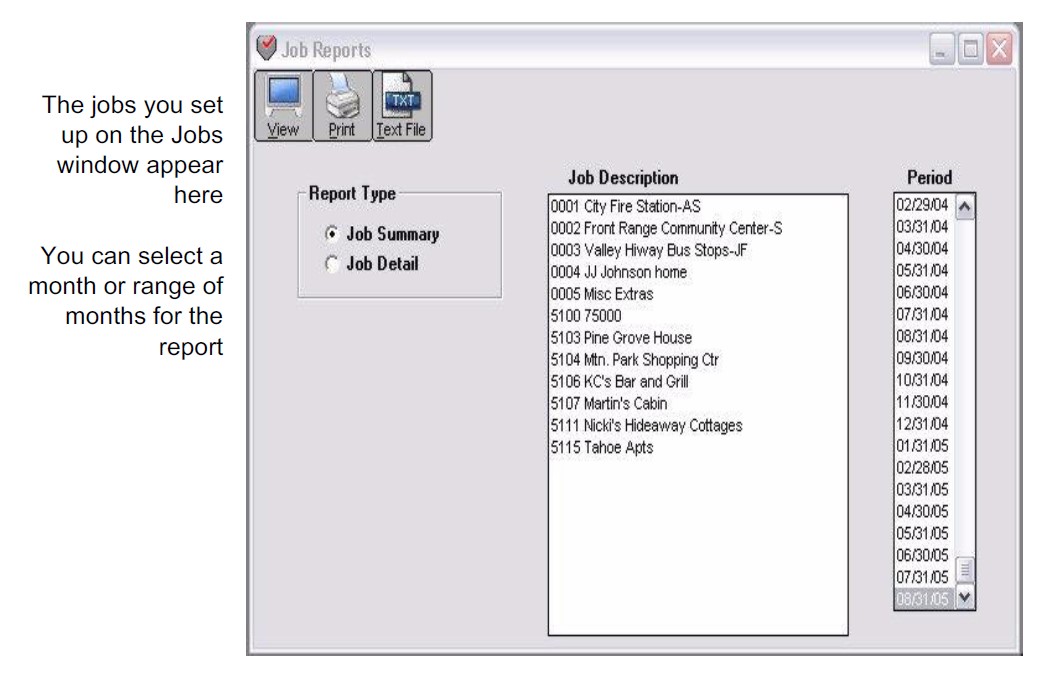

You can select a month or range of months for this report.

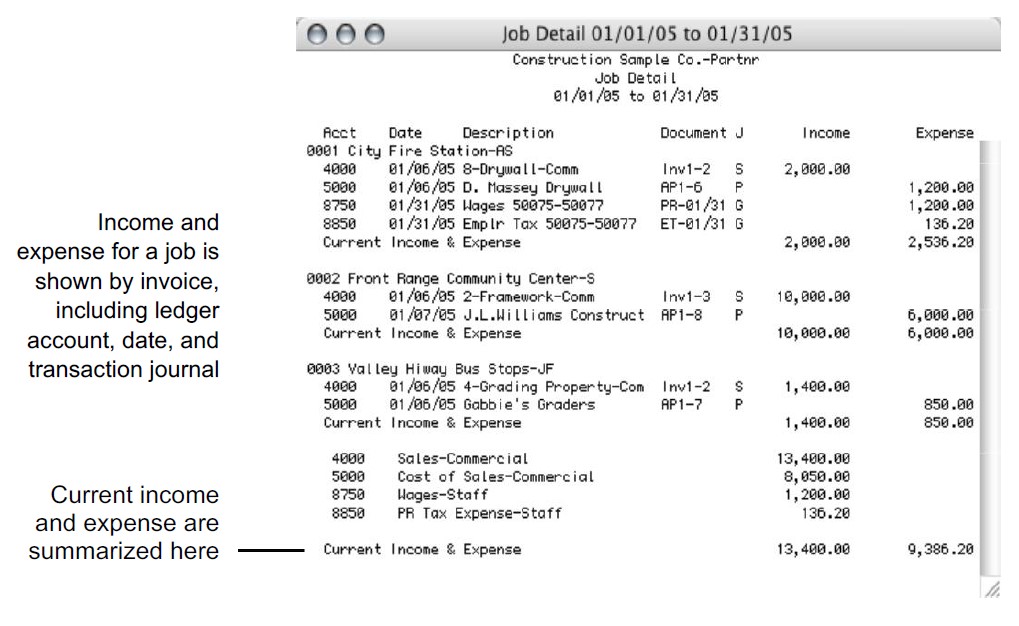

Job Detail

This report shows the following income and expense details for each selected job:

- Ledger account number for each income or expense

- Income or expense date

- Description of each income or expense

- Document number associated with each income or expense

- Journal type used to record the income or expense

- Amount of each income or expense

- Totals of all jobs selected

After closing the year, job reports will no longer show job detail for the closed year. However, the income and expense for the Job are added to Prior Income and Prior Expense in the new year.

Creating Jobs Reports

- Select the job name or names.

If necessary, scroll the list box to find the name of the job you want.

You can select a consecutive or non-consecutive series of jobs from the list (for details, see “Making Selections in a Reports List.”

If no jobs are selected, all jobs will be reported.

- Select a month or range of months.

- Select the Job Summary or Job Detail radio button.

- Click View, Print, or Text File.

Job Summary report example:

Job Detail report example:

Related Articles

How to Create Chart of Accounts Report

How to Create Trial Balance Report

How to Create Transaction Journals Reports

How to Create General Ledger Report

How to Create Balance Sheet Report

How to Create Income Statement Report

How to Create Cash Flow Reports

How to Create Financial Snapshot Reports